Markets | LNG | NGI All News Access

New LNG Vessels May Soon Outstrip Natural Gas Supply, Wood Mackenzie Warns

Demand is robust for vessels to transport liquefied natural gas (LNG) to worldwide markets, but there is a risk that capacity may soon outstrip supply, according to a study by consulting firm Wood Mackenzie Ltd.

The new analysis by the UK firm comes as increased gas supply is being absorbed more easily than had been expected, driven by strong demand in Asian markets. There also is emerging demand for ships that can move cargo to Central America ports and via an expanded Panama Canal.

A series of final investment decisions (FID) on major supply projects also is nearing, particularly for North American projects, which may increase demand for more ships, researchers said.

Wood Mackenzie’s Andrew Buckland, principal analyst for LNG shipping and trade, warned that supply project sponsors “need to be careful they don’t over-order.” There are still many ships in the pipeline being built following the 2011-2014 building boom for export facilities, which means there could be excess ships arriving ahead of supply.

“LNG shipping is benefitting from an unprecedented wave of new LNG supply projects coming online in a relatively short period,” Buckland said.

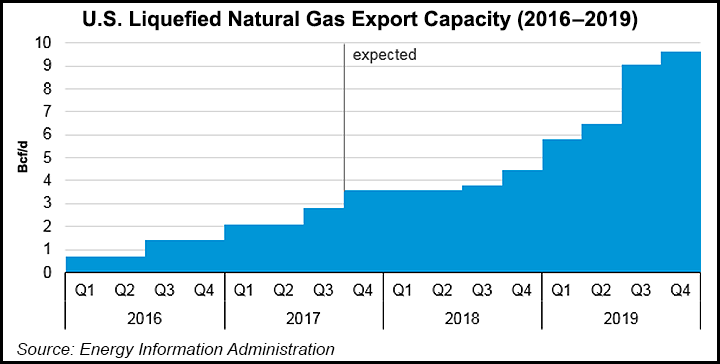

Between 2015-2020, Wood Mackenzie is forecasting LNG production to increase by more than 150 million metric tons/year (mmty), compared to 20 mmty in the five years prior to 2016.

Besides global supply/demand for gas, the locations of the supply sources to end-use shippers would have a major impact on the numbers of ships needed.

For example, moving 1 mmty of LNG from the U.S. Gulf Coast to Japan would require about 1.9 ships, while the same amount of LNG from Australia to Japan requires only 0.7 of a ship.

With all the activity in the shipbuilding space, prices for LNG ships are more attractive than ever, according to Buckland, who thinks this adds to the early potential for a glut and less supply to transport.

“The new building prices look even more attractive when you consider how much more you get for your money with the latest ship designs,” he said. “The temptation for owners is to order sooner rather than later while the new building price remains low.”

The latest vessels, bigger and more efficient, are better designed and technologically advanced, making ships completed only a few years seem “outdated.” New LNG tankers are typically up to 180,000 cubic meters (cm) in capacity, compared to 155,000 cm for older ships.

To date this year, about 33 LNG ships have been ordered worldwide, compared with 19 in 2017, so interest is definitely on the upswing, Buckland said. Also, 36 new vessels have been added to the LNG fleet, 22 are scheduled for delivery before the end of this year, and three were scrapped.

Central America Opening Up

Moving more LNG via ships from the U.S. Gulf Coast to global destinations will become increasingly important as new facilities underway in Texas and Louisiana are completed and more markets emerge in Central America.

For example, the Costa Norte 381 MW combined-cycle generation plant by units of AES Corp. recently came onstream on Telfers Island in the province of Colon, about 50 miles north of Panama City and within sight of the Panama Canal.

A companion to Costa Norta, an LNG reception and storage terminal, was built as an joint venture (JV) between AES and Engie with about 170,000 cubic meters of capacity (6 MMcf). The import terminal received its first cargo in May.

The power plant is to use about 0.4 million metric tons/year (mmty) of LNG with the remainder of the 1.5 mmty capacity distributed throughout the region, using trucks or floating storage regasification units.

U.S. Treasury’s David Malpass, undersecretary for International Affairs, was in Panama last month to help inaugurate the Costa Norte plant. U.S. officials also signed a memorandum of understanding to encourage more private investment to expand U.S. LNG imports and distribute gas in Latin America.

The Treasury-led initiative is called America Crece, incorporating the Spanish word for growth, aimed at boosting U.S. gas exports, developing Latin American energy resources and downstream demand.

With Costa Norte’s strategic location adjacent to the Panama Canal, the LNG imports there could also be used as ship fuel. The AES-Engie alliance already has an operation in the Dominican Republic, the 1.5 mmty Andres regasification facility.

In addition, Energia del Pacifico, (EDP) a JV between El Salvador business people and U.S.-based Invenergy LLC, is working to create a second wave for Central America’s gas revolution with an LNG import terminal and 378 MW combined-cycle plant in the country that is expected to take three years to build. A unit of Royal Dutch Shell plc is to supply the LNG at a cost indexed to Brent, not Henry Hub.

Meanwhile, LNG exports via the Panama Canal are set to escalate. Authorities plan to lift self-imposed daylight and encounter restrictions for vessels beginning Oct. 1. Deputy Administrator Manuel E. Benitez during a press briefing in July at the World Gas Conference in Washington, DC, said, “Our plan is to be ahead of the demand.”

Under the revised rules, LNG ships will be able to traverse the Canal at night, and two carriers at a time may be on Gatun Lake, the man-made waterway at the north end. The changes will allow two LNG tankers to move in different directions through the Canal at the same time.

The Canal expansion, completed two years ago, now has eight slots available for reservations, with as many as 11 ships passing through in one day. An analysis by the Panama Canal Authority found the new larger locks may be able to handle as many as three LNG shipments in one day.

A concerted effort also is underway to enhance the use of LNG worldwide as a marine transportation fuel to reduce emissions. A combination of environmental and economic factors, including a decision by the International Maritime Organization to reduce sulfur content in ship fuels beginning in 2020 is driving the stepped up interest, according to DNV GL researchers.

In addition, LNG is considered the only alternative source with surplus quantities worldwide. “LNG is available in sufficient quantities today to meet the potential requirements of the shipping industry for many years,” DNV GL researchers noted.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |