Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

Strong New England, Great Lakes Balanced by Weak West, Marcellus; Futures Steady

Physical gas for delivery Friday moved little following the release of the weekly Energy Information Administration (EIA) storage report.

In the physical market, double-digit gains in New England along with firm quotes in the Great Lakes and Midcontinent were largely offset by weakness in the Marcellus, Appalachia, Rockies and the West Coast. Overall the market was down a penny.

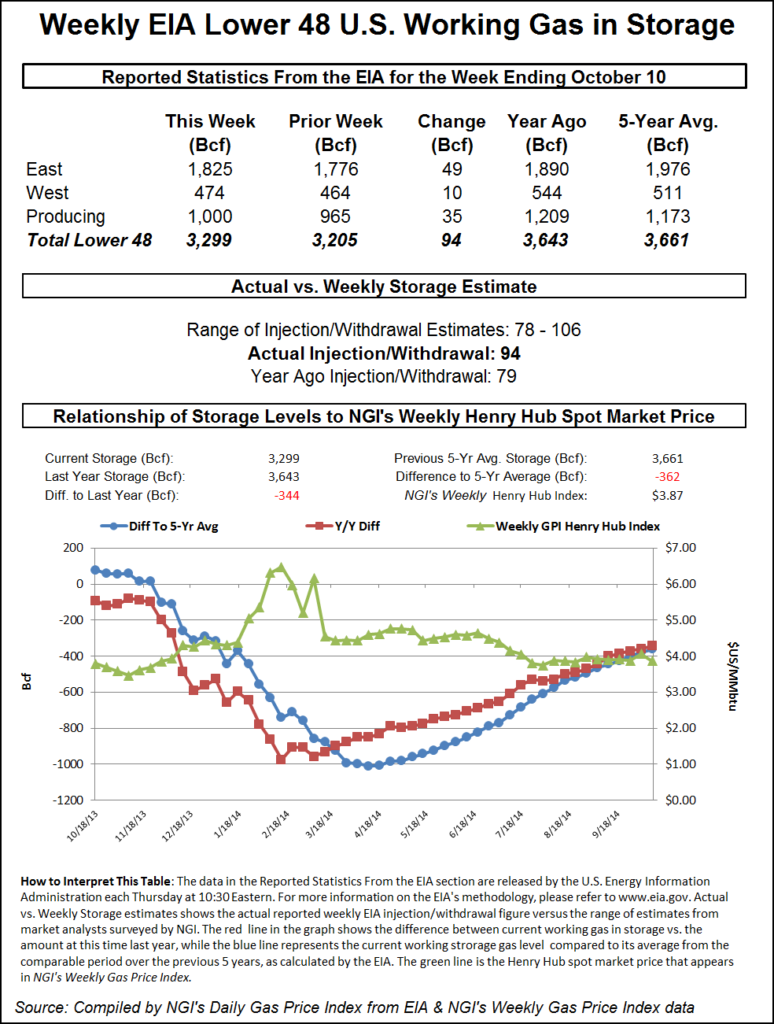

The EIA reported a storage build of 94 Bcf, somewhat higher than market expectations, and prices fell initially only to recover to unchanged on the day. At the close November was 0.4 cents lower at $3.796 and December was unchanged at $3.885. November crude oil snapped out of its tailspin and rose 92 cents to $82.78/bbl.

New England next-day prices rose, but points to the south were flat to lower. Weather was forecast to be active, but temperature outlooks called for high readings in the East above normal, but not high enough to increase power loads or prices. The National Weather Service in New York City said, “weak high-pressure builds in from the southwest for Friday, [and] a cold frontal passage on Saturday will be followed by high pressure for Sunday and Monday. A deep upper trough and strong low pressure will impact the area for the middle of next week.”

Temperatures were expected to be above normal along the Eastern Seaboard but not far removed from the 65 degree inflection point of increased degree day loads. AccuWeather.com forecast that Boston’s high Thursday of 70 would hold Friday and rise to 72 on Saturday. The normal high in Boston is 61. New York City’s 71 high Thursday was expected to ease to 70 Friday and slip further to 68 Saturday. The normal mid-October high in the Big Apple is 63. Washington, DC’s maximum on Thursday of 66 was seen rising to a pleasant 73 Friday and then sliding to 71 Saturday. The normal high in Washington, DC is 68.

The mild temperatures translated into lower peak power and sliding next-day power prices. The New York Independent System Operator predicted that peak loads Thursday of 19,917 MW would ease to 18,914 MW Friday and drop to 17,298 MW Saturday. At the PJM Interconnection peak load Thursday of 32,099 MW was anticipated to slide to 30,615 MW Friday and 27,945 MW Saturday.

IntercontinentalExchange reported peak power Friday at the ISO New England’s Massachusetts Hub fell $4.49 to $45.03/MWh, and at the PJM West terminal next-day power fell $3.80 to $38.62/MWh.

Next-day gas at the Algonquin Citygates rose 44 cents to $3.52, and gas on Iroquois Waddington rose 2 cents to $3.94. On Tennessee Zone 6 200 L Friday packages were seen at $3.51, up 42 cents.

Deliveries to New York City via Transco Zone 6 were flat at $2.06, and parcels on Tetco M-3 added a penny to $2.07.

Gas at Transco Leidy was flat at $2.00, and parcels at Tennessee Zone 4 Marcellus came in 4 cents lower at $1.89. On Millennium Friday gas fell by 11 cents to $1.95, and gas on Dominion South changed hands 2 cents lower at $2.00.

Low power loads and soft next-day power pricing also contributed to losses of a few pennies on the West Coast as well.

The California Independent System Operator forecast that Thursday’s peak load of 30,533 MW would slide to 29,249 MW Friday, and IntercontinentalExchange reported next-day peak power at NP-15 eased 58 cents to $46.23/MW. Friday peak power at SP-15 was off by 14 cents to $46.62/MWh.

Gas at Malin for Friday delivery shed 4 cents to $3.66, and packages at the PG&E Citygates were quoted 4 cents lower at $4.27. Deliveries to the SoCal Citygates were seen 5 cents lower at $4.06, and gas at SoCal Border points came in at $3.83, 5 cents lower. Gas on El Paso S Mainline shed 4 cents to $3.90.

The primary futures price driver was the morning release of storage data by the EIA, but this week’s builds were forecast to be the first week in the last 12 that won’t break the triple-digit threshold. The year-on-five-year deficit, nonetheless will likely continue to contract. Last year, 79 Bcf was injected, and the five-year average is a 78 Bcf increase. Analysts at United ICAP predict an 87 Bcf build, and First Enercast is looking for an 86 Bcf injection. A Reuters poll of 25 traders and analysts resulted in a 91 Bcf average with a range of 78-106 Bcf.

Bentek Energy’s flow model figured on a 90 Bcf injection. “The expected injection brings inventories close to 3.3 Tcf by only the second week of October, and similar weather for the next few weeks makes peaking above 3.5 Tcf by the end of the month more likely as seasonally strong injections are expected to continue for at least the next two weeks and potentially into November,” Bentek said. “Residential and commercial demand reached its highest level since early May and averaged 16.5 Bcf/d during the week, which was an increase of 4.1 Bcf/d from the previous week. The uptick in residential and commercial was partly offset by declining power burn demand, which fell 0.8 Bcf/d week-over-week to average 22.3 Bcf/d.”

Once the number was released at 10:30 a.m. EDT November futures sank to a low of $3.744 and by 10:45 EDT November was trading at $3.778, down 2.2 cents from Wednesday’s settlement.

“The market is pretty much trading where it was before the number came out. We moved 4 cents down and now we are right back to where we were,” said a New York floor trader. “Natural gas is a pretty tame market right now. Everyone is following oil.”

At Citi Futures Perspective analysts saw the figure as “a moderately bearish surprise. The build was also more than our weather-based model had projected, which will translate into higher rates of injections going forward,” said analyst Tim Evans. “It looks as though the background supply/demand balance is at least slightly weaker than the recent flows had suggested.”

Inventories now stand at 3,299 Bcf and are 344 Bcf less than last year and 362 Bcf below the five-year average. In the East Region 49 Bcf was injected and the West Region saw inventories increase by 10 Bcf. Stocks in the Producing Region rose by 35 Bcf.

If there were concerns that the high pace of injections might come to a halt sometime soon, it will not be because of increased heating and cooling requirements. The National Weather Service expects well below normal degree day (DD) accumulations for the week of Oct. 18, which should impact next week’s storage figures. Combined heating and cooling degree days in New England are anticipated to be 50, or a stout 54 DD below normal. The Mid-Atlantic is forecast to see 34 DD, or 56 fewer than its seasonal tally. The greater Midwest from Ohio to Wisconsin is set to “enjoy” 47 DD, or 48 fewer than normal.

Should prices break below their recent trading range, analysts look for a long-term buying opportunity. “[We] Peg $3.727-3.711 as critical support. Fail to carve out a bottom into this zone and we will be looking for a test of the lower bounds of our proposed falling wedge, somewhere between 3.460 and 3.016,” said Brian LaRose of United ICAP. “The next cycle low in the 35-month bottoming cycle is slated for March of 2015. A break below key support will likely be a big long-term buying opportunity.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |