NGI The Weekly Gas Market Report | Markets | NGI All News Access

Western NatGas Prices Could Be Up This Winter, Raymond James Says

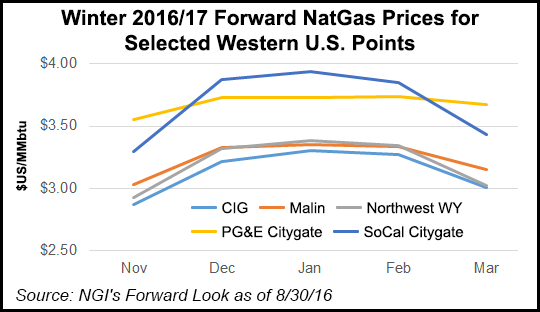

Although natural gas prices were not discussed when officials met last Friday to review California’s draft winter energy reliability plans, higher prices may be an issue this winter throughout the West as three factors converge, according to Raymond James. The firm sees $4-4.50/MMBtu prices coming out of the Rockies.

A combination of lower-than-normal natural gas storage, for which Southern California is the poster child, dwindling production due to low commodity prices, and higher-than-normal demand around the West could produce “a very bullish gas price environment for Rockies and West Coast producers,” according to Raymond James analysts Kevin Smith and Anthony Diaz

“In fact, if our bullish thesis plays out, we expect to see natural gas prices in this region match or eclipse the $4/MMBtu price level,” the two analysts wrote.

A California Energy Commission (CEC) analyst who participated in the winter reliability workshop last week (see Daily GPI, Aug. 29) would not speculate on the analysts’ projection. The workshop had “mention of higher costs for electricity suppliers, but it was a statement without explanation,” said CEC’s Albert Lundeen. “Price questions in general are more the focus of the California Public Utilities Commission [CPUC].”

NGI queried the CPUC late Monday, but its communications director had no immediate response.

The Raymond James brief zeroed in on Southern California Gas Co.’s closed Aliso Canyon underground gas storage facility (see Daily GPI, Aug. 17). At 86 Bcf, Aliso is the state’s largest, and holds more than one-fifth of the Pacific region’s 416 Bcf of gas storage capacity.

“At this point, there is no visible time frame for the storage facility to begin injection operations to replace the lost gas,” the analysts said.

Even if California energy officials limit gas-fired generation in the state, it will not eliminate the possibility of a spike in gas demand for power generation that could result in a regional uptick in natural gas prices, they said.

Rockies gas producers stand to benefit.

“All the necessary ingredients are available for a large seasonal move in natural gas prices on the West Coast this winter,” Raymond James said.

With several large Rockies producers now capital-constrained and others, such as QEP Resources, switching to focus on the Permian Basin, “Rockies gas prices (Opal) will likely need to move higher than the market anticipates to see an increase in drilling activity, likely between $4 and $4.50/MMBtu,” Raymond James said. “The companies that will feel this pain are both the retail and industrial users of natural gas.”

Heavy oil producers that inject gas into reservoirs for artificial lift, such as Los Angeles-based Occidental Petroleum spinoff California Resources Corp., will be hurt, while the Rockies producers would enjoy a windfall.

Among the antecedents to the projected western gas price uplift, the analysts said, is the relative lack of hydroelectric power over the past four years. In 2011, California got 21% of its power from hydroelectric sources; last year it was down to 7%.

“The lowest supply numbers for hydropower come in the fall and winter, so this will put further pressure on natural gas inventories as winter is when natural gas use peaks,” the analysts said, and if California has a colder-than-normal winter, the region may reach the five-year gas storage low levels of under 100 Bcf in March 2014, when prices were $5.84/MMBtu, trading at a 94 cent/MMBtu premium to Henry Hub. Southern California gas prices currently trade at about $2.80/MMBtu, which is only a 3 cent/MMBtu premium to Henry Hub.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |