Markets | E&P | NGI All News Access

Alberta Natural Gas Market Share Declining Even as Production Increases

Canada’s chief natural gas supplier province is producing more but enjoying it less, according to government barometers of industry performance.

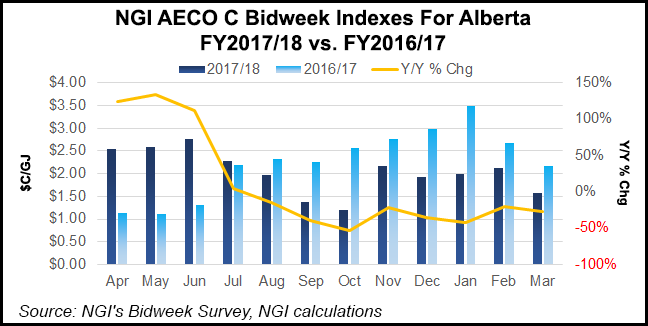

While Alberta’s production grew by 5%, its market value shrank by 6%, show records for the provincial treasury’s 2017-2018 fiscal year (FY), which ends this month.

The latest quarterly budget statement by Alberta Finance Minister Joe Ceci shows that total annual output climbed to 4.4 Tcf for 2017-2018 from 4.2 Tcf in FY2016-17.

But the Alberta Reference Price (ARP) — the actual weighted average earned by all sales, compiled for royalty collection purposes — slid to C$1.90/GJ ($1.60/MMBtu) for the FY from C$2.01/GJ ($1.69/MMBtu) in 2016-2017.

The bare numbers fall short of registering the severe disappointment felt by the industry and the treasury. When Ceci presented the provincial budget a year ago, the ARP was forecast to climb by 45% to C$2.90/GJ ($2.44/MMBtu).

The washout this year is leaving Alberta gas royalties, formerly the treasury’s top earner, near C$500 million ($400 million), down by 94% from the pre-shale gale peak of C$8.4 billion ($6.7 billion) in 2005-2006.

Although growing British Columbia (BC) gas production has reached 1.6 Tcf/year, Alberta still accounts for nearly three-quarters of the Canadian total. About half is exported to the United States for varying prices in markets across North America.

While acknowledging competition from low-cost U.S. shale supplies, Canadian gas producers also blame their hard-time prices on market access limitations of TransCanada Corp.’s Alberta and BC supply collection grid, Nova Gas Transmission Ltd. (NGTL).

The pipeline network is responding with facilities additions, although at a gradual pace with projects securely supported by long-term transportation service contracts that require producer commitments often lasting a decade or more.

NGTL’s latest step is posting a preliminary project description for a package scheduled for completion in 2021, to increase capacity by 620 MMcf/d at grid inlets and 1 Bcf/d at outlets for C$2.4 billion ($1.9 billion).

In the meantime, three smaller facilities additions are under construction or advancing through regulatory approval stages before the National Energy Board.

Work is nearing completion on a central Alberta project called the Sundre Crossover, a short C$99 million ($80 million) stretch of pipe for a 233 MMcf gain in export delivery capacity to the U.S. Pacific Northwest and California.

NGTL is currently seeking approval for two more Alberta additions: the C$207 million ($166-million) North Path to serve rising gas demand by thermal oilsands plants, and the C$409 million ($327-million) West Path near Calgary for further increases in capacity for flows into export pipelines.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |