E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Permian Delaware-Focused EagleClaw, Caprock to Combine Midstream Operations in $950M Deal

Permian Basin midstreamers EagleClaw Midstream Ventures LLC and Caprock Midstream Holdings, each focused on the Delaware formation in West Texas, agreed to merge Wednesday in a transaction worth an estimated $950 million.

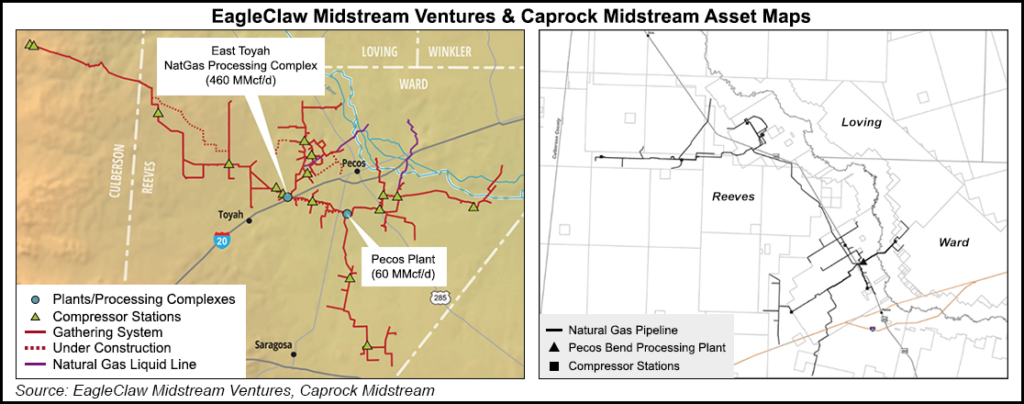

The all-cash combination, once completed as expected by year’s end, would carry the EagleClaw brand and be led by its executive team. The Midland, TX-based portfolio company of private equity (PE) giant Blackstone Energy Partners is considered the largest privately held midstream operator in the Delaware, with assets in Reeves, Ward and Culberson counties. It now has 550-plus miles of natural gas and natural gas liquids (NGL) pipelines, as well as 720 MMcf/d of processing capacity.

Energy Spectrum Capital and Caprock Midstream Management own Caprock, headquartered in Humble outside Houston. Its assets are in Reeves and Ward counties, where it now operates two natural gas processing facilities. Once two additional facilities under construction are completed, Caprock would have an estimated 540 MMcf/d of processing capacity. It also operates almost 300 miles of gas, crude, NGL and water gathering pipelines; 23,000 bbl of crude storage; and water disposal facilities with a capacity of 210,000 barrels per day.

“I have known and respected Mike Forbau, Caprock’s co-founder and CEO, for over 20 years,” said EagleClaw founder and CEO Bob Milam. “We look forward to building on the great footprint that Mike and the Caprock team have assembled to date and providing Caprock’s customers with best-in-class service consistent with our record of safe and reliable performance.”

EagleClaw, acquired by Blackstone last year, has long-term commitments from producers across more than 310,000 acres. Since Blackstone’s takeover, EagleClaw has more than doubled its processed volumes and system capacity, increased the amount of acreage under long-term dedication by more than 55%, and entered into partnerships with Kinder Morgan Inc. (KMI) and Targa Resources Corp. to improve takeaway options for gas and NGLs.

Among other things, EagleClaw is partnering with KMI and Apache Corp. on the 42-inch Permian Highway Pipeline Project, which would move gas along the Texas coast and potentially into Mexico. Targa last year sold a 25% stake to Blackstone in the $1.3 billion Grand Prix NGL pipeline to connect Permian liquids and Targa’s North Texas gathering system to its fractionation and storage complex at Mont Belvieu near Houston. Grand Prix is expected to be operational by mid-2019.

Caprock has long-term dedications for gas, crude and/or water-related services in the Delaware that total more than 115,000 acres.

“Caprock was formed with the intention of providing producers with a focused service partner in a high growth basin,” Forbau said. “We have enjoyed working with our key customers to facilitate the development of the Delaware Basin, a world class resource. We are proud of the work our team has done from tying in the first exploratory wells on this acreage to building infrastructure to enable our customer’s transition to pad development.”

Once combined, EagleClaw would operate close to 850 miles of gas, NGL, crude and water gathering pipelines; 1.3 Bcf/d of processing capacity; and crude and water storage facilities, with 425,000 acres-plus under long-term dedication for midstream services. The acquisition also extends EagleClaw beyond natural gas gathering and processing related services into crude- and water-related offerings.

“Following our recent announcement of the Permian Highway Pipeline in partnership with Kinder Morgan, the acquisition of Caprock is another exciting chapter in the continued growth story of EagleClaw,” said CFO Jamie Welch. “This transaction expands our business in every aspect, from asset footprint, to customer diversity, to breadth of service offering, while remaining true to EagleClaw’s core mission of providing customer-focused midstream services in the Permian Basin.”

The existing Caprock operating company, to be renamed EagleClaw Midstream II, would be a sister entity to the existing EagleClaw operating business. All of Caprock’s field personnel are to be offered opportunities to remain with the combined company. Caprock water assets are to be operated under a services agreement with Waterfield, a Blackstone-backed partnership that works with upstream companies in the Permian.

“As investors across the energy value chain, with extensive holdings of upstream and midstream businesses, we have firsthand appreciation for the critical nature of EagleClaw’s services, the importance of safe and reliable operations, and the mutually beneficial relationship with the company’s producer customers,” said Blackstone Energy Partners CEO David Foley.

Jefferies LLC acted as Blackstone and EagleClaw’s financial adviser, while Akin Gump served as legal counsel. Evercore ISI and Barclays were financial advisers to Caprock and Energy Spectrum. Vinson & Elkins LLP and Orrick, Herrington and Sutcliffe LLP acted as legal counsel to Caprock and Energy Spectrum.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |