NGI The Weekly Gas Market Report | Earnings | Infrastructure | LNG | LNG Insight | NGI All News Access

4Q2019 Earnings: Sempra Sees Opportunities in U.S. Natural Gas Utilities, LNG Exports

Sempra Energy’s management team is pinning growth on California and Texas utilities, as well as a revival in liquefied natural gas (LNG) growth.

CEO Jeff Martin during a conference call to discuss fourth quarter performance previewed the five-year capital expenditure (capex) program, which is set at $32 billion through 2024.

The combined rate base for California utilities Southern California Gas Co. and San Diego Gas and Electric Co., as well as the power utility Oncor in Texas, will increase to $50 billion in 2024, according to CFO Trevor Mihalik.

“The increased capex program will be funded from a portion of the multi-billion-dollar sale of South American utility companies, internal cash flow and other sources,” Mihalik said.

Oncor has given Sempra an increased focus in the Texas market, Martin said.

“Texas is a top priority for our company, and we continue to operate in a straight line there,” he said. “I think we’re in a position in which we have new flexibility in the earnings power of the company, which is about 88% attributable to our U.S. utilities.”

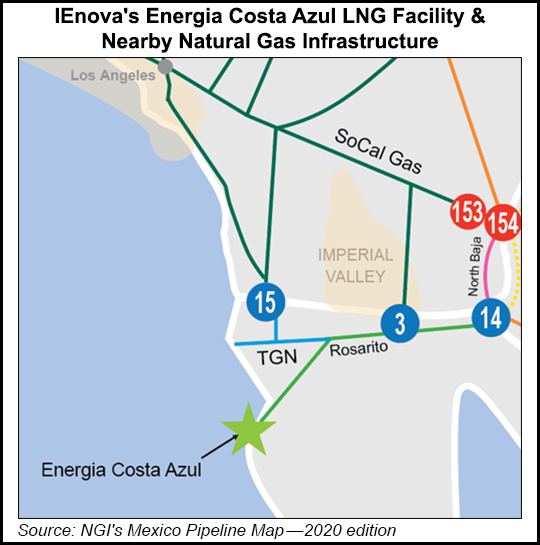

Martin also reiterated that the Energia Costa Azul LNG export project for Mexico’s west coast remains on track for sanctioning by the end of March, confirming the announcement earlier in February by Mexico unit Infraestructura Energética Nova.

“Our view is that over the upcoming decade there will be a shortage of LNG, and our projects are probably in the best position to take advantage of this, so our confidence level remains the same,” Martin said. Our focus remains on long-term opportunities.”

In 4Q2019, net profits totaled $447 million ($1.55/share), compared with $864 million ($3.03) in 4Q2018. For 2019, Sempra reported all-time high earnings of $2.1 billion ($7.29/share), versus $924 million ($3.42) in 2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |