E&P | NGI All News Access | NGI The Weekly Gas Market Report

Whiting to Keep Some DJ Basin Assets; Add Williston Acreage

Denver-based Whiting Petroleum Corp.’s CEO Brad Holly on Wednesday said his company has pulled some of its Denver-Julesburg (DJ) Basin assets from the sales block and added nearly 55,000 net acres in the Williston Basin as its drilling teams continue to set new records for shortening well completion times.

During a 2Q2018 earnings conference call, Holly reported that recent bids on Whiting’s assets from its Redtail development program turned out to be disappointing, so the company will retain the producing wells and continue to reap the cash flow.

“We do not plan to invest additional capital at this time, but we’ll continue to operate the assets to maximize cash flow and continue to optimize the asset for returns,”Holly said, adding that the Redtail properties are expected to generate $250 million after deficiencies this year.

In May, Holly announced the plan to move forward with a possible sale of some assets in the DJ Basin in Colorado.

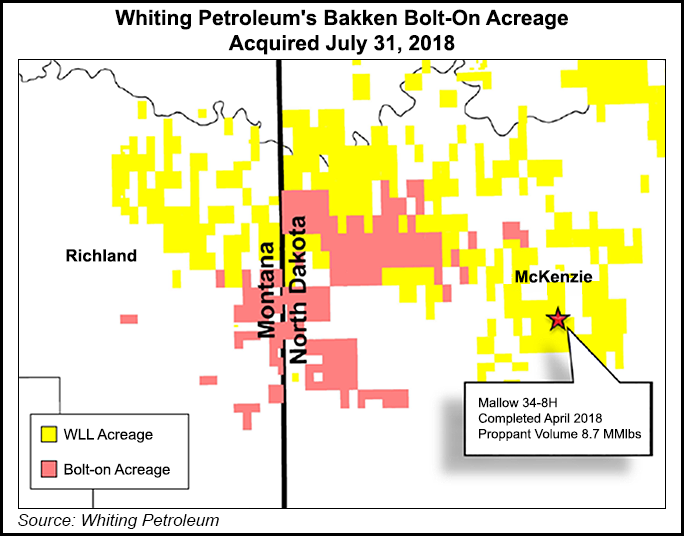

In the Williston Basin in North Dakota, Whiting closed the $130 million purchase of approximately 55,000 net acres that Holly said “fits perfectly” with the company’s Hidden Bench and eastern Missouri Breaks areas. “The acreage with current production of 1,290 boe/d lies on trend with the prolific Malow well we announced in the first quarter this year,” he said.

Holly described the purchased acreage as “slightly drilled” with 35 net Bakken and Three Forks wells. Holly said the company is expecting “transformative results” from the added acreage, calling the addition “the perfect kind of bolt-on opportunity.” No information was released on the seller.

As one of the largest producers in the Bakken, Whiting is touting its advances in hydraulic fracturing (fracking) and well completions with recent savings of more than $1 million per well.

Holly cited one drilling team that he said achieved “strong production results while reducing well cost by $400,000 per well through optimization and the use of appropriate proppant volumes.”

Whiting’s time for average completion has dropped annually since 2011 from 23 days to about 9 days in 2Q2018,Holly said, adding that the company’s all-time record is down to 6.7 days.

In 2Q2018, Whiting production reached 11.5 million boe, compared with 10.25 million boe for the same period last year, and average production was 126,180 boe/d, compared to 112,660 boe/d for the same 2017 period.

Net income for the most recent quarter was $57.3 million (63 cents/share), compared to a loss of $65.3 million (negative 72 cents) for the second quarter last year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |