Markets | LNG | NGI All News Access | NGI The Weekly Gas Market Report

LNG Awakening Part 1: Buyers Seeking Transparency to Develop Price Benchmark

Note: This is the first in a three-part NGI series titled “Navigating the Nascent LNG Market Through A Choppy World Trade Sea,” which explores the emerging global liquefied natural gas market and the challenges it poses to buyers and sellers seeking to capitalize on the worldwide expansions underway.

Buyers and sellers of liquefied natural gas (LNG) are starting to turn to online trading platforms to conduct their business in an effort to gain the transparency, liquidity and optionality they desire to trade physical cargoes, as well as an efficient marketplace to execute transactions.

“Buyers want to have the choice for some optionality as well. They want flexibility,” said GLX CEO Damien Criddle, whose independent online platform trades LNG. Buyers last year sought contracts that averaged around seven years, Royal Dutch Shell plc said in its second annual outlook on the global LNG market.

Most LNG in the global marketplace today is sold under long-term contracts of 10-20 years, fee structures still desired by most sellers. For example, Cheniere Energy Inc.’s recent deal with PetroChina International Co. Ltd. is to sell 1.2 million metric tons per year through 2043. However, there is a growing appetite from buyers for shorter contracts with more flexibility.

The need for greater flexibility in a marketplace that has seen spot LNG volumes increase substantially in the last decade is one reason Criddle, a former LNG transaction lawyer, and his team formed GLX in 2015. The Singapore-based company launched its trading platform last year and now has more than 40 members from Asia, Australia, Europe, the Middle East and North America. Another five companies now are in the process of joining the exchange.

GLX closed its first transaction on May 21. The deal was the first time Malaysia’s state-owned Petroliam Nasional Berhad, through subsidiary Petronas LNG Ltd. (PLL), sold an LNG cargo on an online trading platform. Criddle said a number of cargoes have negotiated using the platform, but the recent Petronas trade is the first to utilize the end-to-end functionality of GLX through to close the deal.

PLL issued a tender invite to 30 registered GLX members to sell its delivered ex-ship cargo, with the bidding process running smoothly and garnering “healthy interest” from bidders throughout the trade window, Petronas said recently.

In addition to selling its cargo at a competitive price, the company’s use of the digital platform as an alternate tool to market cargoes “further proves Petronas’ commitment in innovation and digitalization, which we believe will contribute toward a more transparent and efficient LNG marketplace,” said Petronas Vice President Ahmad Adly Alias, who handles LNG marketing and trading.

As U.S. Exports Expand, Trading Liquidity To Grow

Criddle said the ingredients are in the mix for the global LNG market to see increased liquidity and eventually more price indexes, especially once additional export volumes from the United States begin hitting the market. “The viability of flexible volumes makes the market more efficient.”

There is about 24 Bcf/d of U.S. liquefaction capacity either in operation, under construction or approved by both the Federal Energy Regulatory Commission and the Department of Energy (DOE). In total, DOE has approved export licenses for 52.9 Bcf/d, “although it is highly unlikely that this level of investment will actually occur,” the Commodity Futures Trading Commission (CFTC) said in a recent report on U.S. LNG export growth.

Cheniere’s Sabine Pass began exporting gas in February 2016, the first U.S. facility to export LNG sourced from the Lower 48. In March, Dominion Energy began commercial service at the second LNG export project, Cove Point LNG on Chesapeake Bay in Maryland. Elba Island in Georgia is expected to begin commercial operations later this year. Freeport LNG, after announcing in April a nine-month delay in bringing its export facility online, is expected to begin commercial operations in the second half of 2019, with each of three trains coming online sequentially through the first half of 2020.

Many LNG buyers are relatively new entrants that need supply but don’t necessarily know how to secure it, so it’s up to companies to provide a central marketplace that fosters market engagement while also addressing some of the unique challenges of the global LNG market. For example, in the call for greater optionality, some buyers/sellers seek contract terms that offer flexibility in not only where cargoes come from, but also what buyers can do with those cargoes once they are delivered.

U.S.-based Redwood Markets in April launched an online trading platform, Redwood Marketplace, that offers buyers and sellers the means to transact a deal. It also runs a multitude of custom contracts that are based on “how LNG actually trades,” CEO Ajay Batra told NGI. “This is one commodity that is logistically so complicated that traditional execution on screen doesn’t work.”

Interest in the online exchange was “quite responsive” with several interested members seeking view-only privileges in order to get acclimated to the platform, Batra said. Redwood Marketplace can be utilized for contracting spot, short, medium and long-term transactions.

While the online exchange was created to provide the global LNG market with a trusted platform in which to do business, Redwood also has its eye on establishing an LNG index based on those deals. Even as the expanding LNG market has drawn the attention of big portfolio players, Batra said it will be buyers of physical cargoes that ultimately create the liquidity and price transparency the market needs to succeed. “It’s an adoption game at the end of the day. We all know this is new demand and new buyers.”

LNG Pricing Still In Early Stages

As for what an LNG benchmark may look like, GLX’s Criddle said he expected the price of future LNG cargoes to be a mix of those linked to oil, the U.S. benchmark Henry Hub and others linked to an LNG price index. Any successful LNG index would be one that is comprised of real prices of transactions, “not those editorial in nature. The market will decide what it likes. The benchmark has to be trusted. That’s the key to a successful index,” he said.

Batra agreed, noting that benchmark price assessments in the global LNG space such as the Japan Korea Marker (JKM), offer little to no transparency and aren’t based on actual deals. Redwood’s LNG index would be based on actual transactions executed on its trading platform. “Our goal is to publish a real index. Paper by itself does nothing. It’s a hedge at best.”

Furthermore, the market is becoming more competitive, with LNG exporters “quickly running out of ways to structure deals based on Henry Hub,” Batra said. Considering all the LNG export projects under construction, he estimated around 900 cargoes could be exported from the Gulf Coast during 2019-2020, providing “all the right ingredients for producing a real LNG index. There’s only so many ways you can be creative with Henry Hub.”

The Gulf Coast Marker, another LNG price benchmark, so far hasn’t gained much traction but has potential given the sheer number of cargoes expected to be exported from the region, sources said.

Meanwhile, some of the fastest growing importing countries are also looking to launch trading platforms and set individual indexes, citing the need for more market transparency. India, which is expected to see a surge in LNG imports to double the share of natural gas in its generation mix to 15% by 2022, is said to be launching a platform later this year.

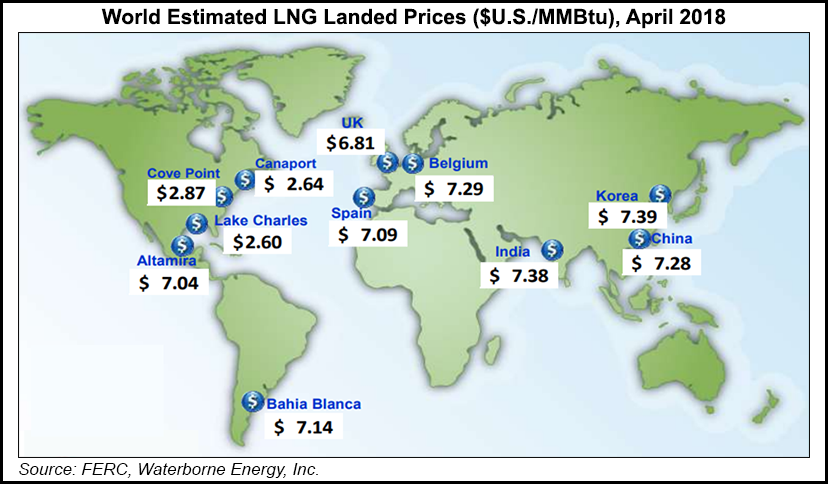

India currently imports LNG at global rates of around $7.50/MMBtu, while the government sets domestic gas prices at $3.06/MMBtu. The new trading platform would seek to standardize LNG pricing so that domestic prices are not set at such a discount to international market rates.

China, which last year passed South Korea as the second largest LNG importer, launched the Chongqing Oil and Gas Exchange earlier this month. The trading platform is for domestic output, pipeline imports from Central Asia/Myanmar and imports of LNG. It is the second exchange set up in the country.

China launched a similar exchange in Shanghai in 2015, and in April, China National Offshore Oil Corp used it to sell LNG cargoes for the first time on a domestic exchange. The Chongqing Oil and Gas Exchange, which executed its first pipeline gas transaction on May 11, also auctioned off LNG volumes but results had not been announced at the end of May.

Singapore appears to be edging out the competition as a preferred location for an Asian LNG hub. In May, a Deloitte survey of more than 80 senior energy industry leaders from across the Asia-Pacific region found that 74% thought Singapore would attain the position by 2023. Ten percent of respondents each selected China and Japan as other potential hub locations.

Looking at possible LNG pricing benchmarks, 52% of respondents in the survey believe the JKM will be the most widely chosen for spot trades in 2023, followed by 16% for Henry Hub and the SGX LNG Index, which was jointly developed by Singapore Exchange and Energy Market Co. in 2016.

In its outlook, Shell said the use of the JKM has risen considerably over the last year, reflecting “demand from the industry for price risk management.” The CFTC agreed, noting that as gas-indexed contracts become more prevalent, and as U.S. exports increase, it is likely that trading in U.S. derivatives markets will increase as a result, especially by overseas traders.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |