Utica Shale | E&P | Earnings | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

4Q2019 Earnings: Appalachia’s CNX Staring ‘Down the Barrel’ of Tough Year Ahead

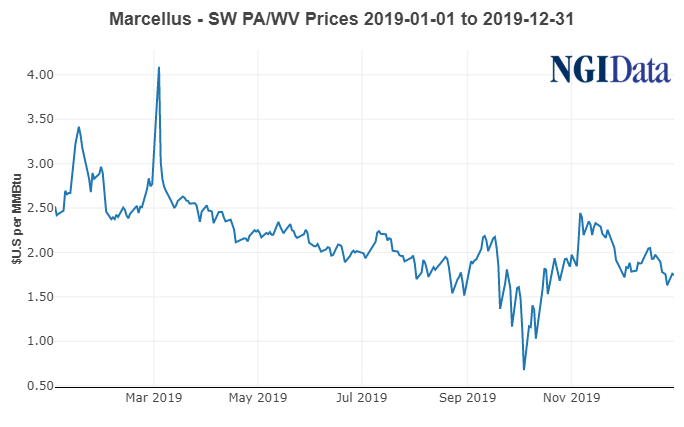

Appalachian pure-play CNX Resources Corp. on Thursday said it recorded a nearly $500 million impairment on natural gas properties in Pennsylvania during the fourth quarter as commodity prices continued their downward spiral.

CEO Nicholas Deluliis acknowledged that the company is staring “down the barrel of a very challenging 2020,” as management again said they would slash this year’s budget by $40 million to a range of $530-610 million. Following spending cuts late last year, the company spent $876 million in 2019, coming in under budget.

This year’s production guidance was also lowered to 525-555 Bcfe, compared with a previous range of 535-565 Bcfe. Deluliis said activity is being cut given the “current macro conditions.” He added that this year’s program would better position the company in 2021 and beyond.

The company took a $327 million one-time writedown on Marcellus Shale assets in addition to a $119 million impairment on unproved properties and expirations. All the properties are in central Pennsylvania.

CNX’s average sales price for the fourth quarter came in at $2.54/Mcfe, down from $3.09 in the year-ago period and 51 cents below Henry Hub.

Deluliis said this year’s plans should generate $200 million of free cash flow and position the company for more than that in 2021, when management expects to grow year/year production by 5%. The company was nearly cash flow neutral in 2019.

Heading into the new year, CNX also slashed selling, general and administrative expenses by $30 million. Management hopes to find additional savings for that line item, while they also plan to focus on driving more efficiencies and further simplifying the company structure.

CNX Midstream Partners LP has also agreed to eliminate its incentive distribution rights, giving CNX majority ownership and $135 million in cash payments from December 2020 through December 2021. Free cash flow projections over the next two years also include plans for $100 million of asset sales. For example, surface acres and rights-of-way will likely be for sale, Deluliis said.

CNX said it produced 143.4 Bcfe in the fourth quarter, up from 136.1 Bcfe in the year-ago period. For the full year, CNX produced 539 Bcfe, compared to 507 Bcfe in 2018.

The company drilled 12 wells during the final quarter of 2019 and completed seven with an all-electric fracture crew. CNX plans to continue running two rigs this year.

Fourth quarter operations also included a Pennsylvania state record, when CNX drilled a Marcellus lateral to nearly 20,000 feet on the Rich Hill 71 pad in the southwestern part of the state.

CNX reported a fourth quarter net loss of $271 million (minus $1.45/share), compared with net income of $102 million (50 cents) in 4Q2018. For the full year, the company reported a net loss of $80.7 million (minus 42 cents), compared with net income of $796.5 million ($3.75) in 2018.

Want to see more earnings? See the full list of NGI’s 4Q2019 earnings season coverage.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |