Natural Gas Futures Climb Ahead of EIA Storage Data as Cooling Demand Still Supportive

Natural gas futures nosed higher Wednesday, keeping the gains from the previous day’s big rally as forecasts maintained hotter temperatures through early June. Spot prices continued to strengthen across the Midwest and Texas, with major cities in those regions expected to see highs in the 80s and 90s into the weekend; the NGI National Spot Gas Average added 9 cents to $2.53/MMBtu.

The June contract settled 0.6 cents higher at $2.914 after trading as high as $2.939 and as low as $2.898. The July contract gained 1.9 cents to settle at $2.955.

Bespoke Weather Services said Wednesday its outlook was neutral to slightly bullish “as we continue to weigh cooling demand additions to our forecast against looser balances. We also see spreads as currently very supportive, seemingly allowing for one leg higher in prices along the strip should” this week’s Energy Information Administration (EIA) storage report “not miss bearish.”

Bespoke said it had a bearish bias previously based on “power burn and balance data that was not particularly tight, though” Thursday’s “EIA print should mask some of that looseness given production decreases from pipeline maintenance. However, our sentiment turned slightly bullish” Tuesday as weather guidance showed a “significant amount of cooling demand that was likely through the first week of June, and since then forecasts have only trended more impressive.”

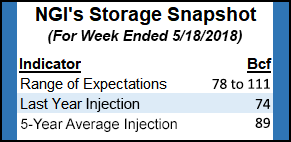

Estimates for the Thursday’s 10:30 a.m. ET Energy Information Administration (EIA) storage report show the market anticipating a build large enough to chip away at deficits but not by much.

A Reuters survey of traders and analysts on average predicted a 92 Bcf injection for the week ending May 18, with responses ranging from 85 Bcf to 100 Bcf. A Bloomberg survey produced a median 91 Bcf injection, with responses from 78 Bcf to 111 Bcf. Last year, EIA recorded a 74 Bcf build for the period, with a five-year average injection of 89 Bcf.

ION Energy predicted a 90 Bcf build, while Intercontinental Exchange EIA futures for this week’s report settled Tuesday at an injection of 94 Bcf.

Last week, EIA reported a 106 Bcf injection into Lower 48 gas stocks for the week ending May 11, close to consensus estimates and larger than both last year’s 64 Bcf build and the five-year average 87 Bcf injection for the period. The year-on-year storage deficit stood at 821 Bcf as of last week, while the year-on-five-year deficit stood at 501 Bcf, EIA data show.

INTL FCStone Financial Inc. Senior Vice President Tom Saal told NGI this week that he’s bullish overall on natural gas given the large storage deficits at this point in the season.

“We’ve got these deficits, and the people who are bearish are saying don’t worry about it, we’ve got plenty of gas,” Saal said. “I’m saying, ”Show me.’ Last week, we put in over 100 Bcf, and the market rallied on that, which is pretty impressive. Are we going to do another 100 Bcf this week? Maybe not.”

Turning to the spot market, with near-term forecasts showing widespread above-normal temperatures, Henry Hub day-ahead prices gained ground on prompt-month futures, adding 8 cents to average $2.86 Wednesday, setting the tone for gains across much of the Lower 48.

In the Midwest, Radiant Solutions was calling for highs in Chicago to climb into the upper 80s over the next several days, while Minneapolis was expected to see highs reach the 90s by the weekend, nearly 20 degrees hotter than normal.

The Midwest Regional Average increased for the fourth straight trading day, with Chicago Citygate tacking on another 6 cents to $2.74, while in the Midcontinent, Northern Natural Ventura added 11 cents to $2.71.

In Texas, Radiant was forecasting highs in Dallas in the 90s through the end of the month, potentially approaching triple digits next week. Houston was also expected to stay hot, with highs in the mid 90s, about 4 degrees above normal, according to the firm.

Carthage added 11 cent to $2.80 Wednesday, while Houston Ship Channel tacked on another 3 cents to average $2.95. Points in the pipeline-constrained producing region of West Texas also gained on the day, with Waha adding 7 cents to average $1.80.

In Appalachia, prices were mixed. Dominion South added 5 cents to $2.23, while Transco-Leidy Line dropped 6 cents to $1.18.

Transco told shippers Wednesday that ongoing unplanned maintenance at its Compressor Station 520 in Salladasburg, PA, will extend through June 1. Transco had first announced unplanned maintenance at the station last month, and the most recent notice prior to Wednesday had scheduled the work to conclude this week. Transco said service through Station 520 and the Leidy Line will be impacted.

Meanwhile, after submitting requests to FERC this month to bring online its Majorsville Lateral and remaining sections of its Mainline B, “the Rover Pipeline is now in the endgame, having requested authorization to bring on the entire project with the exception of the Sherwood and Columbia Gas (TCO) laterals,” Genscape Inc. analyst Colette Breshears told clients Wednesday.

“After a long wait, all Rover” horizontal directional drills “are complete. Construction on all requested laterals and pipes is complete,” Breshears said, adding that filings suggest the Sherwood and TCO laterals were largely finished but that landslides during the spring held back completion on sections of those pipes as contractors waited for more favorable conditions.

As for when the Federal Energy Regulatory Commission will authorize the remaining portions of the project under consideration, “we have no good estimates,” Breshears said. “Continued earth movement/slips along the Burgettstown, Majorsville, Sherwood and TCO laterals may impact FERC’s approval of those lines, which will impact the addition of supply paths to Rover. Mainline B, which adds the rest of Rover’s throughput to bring it from 2 Bcf/d to 3.25 Bcf/d, doesn’t seem to have any major restoration or remediation efforts left to hurdle.”

Rover, designed to transport Marcellus and Utica shale gas east-to-west to reach markets in the Midwest, Gulf Coast and Canada, headlines a slew of new Appalachian takeaway expansions expected to come online over the next few years. Anticipated supply growth from producers drilling to fulfill commitments on these expansions has been cited by analysts as a factor in recent long-term bearish forecasts for natural gas prices.

Breshears said Wednesday that Genscape doesn’t expect the start-up of Rover’s remaining facilities to coincide with any near-term ramp-up in production out of the Ohio, southwestern Pennsylvania and northern West Virginia areas the project is designed to serve.

“Instead, expectations are for gas to reroute from current pipelines to flow onto Rover, especially at Majorsville and Sherwood, where processing plants are connected into TCO, Tetco and Dominion,” Breshears said. The start-up of the Burgettstown Lateral — expected to be supplied by the new Harmon Creek and Revolution plants — could bring some new production online, but these volumes should “grow slowly as these systems turn on for the first time.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |