Shale Daily | Infrastructure | NGI All News Access

4Q2019 Earnings: Enable Sees Record 2019 Volumes But Lower Revenues, Bracing for ‘Headwinds of 2020’

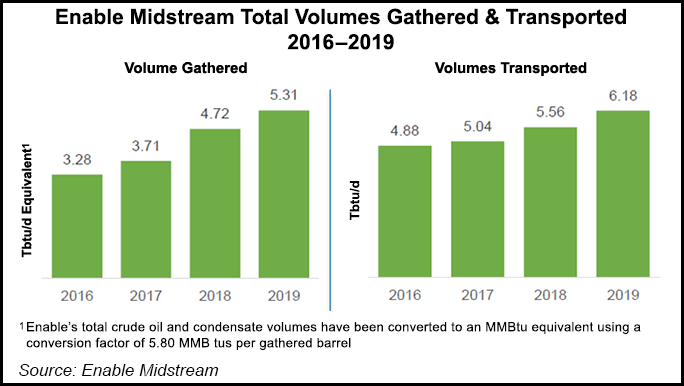

Weaker commodity prices made a dent in Enable Midstream Partners LP’s revenues to close out 2019, but the Oklahoma City-based midstreamer persevered in part on the strength of record-high annual natural gas gathering, processing and transportation volumes.

In its full-year and 4Q2019 financial results released this week, Enable reported 1,666 trillion Btu (TBtu) in natural gas gathered volumes in 2019, besting the 1,637 TBtu recorded for 2018. Processed volumes climbed to 925 TBtu from 877 TBtu in 2018, while transported volumes rose to 2,254 TBtu, up from 2,028 TBtu a year earlier.

Still, a challenging commodity price environment accompanied lower revenues during the fourth quarter for Enable’s gathering and processing and transportation and storage segments.

“The energy industry experienced significant changes in 2019, and Enable rose to the challenge as we set records for annual gathering, processing and transportation volumes,” CEO Rod Sailor said. “As we face the headwinds of 2020, Enable remains focused on operational excellence, cost discipline and efficient capital deployment.”

As of earlier this month, management counted 27 rigs drilling across Enable’s footprint that were expected to connect to the midstreamer’s gathering systems, including 19 in the Anadarko Basin, five in the Ark-La-Tex Basin and three in the Williston Basin.

Also in the company’s plans for 2020, Enable will file certificate applications with FERC during the first quarter to build the proposed Gulf Run Pipeline, designed to supply the Golden Pass liquefied natural gas (LNG) terminal. Management currently expects to seek authorization to build an approximately 1.7 Bcf/d pipeline, meeting the needs of the 1.1 Bcf/d commitment from Golden Pass and allowing for “additional capacity subscriptions that may develop from ongoing discussions.”

Subject to Federal Energy Regulatory Commission approval, management expects to place Gulf Run in service in late 2022 at a total project cost of around $640 million.

Revenues for 4Q2019 totaled $731 million, down from $950 million in 4Q2018. Full-year 2019 revenues came in at $2.960 billion, versus $3.431 billion in 2018.

By segment, gathering and processing revenues were $579 million for 4Q2019, down from $808 million in the year-ago period. This reflected a decline in natural gas sales revenues due to lower average realized prices and lower sales volumes, as well as a decline in natural gas liquids (NGL) sales revenues driven by lower prices.

Among other factors, lower processed volumes and processing service revenues in the Ark-La-Tex and Arkoma basins also played a role, according to management.

Among the factors partially offsetting the declines in this segment, Enable saw an increase in natural gas gathering revenues from higher fees and gathered volumes in the Anadarko and Ark-La-Tex areas. The company also saw increased revenues from crude oil, condensate and produced water gathering driven by its November 2018 acquisition of Anadarko assets from Enable Oklahoma Crude Services LLC.

Transportation and storage segment revenues were $236 million for 4Q2019, down from $325 million in 4Q2018, primarily a result of lower natural gas sales volumes and lower average sales prices. Partially offsetting this decrease was an increase in realized gains from natural gas derivatives, according to management.

Transported volumes for the quarter totaled 551 TBtu, or 5.99 TBtu/d, versus 526 TBtu (5.72 TBtu/d) in the year-ago period. Enable reported 426 TBtu (4.62 TBtu/d) in natural gas gathered volumes and 236 TBtu (2.57 TBtu/d) in natural gas processed volumes, in line with year-ago totals.

Produced NGL totaled 128,450 b/d, down from 136,740 b/d in 4Q2018, while crude oil and condensate gathered volumes totaled 153,060 b/d, up from 76,590 b/d in the year-ago quarter.

Interstate transportation firm contracted capacity was 6.3 Bcf/d for the quarter, versus 6.24 Bcf/d in the year-ago quarter. Intrastate transportation average deliveries totaled 2.09 TBtu/d in the quarter, down from 2.21 TBtu/d a year ago.

Enable reported net income attributable to limited partners of $18 million (2 cents/unit) for the fourth quarter, versus $174 million (38 cents) in the year-ago quarter.

Full-year 2019 net income was $396 million (83 cents), versus $521 million ($1.12) for full-year 2018.

Want to see more earnings? See the full list of NGI’s 4Q2019 earnings season coverage.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |