Regulatory | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Tres Palacios Can’t Abandon Unused Storage Capacity, FERC Says

The market might not want Tres Palacios Gas Storage LLC’s (TPGS) extra Gulf Coast cavern capacity, but the company can’t abandon it either, FERC said on Thursday.

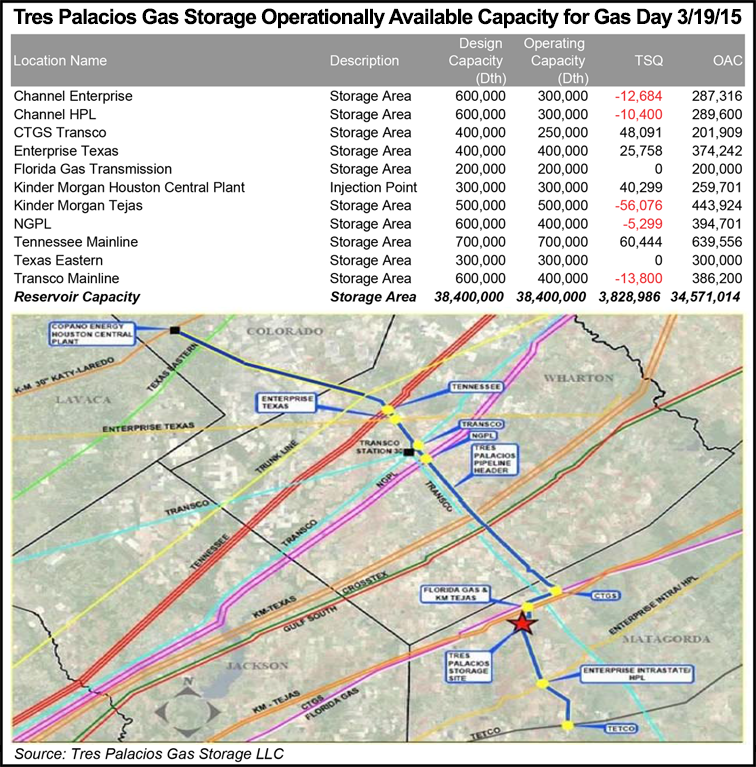

TPGS is currently certificated for working gas capacity of 38.4 Bcf plus 18.86 of base gas for total capacity of 57.26 Bcf. Back in 2013, TPGS asked the Federal Energy Regulatory Commission for authorization to abandon up to 22.9 Bcf of working capacity at its three-cavern facility in Matagorda, Colorado and Wharton counties in Texas. TPGS said the market didn’t want the capacity and an abandonment would cut its cavern lease payments to Riverway Storage Holdings LLC and Underground Services Markham (see Daily GPI, Dec. 10, 2013).

But the lessors told FERC that what TPGS sought was really not an abandonment at all, because the storage operator would have the ability to file to reclaim the abandoned capacity in the future (see Daily GPI, Jan. 8, 2014).

TPGS shot back that cutting its payments for unneeded capacity would be good for the company, and thereby good for the Gulf Coast storage market — and in the public interest (see Daily GPI, Feb. 21, 2014). Riverway and Underground Services said the company was just trying to duck market risk.

TPGS said its proposed abandonment would not harm customers — and none of them protested — but FERC didn’t go along with the abandonment for several reasons.

“…[B]ased on the record, notwithstanding the lack of protests from existing customers, we cannot find that the abandonment proposed by Tres Palacios is permitted by the public convenience or necessity,” FERC said in its order Thursday [CP14-27].

“…Tres Palacios’s current certificate authorizes specific parameters for each cavern, including maximum working and cushion gas volumes and operating pressures. Here, Tres Palacios requests an overall total reduction in working gas storage capacity without specifying how this reduction would be applied to each cavern, or how it would affect other facility parameters. Tres Palacios’s request is not consistent with either current Commission policy or Tres Palacios’s existing certificate authority,” the Commission said.

Further, FERC said TPGS didn’t give it enough information to evaluate the technical aspects of its proposal. TPGS said it would provide to the Commission information on “physical configuration of the caverns, engineering analyses and market need” after approval of the abandonment. That wasn’t good enough to ensure the Commission that salt cavern integrity would be protected, the order said. The Commission said its ruling was made without prejudice to TPGS filing a “properly supported application” for abandonment.

As for a reduction in sublease payments to Markham that an abandonment would have effected, FERC said the issue should be decided in District Court for Harris County, TX, where the parties have a case held in abeyance pending the outcome of the FERC proceeding.

Last November Crestwood Midstream Partners LP and an affiliate of Brookfield Infrastructure Group swooped in to buy TPGS from Crestwood Equity Partners LP for $130 million in cash in a deal that has since been finalized. Crestwood said the deal would “substantially increase” utilization of TPGS storage capacity (see Daily GPI, Nov. 24, 2014).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |