NGI The Weekly Gas Market Report | E&P | Earnings | Infrastructure | NGI All News Access

4Q2019 Earnings: Helmerich & Payne Increasing Market Share on Efficient Rig Fleet as Customers Tighten Belts

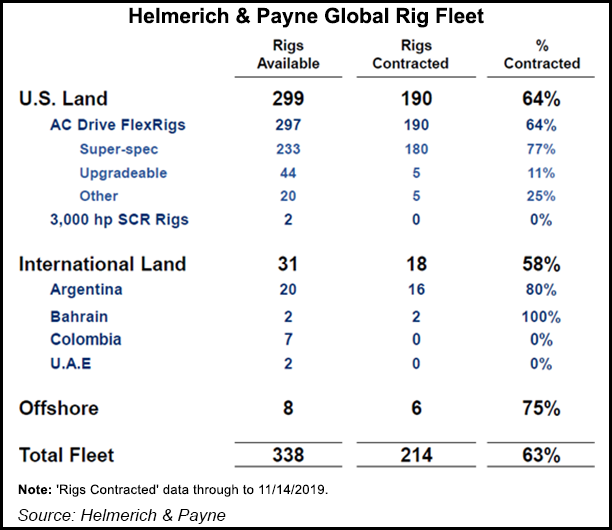

Amid a tough commodity price environment for its customers, Tulsa-based oilfield services (OFS) operator Helmerich & Payne Inc. (HP) grew market share from 22% to 24% during the recent quarter on strong demand for its efficient super-spec rigs.

In its U.S. Land business, HP exited the quarter with 195 contracted rigs, the first time since 2018 that HP saw a sequential increase in activity, management said.

The company increased its U.S. Land market share to 24% by the end of the quarter “due to the continued sidelining of less capable legacy rigs in the industry,” CFO Mark Smith said during a conference call Tuesday to discuss the company’s fiscal 1Q2020 results.

U.S. Land revenue for the quarter was down $36 million sequentially to $509 million; operating margins decreased $7 million sequentially to $182 million. Revenue days were down 6% to 17,685, versus 18,765 in the prior quarter, management said.

HP reported U.S. Land adjusted average rig revenue of $25,397/day for the quarter and a U.S. Land adjusted average rig margin of $10,410/day, both roughly flat sequentially.

“We believe capital discipline by our customers will remain a prevailing theme, and we expect industry activity to look similar to the average level experienced during the second half of calendar 2019, which implies a modest increase from current levels,” CEO John Lindsay said. “As drilling performance continues to improve, a significant portion of these gains are attributable to the added capabilities and efficiencies from super-spec capacity rigs.”

The greater efficiencies associated with the super-spec rigs also mean higher maintenance and capital costs, Lindsay said, noting that revenues for “optimized drilling solutions” will need to increase to cover these costs.

Management revealed that HP is shifting toward performance-based contracts as a model for divvying up the fruits of its labors with its customers.

“Given our customers’ focus on spending within budgets, optimizing investment and value, we are continuing to develop new pricing solutions to reflect the growing partnership between H&P and our customers,” Lindsay said.

“Our performance contracts are gaining ground as a larger portion of the fleet is shifting to this commercial model,” Smith added. “As H&P provides value to our customers such as by reducing their overall well spread costs, then H&P participates in that savings creation. These performance contracts are now generating approximately $500 per day more in margin than our average day rate and model margins produced.”

Looking ahead, management said based on customer conversations, it expects capital expenditures in calendar 2020 to decline around 10%.

“This implies that the number of wells drilled in 2020 would decline by 2,300 from the 16,400 wells drilled during calendar year 2019, an approximate 14% decrease,” Smith said. “…As the market tightens and as opportunities to displace legacy rigs arise, our initial objective is to put the 35 idle super-spec rigs we currently have back to work. Also, we still have 44 FlexRigs that are upgradeable to super-spec when and if market conditions warrant that investment.”

Total quarterly revenues clocked in at $614.7 million, down from $649.1 million in the previous quarter and $740.6 million in the year-ago quarter.

Net income was $30.6 million (27 cents/share) for the quarter, versus net income just shy of $19 million (17 cents/share) in the year-ago period.

Want to see more earnings? See the full list of NGI’s 4Q2019 earnings season coverage.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |