Regulatory | Infrastructure | NGI All News Access

PG&E to File for Bankruptcy, Searching for New CEO

The board of PG&E Corp. said Monday it intends to file for Chapter 11 bankruptcy reorganization before the end of the month. CEO Geisha Williams has resigned.

The company’s stock price plummeted to $8.38/share on Monday, down by more than half from Friday’s close.

The board named as interim CEO John Simon, executive vice president and general counsel since 2017, while a search has begun for a permanent chief.

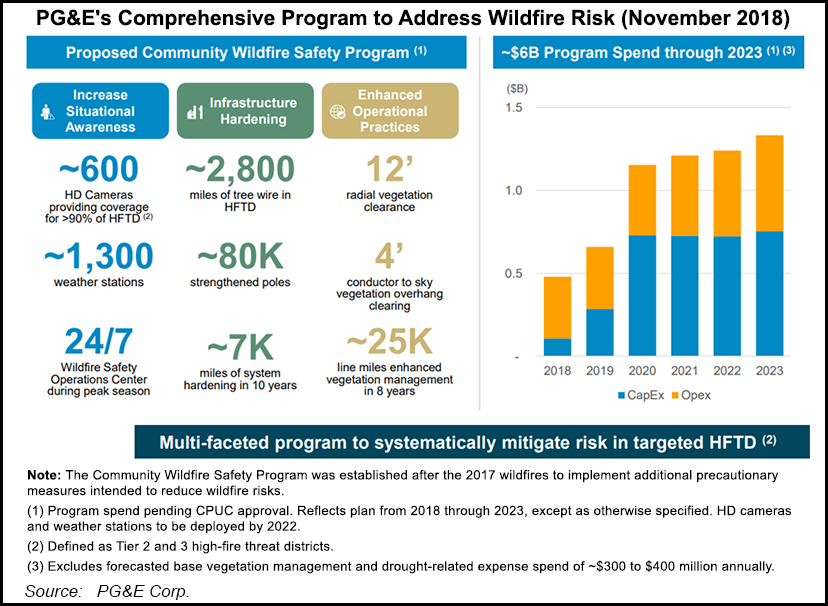

The moves are the latest fallout from Northern California wildfires over the past two years that have trapped PG&E and its utility, the Pacific Gas and Electric Co., in an increasingly tenuous financial situation where it faces billions of dollars of liability.

“While we are making progress as a company in safety and other areas, the board recognizes the tremendous challenges PG&E continues to face,” said Chairman Richard Kelly.

The holding company and utility have provided a 15-day advance notice required by California law on the intended bankruptcy filings. Kelly called Chapter 11 “the only viable option” to address the company’s responsibilities to its stakeholders.

During the reorganization bankruptcy process, PG&E intends to continue investing in its system safety as it works with regulators, policymakers and other key stakeholders to “consider a range of alternatives,” Kelly said.

“PG&E expects that the Chapter 11 process will support the orderly fair and expeditious resolution of its potential liabilities resulting from the 2017 and 2018 wildfires,” he said. “It will assure the company has access to the capital and resources needed to continue to provide safe service.”

Company officials said there should be no impact to its natural gas or electric utility service as a result of the voluntary filing.

“We believe a court-supervised process under Chapter 11 will best enable PG&E to resolve its potential liabilities in an orderly, fair and expeditious fashion,” said Simon. “We also expect the process will enable PG&E to access the capital and resources we need to continue providing safe service.”

While state lawmakers and regulators have been looking at steps to prop up the utility, PG&E ultimately concluded that state assistance would take too long, PG&E said in a Securities and Exchange Commission filing on Monday. PG&E said the potential liabilities from all the fires combined could exceed $30 billion.

The company is facing up to 50 lawsuits on behalf of 2,000 individual plaintiffs for 2018’s Camp Fire, and more than 700 lawsuits on behalf of 3,600 plaintiffs for fires in 2017.

Analysts at ClearView Energy Partners LLC said the key now is whether state lawmakers will take action to head off the bankruptcy filings by extending utility protections passed last year to cover last year’s fires. State regulators are powerless to do anything, they said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |