E&P | NGI All News Access | NGI The Weekly Gas Market Report

Stronger North Dakota Oil, NatGas Production Stats Spur ‘Happy Talk’

North Dakota’s chief energy regulator on Tuesday called the latest oil and natural gas production numbers “happy, happy, happy,” despite continuing low commodity prices.

The numbers for April, the most recent month for complete statistics, showed “a big increase” for natural gas production, and a larger-than-expected total for crude oil, said Lynn Helms, director of the state’s Department Mineral Resources. Production was centered again on the five-county core area of the Bakken Shale, where gas production in conjunction with oil is strongest.

“Even though we saw a 6% increase in gas production, we hung on to our 90% gas capture level,” Helms said. He noted some continuing concerns about capture problems” on the Fort Berthold reservation.

“But we’re happy about the gas production, happy about the oil production and happy about the oil permitting,” which continues to increase again. Helms noted that the state gained five active rigs since the beginning of June.

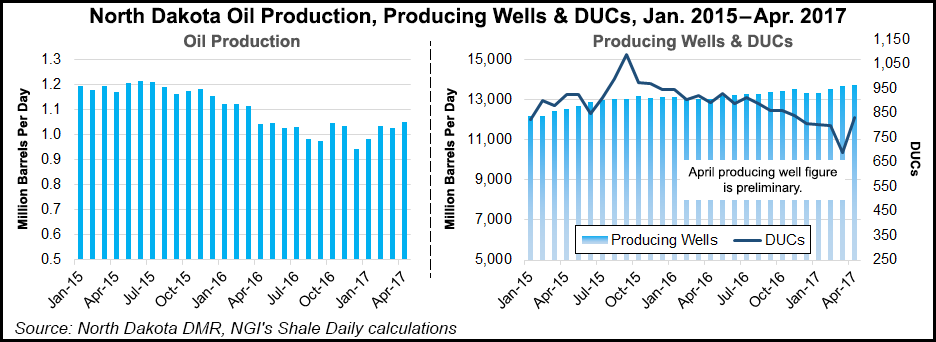

For April, natural gas production was 55 Bcf (1.83 Bcf/d), compared to 53.6 Bcf (1.73 Bcf/d) in March. Oil production was 31.5 million bbl (1.05 million b/d) in April, versus 31.7 million bbl (1.02 million b/d) in March.

“In May we were back up to more than 100 permits and two seismic permits, so industry appears to be confident that regardless of the short-term dampening of oil prices that fundamentally inventories are going to come down, and that the OPEC production cuts are going to go up, so we’ll see strong pricing out into the future,” Helms said, referring to the Organization of the Petroleum Exporting Countries decision to extend output cuts through next May. Helms said Dakota Access Pipeline’s startup on oil pricing has not kicked in yet.

More rigs and more mergers and acquisitions (M&A) are positive signals, he said.

“We’ve added five rigs since the end of May to be at 55 today, and some of the small companies are coming in and making acquisitions.” Some M&A activity is “starting to show up in the rig count, so there is some confidence” by producers.

A similar story is unfolding in the drawdown of drilled but uncompleted wells (DUC) and more people, as fracture (frack) and drilling crews staff up.

“With better oil prices, I think we are seeing companies open wells up; they’re not restricting wells as much,” Helms said. “The key is the drilling crews are outrunning frack crews, and you can see that in the jobs numbers are up.”

The industry goal is to get to 25 active fracking crews this year, but Helms said to date the number is below 20.

“They’re really struggling to hire qualified people for their frack crews because most of those people took off for Texas since they ramped up down there” in the Permian Basin and increasingly, the Eagle Ford and Haynesville shales. “Our website is listing close to 200 frack crew jobs.”

Helms predicted that with 55 drilling rigs and less than 20 frack crews, drilling may not keep up. He thought the inactive well count could be reduced throughout the summer with the drier weather, nevertheless.

In regard to gas capture, statewide the level is 90% and even higher in some individual areas. However, on the Fort Berthold Reservation the level in April was 86% and more recently below 85%, which is the current state mandated capture level. Inability to secure rights-of-way permits in a timely manner on the federal lands has been identified as the primary cause, said Helms.

Interior Secretary Ryan Zinke has indicated he wants to revise the federal lands right-of-way rules, Helms noted. However, “it is an incredibly difficult and convoluted process” involving federal agencies and the Bureau of Indian Affairs.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |