Infrastructure | NGI All News Access

Energy Transfer to Simplify Corporate Structure in ETE-ETP Tie-Up

Energy Transfer Equity LP (ETE) has agreed to acquire its affiliated master limited partnership (MLP) Energy Transfer Partner LP (ETP) in an all-stock transaction valued at $27 billion, management for the two companies announced.

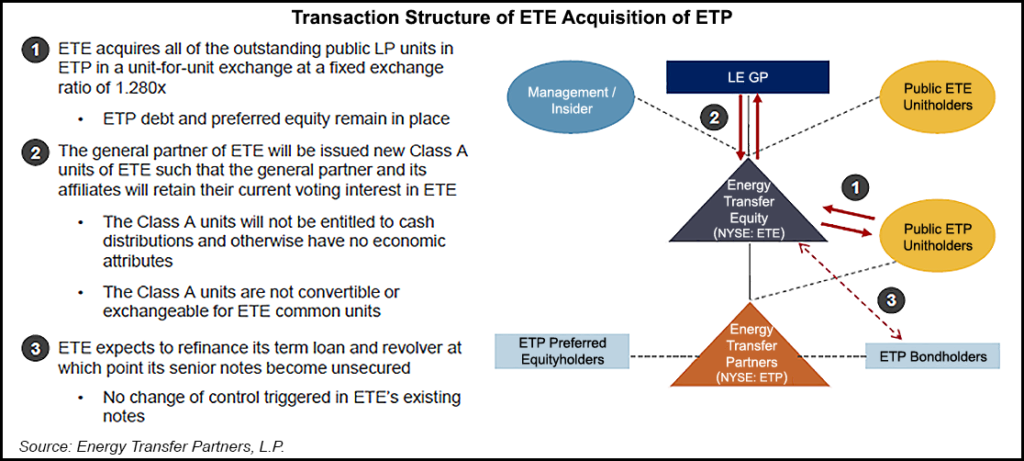

Under the agreement, ETP will merge with a wholly-owned subsidiary of ETE in a unit-for-unit exchange, with each ETP unitholder other than ETE and its subsidiaries receiving 1.28 common units of ETE for each ETP common unit owned. Expected to close in the fourth quarter, the transaction provides a premium to the current ETP common unit trading price and will be immediately accretive for ETE’s distributable cash flow per unit.

In addition to simplifying the organization structure and “further aligning the economic interests within the Energy Transfer family,” management for the Dallas, TX-based companies said the deal would allow the combined partnership to reduce its leverage ratio and reduce the need to issue equity to fund organic growth projects.

The transaction would reduce equity cost of capital by eliminating ETE’s incentive distribution rights in ETP, meaning more cash for the combined partnership from investments in organic growth projects and mergers and acquisitions, management said.

“The transaction is expected to strengthen the balance sheet of the combined organization by utilizing cash distribution savings to reduce debt and to fund a portion of ETP’s robust growth capital expenditure program,” management said. “The completion of major capital projects currently in progress is expected to continue to generate strong distributable cash flow growth for the combined partnership following the transaction.”

The deal would improve cost of capital by eliminating ETE’s incentive distribution rights in ETP, meaning more cash for the combined partnership from investments in organic growth projects and strategic mergers and acquisitions, management said.

The transaction has been approved by the boards of directors and conflicts committees of both partnerships but is still subject to majority approval by unaffiliated unitholders of ETP and other customary closing conditions.

The ETE/ETP merger announcement comes as other midstream operators, including Williams and Enbridge Inc., have made plans to simplify their respective corporate structures in reaction to a change in FERC policy in March that removed MLP tax benefits. Loews Corp. similarly announced plans to take over subsidiary Boardwalk Pipeline Partners LP.

ETE’s general partner and its affiliates will be issued a newly created series of Class A units in order to maintain the same voting interest in the combined entity as before the merger.

ETP owns and operates a diversified portfolio of midstream assets encompassing natural gas, natural gas liquids (NGL), crude oil and refined products. That includes 61,000 miles of natural gas pipelines, 146 Bcf of working storage capacity and more than 60 natural gas facilities providing gathering and processing, compression, treating and transportation for regions including the Eagle Ford, Haynesville, Barnett, Fayetteville, Marcellus, Utica, Bone Spring and Avalon shales.

ETP’s intrastate segment includes roughly 7,500 miles of intrastate natural gas pipeline with 14.1 Bcf/d of capacity and three storage facilities in Texas.

ETP is nearing completion on its 3.25 Bcf/d Marcellus/Utica takeaway Rover Pipeline, expected to reach full-service during the third quarter, and the company is working to finish construction of the embattled Mariner East 2 NGL takeaway project in Pennsylvania.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |