E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Concho, RSP Combination to Create Monster Permian Pure-Play

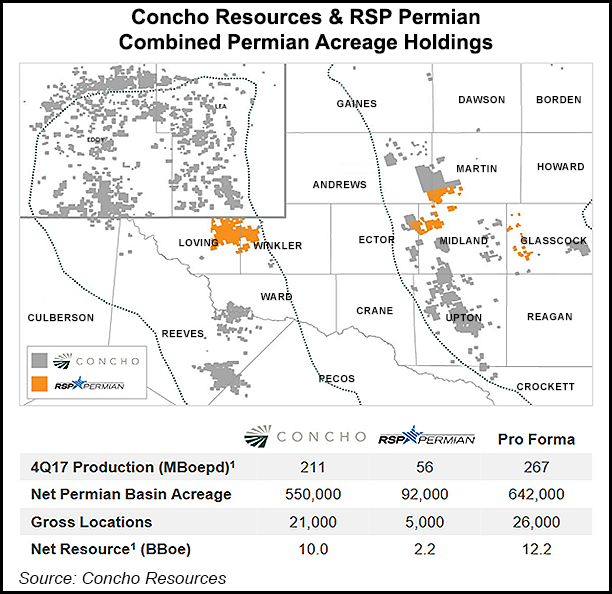

Concho Resources Inc. on Wednesday clinched an all-stock transaction valued at $9.5 billion to take over RSP Permian Inc., creating a Permian Basin pure-play holding close to 640,000 net acres.

The transaction is the largest U.S. upstream merger and acquisition (M&A) deal since 2012 and the largest “purely Permian deal ever,” according to Wood Mackenzie.

The deal, which includes RSP’s net debt estimated at $1.5 billion, would trade 0.32 shares of Concho common stock for each share of RSP, valuing RSP at about $50.24/share, or a 29% premium to its closing price on Tuesday (March 27). The transaction, unanimously approved by each board, would give Concho 74.5% of the combined company, with RSP shareholders owning about 25.5%.

“This transaction provides a compelling opportunity for both Concho and RSP shareholders to benefit from the strength of our combined company,” said Concho CEO Tim Leach during a conference call. RSP’s Permian holdings, which run across about 92,000 net acres of West Texas and New Mexico, “will go right to the top of our development inventory.” Concho already has a substantial leasehold of 500,000-plus net acres.

The combination would allow longer laterals and improved efficiencies, as the Permian moves from exploration to development.

“The RSP team built an exceptional high-margin asset portfolio consistent with our playbook — large, contiguous positions in the core of the Permian Basin,” Leach said. “And they did so with a strategy of maximizing well performance and returns, which provides substantial running room for continuous development with large-scale projects.”

The merger “allows us to consolidate premier assets that seamlessly fold into our drilling program, enhance our scale advantage and reinforce our leadership position in the Permian Basin, all while strengthening our platform for delivering predictable growth and returns,” Leach said.

Midland, TX-based Concho expects to be able to drill longer laterals and gain from RSP’s infrastructure, allowing the operator to more quickly move into manufacturing mode to generate cost savings.

Combining with an exploration and production (E&P) company operating adjacent to some of its areas should allow more long laterals and minimize the risks from parent-child wells drilled near each other, Leach said.

“We’ve consistently described how large contiguous blocks of acreage are strategic and deep in our…premium locations…Directing capital to these locations will enhance our overall program economics.

“We also plan to leverage our land ground game on these assets. That’s our strategy for optimizing assets by coring up acreage into swaps and trades. We did a record number of trades over the last several months, and we expect this to continue as more operators focus on long lateral continuous development…

“We said many times before we were looking to add great assets to our portfolio, but not at the expense of our financial performance or position. We expect the transaction to be immediately accretive to our per share metrics before accounting operational synergies…”

The combined company, set to run 27 rigs, would create “the largest crude oil and natural gas producer from unconventional shale” in the basin, according to Leach.

For perspective, ExxonMobil Corp., the largest acreage holder across the Permian with more than one million acres, expects to be running 30 rigs in the Delaware and Midland sub-basins by year’s end, while Chevron Corp. expects to be running 20 rigs across the basin.

The Concho-RSP tie-up is expected to create “significant operational synergies,” with development optimization, shared infrastructure and capital efficiencies, with a current value of $2 billion-plus, Leach said. The combination also is expected to realize more than $60 million a year in corporate-level savings.

“As RSP has grown and we have seen the resource play develop in the Permian, we have come to recognize that combining with a company with the scale, investment grade balance sheet and operational excellence of Concho will unlock even more value for shareholders,” said RSP CEO Steve Gray.

“The combined company will have the vision and necessary financial strength to efficiently develop the tremendous resource potential of these assets with large-scale projects.”

RSP, which has about 180 employees, during the fourth quarter produced 55,500 boe/d, 80% weighted to crude oil and 20% to natural gas. Its acreage has an estimated 2.2 billion boe of resource potential.

The transaction should be completed in the third quarter, subject to the approval of each company’s shareholders and customer closing conditions.

“Game on in the Permian,” said Jefferies LLC analysts led by Mark Lear. The $9.5 billion overall price “implies $76,000/acre for RSP’s acreage…” Jefferies values RSP’s proved developed producing reserves at about $2.5 billion.

“With Concho trading at a wide premium compared to the broader E&P peer-group and its smaller Permian peers, there has been much discussion of late, including in our meeting with Concho last week in Midland, as to what Concho was going to do to take advantage of that opportunity,” Lear said.

“Much of that conversation has focused on the social/cultural issues around corporate combination, which is probably more simply defined as who is for sale and who is not, so despite there being multiple other opportunities in the market that would have been cheaper (especially on the $/acre metric) this was one of only a few that Concho could get.”

Wells Fargo Securities LLC’s analyst team valued the deal for RSP at closer to $62,750/acre, after backing out projected 2018 production at $50,000/boe a day.

“While we had viewed RSP as a candidate for consolidation, timing always is a wildcard and perhaps a signal that ability to grow acreage position meaningfully through bolt-on transactions is becoming harder, and scale is becoming more of a priority as the basin matures,” said Wells Fargo analyst Gordon Douthat.

“From a broader perspective, M&A always sparks chatter on who could be next, and the transaction is likely to increase urgency for other Permian players looking to add scale as one less target is on the block, which could provide a much needed catalyst for investors on the sidelines to give the group another look.”

Wood Mackenzie research analyst Andy McConn noted that Concho management’s rationale in acquiring RSP is to “realize new efficiencies…But realizing efficiencies to the extent that Concho estimates (over $2 billion) will be challenging for multiple reasons.

“RSP was already a lean business. Its Delaware position is not contiguous with Concho’s. Concho’s operational prowess (e.g., high-ranking well performance) could add value to RSP’s position. But RSP already operated its position with comparable skill.”

Concho’s share price performance, which was down on Wednesday following the announcement, “underscores investors’ anxiety about growth-oriented, rather than discipline-oriented, actions by US E&Ps,” McConn said.

“Headline deal metrics are rich and suggest no pullback in valuations from previous deals for top-tier Permian assets.”

The transaction “also underscores an argument that is gaining steam in the industry, that performance ”sweet spots’ aren’t as big as originally perceived,” he said.

Concho already had “plenty of drilling inventory. Buying RSP, which held a smaller but concentrated position in recognized sweet spots, suggests that Concho recognizes the importance of focusing activity in areas of the highest quality,” said McConn.

The deal marks a step toward consolidation in the Permian, he noted. Between the second quarter of 2016 and the first quarter of 2017, “more than US$40 billion was spent on Permian upstream M&A. However, the targets during this period were mainly assets and privately held companies rather than public corporations.

“Looking ahead, any other large-scale deals will face significant headwinds, i.e. rich valuations, anxious investors, and scrutiny on operational performance,” McConn said. “If this deal is to mark a second wave of ‘Permania’ in the oil M&A market, potential acquirers will have to be firmly confident in the Permian’s long-term potential.”

Upon closing, Concho’s board would expand to 11 directors, including one independent member of the RSP board. Concho would continue to be headquartered in Midland, TX.

Morgan Stanley & Co. LLC acted as financial adviser to Concho, while Sullivan & Cromwell LLP and Gibson, Dunn & Crutcher LLP were legal advisers to Concho. Tudor, Pickering, Holt & Co. was RSP’s financial adviser, and Vinson & Elkins LLP acted as legal adviser.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |