Markets | NGI All News Access | NGI The Weekly Gas Market Report

Mexico Natural Gas Trading Volumes Up 14% in August

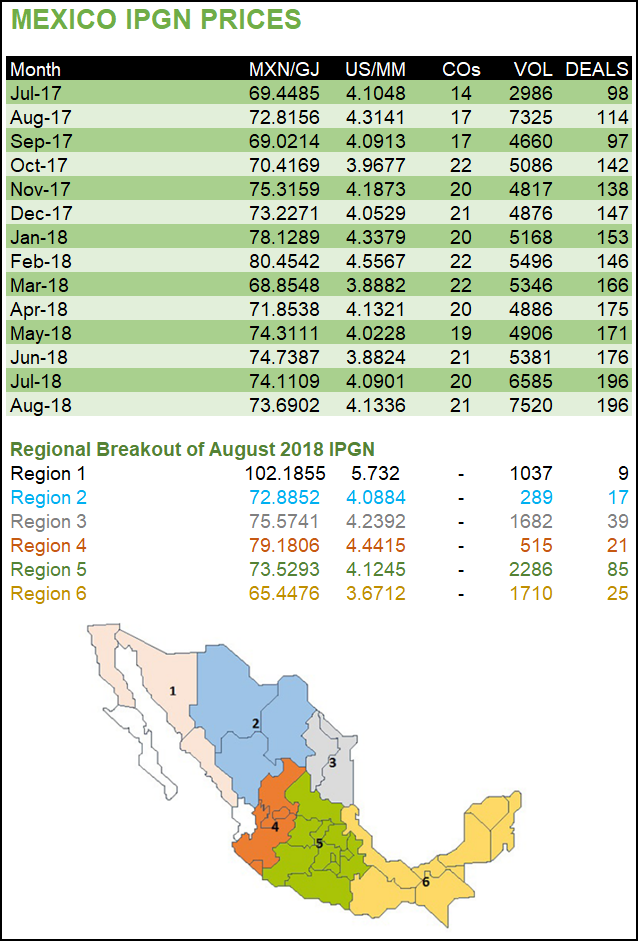

The volume of reported natural gas trades in Mexico totaled 7.52 Bcf/d in August, representing a 14.2% jump from July and a year-to-date high.

The monthly natural gas price index, known by its Spanish initials IPGN, averaged 73.7 pesos/gigajoule (GJ) ($4.13/MMBtu) for August, compared to 74.1 pesos/GJ ($4.09/MMBtu) in July, according to the latest monthly IPGN report from the Comisión Reguladora de EnergÃa (CRE).

On a year-over-year basis, the volume of gas traded was up from 7.33 Bcf/d, while the IPGN increased from 72.82 pesos/GJ ($4.31/MMBtu). The number of transactions reported in August inched up by two to 207 from July, the report said.

The IPGN is derived from mandatory, monthly post-transaction reports filed by marketers, and reflects the average price/molecule of gas plus transport costs. Market participants typically use the Houston Ship Channel, Henry Hub or Waha benchmarks to calculate the price/molecule. Imports from the United States currently account for about 85% of total gas supply in Mexico, according to data from energy ministry Sener.

In peso terms, prices fell sequentially in August in three of Mexico’s established trading regions and increased in the other three.

The largest price drop was seen in region one, to 102.2 pesos/GJ ($5.73/MMBtu) from 116.1 pesos/GJ ($6.41/MMBtu). Region one contains the northwestern states of Baja California, Baja California Sur and Sonora.

The largest increase in trading volume was reported in region three, which includes the northeastern states of Nuevo León and Tamaulipas, to 1.68Bcf/d from 992 MMcf/d.

The monthly IPGN report is meant to be a transitory measure to approximate gas prices until third-party indexes emerge in the country’s newly liberalized natural gas market.

While the gas marketing segment was historically dominated by national oil company Petróleos Mexicanos (Pemex) and state power utility CFE, President Enrique Peña Nieto’s 2013 constitutional energy reform and subsequent secondary legislation paved the way for the creation of a competitive wholesale gas market and imposed asymmetrical regulations on Pemex.

Operatorship of the national pipeline network was transferred from Pemex to national natural gas control center Cenagas. The reform also requires Pemex to offer 70% of its marketing contracts to third parties. As of March, Pemex had ceded over 30% of its gas marketing contract portfolio.

The Comisión Reguladora de EnergÃa (CRE) announced in August that it had approved the second and final phase of the contract release program.

Although leftist President-Elect Andrés Manuel López Obrador has expressed opposition to the reform and to the breakup of Pemex’s vertically integrated model, he has not pledged any gas-specific policy measures, other than a general mandate to reduce dependence on gas imported from the United States.

Mexico’s Comisión Nacional de Hidrocarburos (CNH) last week unveiled a 189-page technical document, which advocates measures such as creating a state company dedicated exclusively to gas exploration and production (E&P), fiscal incentives for gas producers and a program to promote unconventional E&P.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |