Infrastructure | Bakken Shale | E&P | NGI All News Access

Bakken Pipeline System Testing Support for Unused Capacity

Dallas-based Energy Transfer Partners (ETP), majority owner-operator of the Bakken Pipeline System that runs from North Dakota to the Gulf Coast, is gauging interest in more capacity involving subsidiaries Dakota Access Pipeline (DAPL) and Energy Transfer Crude Oil Co. (ETCO).

ETP did not identify how much capacity on DAPL and ETCO lines may be available. ETP is focused “on filling the available capacity” to move more Bakken sweet crude to markets, a spokesperson told NGI’s Shale Daily.

The nearly 1,200-mile DAPL runs from North Dakota through four states to a hub in south-central Illinois at Patoka. From there the 788-mile ETCO, a converted natural gas pipeline, moves the crude to Nederland, TX, in Jefferson County. Nederland is part of the “Golden Triangle,” that makes up a refinery/petrochemical complex between Beaumont, Port Arthur and Orange.

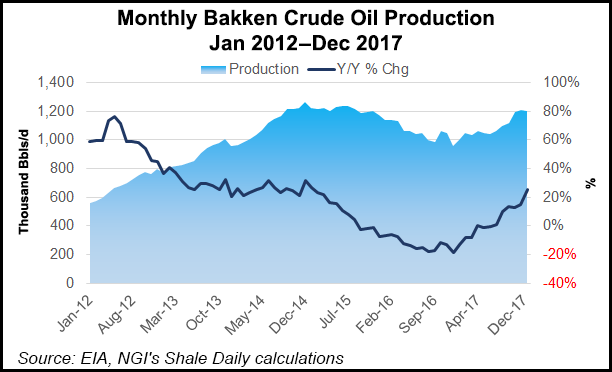

The open season began Thursday and has no official end date. Most of the Bakken’s 1 million b/d-plus production is being shipped to market via pipeline, while rail shipments have slipped to under 10% of the production, according to North Dakota officials.

DAPL went into initial service last June. North Dakota has indicated DAPL has maximum capacity of up to 570,000 b/d.

ETP officials last year said DAPL and ETCO had commitments for about 520,000 b/d.

Morningstar Commodities Research in a recent price analysis of DAPL and rail shipping differences for Bakken producers said “life is looking better for them” with higher crude prices and the availability of DAPL capacity. Morningstar’s Sandy Fielden, director of oil and products research, concluded that DAPL hasn’t necessarily helped producers because they have less flexibility in marketing their output because of long-term take-or-pay contracts with the pipeline. Netbacks to the producers reaching East Coast markets by rail may be superior to pipeline marketed supplies, he said.

During its first six months of operation, only about half of the DAPL supplies reached the Texas Gulf Coast, Fielden noted. Ohio-based Marathon Petroleum Corp., DAPL’s anchor shipper with 9% ownership, has 729,000 b/d refining capacity in the eastern Midwest that is reachable from the Patoka Hub, so Fielden surmises that is a major reason why not all of the Bakken DAPL shipments are reaching Texas.

More than 470,000 b/d flowed on DAPL between June through November, according to Fielden who “assumed that the balance of these shipments left North Dakota on DAPL, but were delivered to Patoka, rather than shipping all the way to the Gulf Coast.”

Separately, North Dakota Pipeline Authority Director Justin Kringstad said he calculated a $3.00/bbl-plus discount improvement for Bakken crude in DAPL’s first six months of operations, translating into $59.2 million in additional state revenue, not factoring in royalty owner or industry revenue impacts, compared with 2016 price discounts.

North Dakota statistics indicate DAPL last June averaged 300,291 b/d, or 58% of its initial 520,000 b/d commitments. It had increased to 446,450 b/d, or 86%, in December, Kringstad said.

With the Brent-West Texas Intermediate price spread at $3.00/bbl today “I do not anticipate that to be large enough to pull barrels away from the pipeline markets back onto rail,” he said. He estimated it would take at least a $5-6/bbl spread.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |