Lean Storage, MVP Delay Have East Coast Markets Bracing for Winter Spikes

Against a backdrop of lean regional storage inventories, the recent delay to Mountain Valley Pipeline LLC (MVP) further tightens the supply/demand balance this winter for East Coast markets that saw constraints drive spot prices to more than $100/MMBtu back in January.

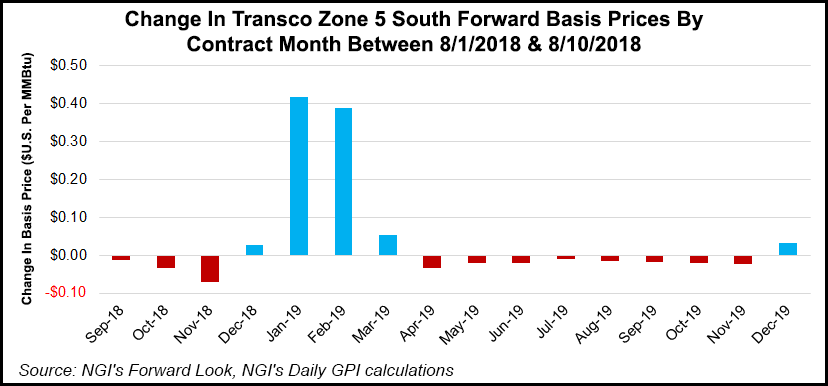

Since FERC’s Aug. 3 order halting all construction on the embattled 2 Bcf/d, 300-mile MVP, traders have priced in significant additional upside risk along the winter strip at Transco Zone 5, which would receive deliveries from MVP, and further north in Transco Zone 6, an analysis of NGI’s Forward Look data shows.

From Aug. 1 through Friday, Transco Zone 5 South January basis gained 41.8 cents to average a $3.354 premium to Henry Hub, while February basis has similarly climbed 38.8 cents to plus $3.259. Transco Zone 6 NY forwards saw a notable jump over the same period, with January basis climbing 76.6 cents to plus $6.021 and February adding 74.2 cents to plus $5.957.

During that time, FERC’s decision to halt all construction on MVP — originally targeting a 4Q2018 start-up — has cast doubts over whether the market will see any new capacity from the pipeline in time for the peak heating season in January and February.

On the heels of last winter’s price blowouts — including a North American record $175/MMBtu trade at Transco Zone 6 NY during a particularly frigid cold blast in early January — East Coast markets will have more pipeline capacity to work with this year but will also likely enter the upcoming winter with much less in storage.

For much of the summer, record-level Lower 48 dry gas production has applied significant downward pressure on futures prices even as cooling demand has helped keep total U.S. storage inventories at a deficit to the five-year average of more than 500 Bcf. While the bullish storage deficits have helped rally front month Nymex futures over the last week and a half, prices as of Monday remained on the bearish side of $3.

In terms of stockpiles heading into the 2018/19 winter, “the East and Midwest regions are trending particularly low as both fell below their 2014 regional low storage levels in June and have remained low in the weeks since,” BTU Analytics LLC analyst Katelyn Hesse said in a recent note.

Hesse estimated that East injections will need to resemble 2014’s mid-July-to-November injection rate of 3.50 Bcf/d in order to avoid setting a new five-year minimum for inventories at the start of winter.

“Low storage levels could lead to high natural gas prices in winter, especially if there is severe weather or extreme cold,” Hesse said. “Even as production in Appalachia grows, depleted storage reserves could result in incremental upward pressure during cold spells, and an overall cold winter could result in prolonged price pressure and volatility.”

That said, the incremental access to Appalachian gas afforded by the start-up of Transco’s Atlantic Sunrise expansion could go a long way toward avoiding a repeat of last winter’s outsized spikes.

That’s according to analysts with Genscape Inc., who told NGI that Atlantic Sunrise will provide an additional path for Northeast Pennsylvania production to reach the eastern seaboard and reduce congestion on Transco’s Leidy Line path.

“Atlantic Sunrise can flow either north or south once it hits Transco near Station 195, so it can bolster both Zone 6 and Zone 5, if needed,” according to Genscape analysts Josh Garcia and Colette Breshears. “This winter, both Zone 5 and Zone 6 should be in a better place to meet their respective demand. Zone 5 can now bypass the Transco Station 515-to-505 route, leaving that path to service Zone 6. When the new greenfield pipe comes into service, it will also bring in a significant uptick in production, around 0.5 Bcf/d.”

But low end-of-October inventories would still present plenty of upside risk for East Coast spot prices even with incremental takeaway expansions ready for service this winter.

“All else being equal, having another source of supply into the Transco Zone 5 and Zone 6 markets via Atlantic Sunrise should help to mute blowouts in pricing,” BTU Analytics analyst Matthew Hoza told NGI in an email. “However, all things are not equal, and current storage levels put the supply and demand balance in a precarious position” in the event of significant winter weather.

“Not only do we have lower storage levels compared to last year, but we also have additional demand online from Cove Point,” Hoza said. “Last winter, Cove Point, since it was in the commissioning phase, only took an average 215 MMcf/d during the winter, compared to about 600 MMcf/d in June and July…not having MVP as an additional potential source of supply puts prices” under upward pressure as Transco Zone 5 has to price higher to compete with surrounding demand.

Though an earlier start-up for MVP would have relieved some pressure on Transco Zone 5 this winter, Garcia suggested storage is likely a bigger factor in creating upside risk for East Coast winter forwards.

“MVP would have been a great winter addition to support Zone 5 from the middle of the zone, but the delay into 2019 is not a large surprise to anyone following the project, and it’s unlikely to materially affect any winter plans,” Garcia said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |