Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Devon Takes $3.1B for EnLink as GIP Builds Midstream Portfolio

Devon Energy Corp. has clinched an agreement to sell its ownership in EnLink Midstream, which it controls, to an affiliate of Global Infrastructure Partners (GIP) for $3.125 billion.

The Oklahoma City-based exploration and production (E&P) company, EnLink’s biggest customer, spun off most of its midstream business in 2013 to create EnLink Midstream LLC and EnLink Midstream Partners LP with Crosstex Energy Inc. EnLink has since grown steadily.

“The sale of our EnLink interests represents a significant step forward in achieving our 2020 Vision to further simplify our asset portfolio and return excess cash to shareholders,” said CEO Dave Hager. “This highly accretive transaction provides a strategic exit from EnLink at a value of 12 times cash flow, a substantial premium to Devon’s current trading multiple.”

Devon owns a 64% interest in the general partner and 23% stake in the master limited partnership (MLP), ownership that has generated $265 million of cash distributions over the past year.

The deal appears to be at a fair price, as Devon at the end of March estimated that its EnLink ownership had a market value of about $3 billion and was projected this year to generate cash distributions of $270 million.

As part of this transaction, Devon has extended through 2029 its fixed-fee gathering and processing contracts for the Bridgeport and Cana plants in North Texas. Minimum volume commitments for the agreements expire at the end of 2018.

Proceeds from the sale, combined with proceeds from E&P assets already sold and those being marketed, “will exceed our $5 billion divestiture target,” Hager said.

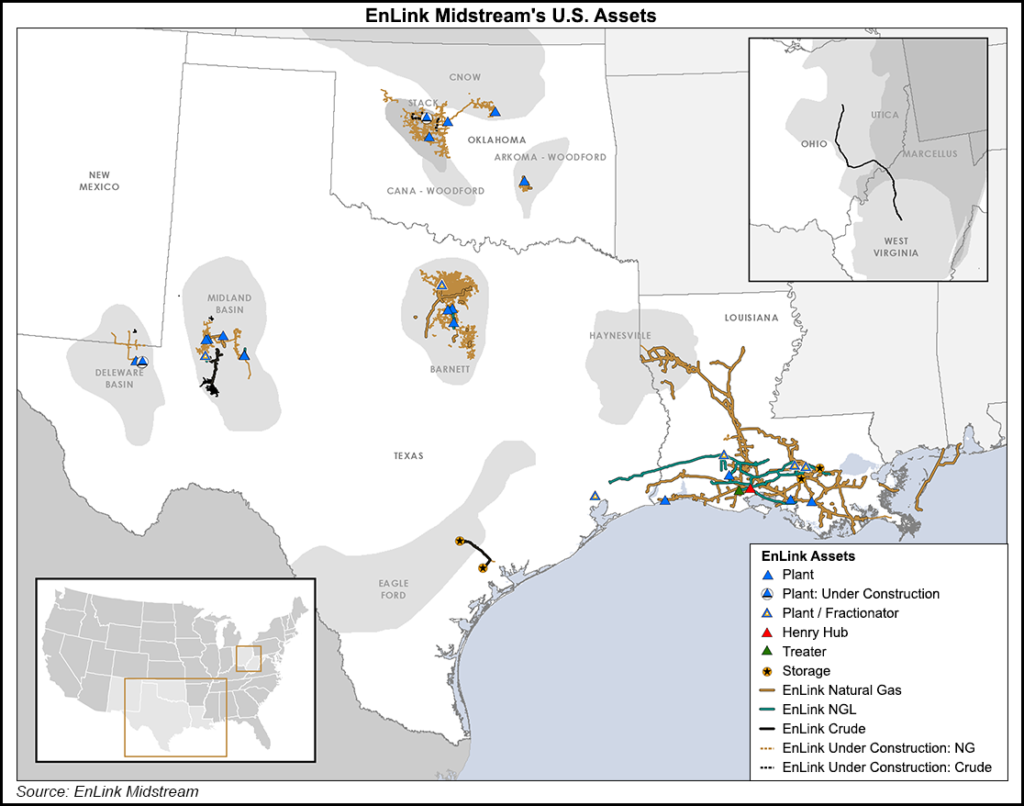

“Looking ahead, we will continue to build upon our strong relationship with EnLink and GIP. EnLink remains a preferred partner for us in the midstream space, and we will continue to pursue mutually beneficial ways to grow our respective businesses across North America’s most prolific growth basins.”

The strategic partnership with GIP “will continue EnLink’s strong momentum, build upon our core strengths and add to our robust growth outlook,” said EnLink CEO Michael J. Garberding. “GIP has significant expertise and experience in the midstream industry that will enhance and elevate our growth plans…We are thankful for the ownership relationship we’ve had with Devon, and we look forward to deepening our long-term commercial relationship with them as EnLink and Devon continue to collaborate in multiple core basins.”

GIP long has been a big investor in U.S. oil and gas operations, including midstream facilities. Last fall, it paid $1.825 billion-plus to buy Medallion Gathering & Processing LLC, which owned the largest privately held crude oil transportation system in the Permian Basin’s Midland sub-basin.

GIP’s broad portfolio includes stakes in E&Ps, Bakken Shale midstream projects and liquefied natural gas export facilities.

The investment “is a unique opportunity for us to partner with a leading energy infrastructure company with scale and a diverse portfolio of operations in leading North American crude oil and natural gas basins at an exciting time,” said GIP Chairman Adebayo Ogunlesi.

In conjunction with the sale, Devon’s board increased a share repurchase program started earlier this year to $4 billion from $1 billion. The $3 billion additional authorization, which represents about 20% of outstanding shares, extends to the end of 2019 and is conditioned upon closing the EnLink transaction, which is set to close in July.

With the transaction, Devon revised its guidance to include consolidated general/administrative and interest savings of about $300 million and a 40% decrease in consolidated debt.

In reaction to the sale, analysts with Tudor, Pickering, Holt & Co. Inc. noted that midstream monetization “has long been a conversation for E&P-sponsored MLPs,” but “the ”all-at-once’ approach versus gradual sell-down could cement views that monetization of interests in favor of the parent balance sheet will take priority over midstream valuation.”

The sale could provide a “read-through for the space, especially similar sponsored names with heavy parent ownership, assuming the sponsors look for a similar exit.” Midstreamers controlled by onshore E&Ps include Western Gas Partners LP (Anadarko Petroleum Corp.), Noble Midstream Partners LP (Noble Energy Inc.) and CNX Midstream Partners LP (CNX Resources Corp.), among others.

Citi acted as the financial adviser to EnLink. For GIP, Intrepid Partners LLC was financial adviser and Latham & Watkins acted as legal adviser. Goldman Sachs & Co. LLC was Devon’s financial adviser, J.P. Morgan Securities LLC provided a fairness opinion and Vinson & Elkins LLP acted as legal adviser.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |