E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Texas Crude Output Down From Year Ago, But More Pain Expected

The Texas Petro Index (TPI), a barometer that measures the health of the state’s oil and natural gas industry, in January surpassed its low point set during the industry’s previous cycle, and there is more pain ahead, according to the economist who compiles the index. But on the bright side, state crude oil production declined from year-ago levels.

“It is at least somewhat encouraging that estimated crude oil production in Texas actually posted a year-over-year decline in January,” said economist Karr Ingham. “Although the decline was modest, we can expect the pace of production decline in Texas and the U.S. to accelerate in 2016.”

While the Texas Alliance of Energy Producers estimates the first year-over-year decline in monthly Texas production in the current cycle occurred in January, the U.S. Energy Information Administration estimates that the first year-over-year decline in monthly U.S. crude oil production since 2011 occurred last December.

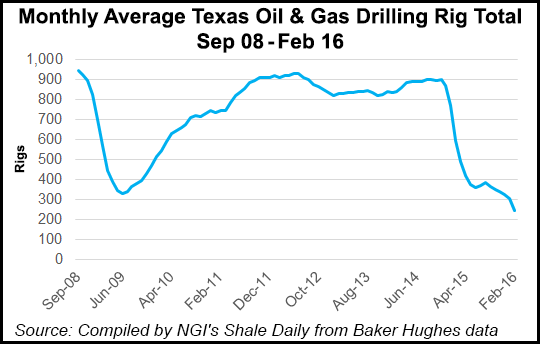

In January — 19 months into the crude oil price collapse — Texas producers recovered less crude oil than they did in January 2015. But the economic contraction gripping the upstream oil and gas industry squeezed tighter, forcing more layoffs, idling more drilling rigs, and driving state well-permitting to a record monthly low, Ingham said.

The TPI in January declined to 181.9, nearly 40% lower than its January 2015 level and the first time in its existence that the TPI fell below the lowest point of the previous industry economic cycle. Following a decline that began in September-October 2008, the TPI reached a nadir of 187.5 in December 2009 before embarking upon a five-year expansion that finally stalled at year-end 2014.

TPI Highlights in January:

Absent meaningful market improvement, Ingham said activity indicators would continue to languish and that more job losses appear to be inevitable. According to the best-available statistical data, Ingham estimates the Texas oil and gas industry lost about 76,000 jobs through January from peak employment of 306,000 in December 2014.

“The last time the crude oil price and the rig count were at present levels, upstream oilfield employment in Texas was about 100,000 less than the January 2016 estimate of about 230,000,” Ingham said. “That suggests the bloodletting in Texas’ upstream oil and gas industry will continue as the year progresses.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |