Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Spectra, Northeast Utilities Partner to Fix New England Gas Supply Woes

Spectra Energy Corp. and Spectra Energy Partners (Spectra) along with Northeast Utilities on Tuesday launched their Access Northeast project, a $3 billion expansion intended to address supply reliability issues and spiking prices for natural gas in the New England market. Mainly, the project would target gas-fueled power plants and their peak-day gas demands.

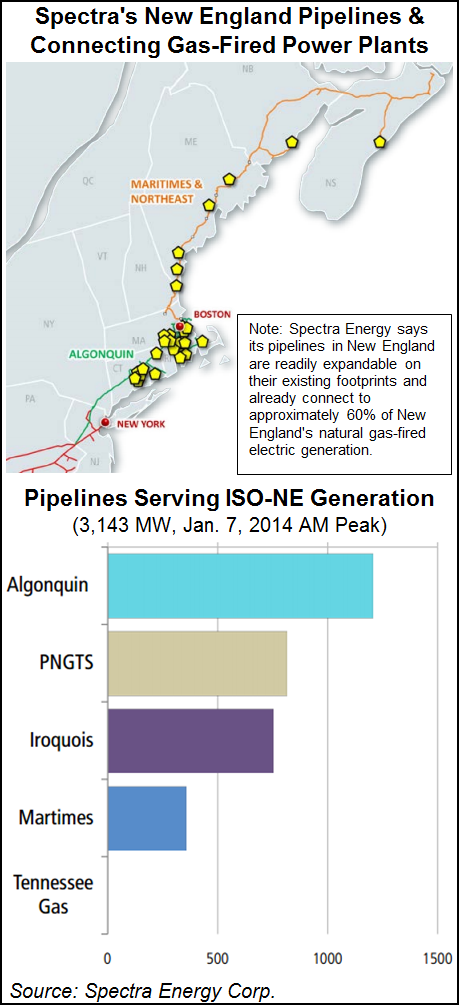

Access Northeast would enhance Spectra’s Algonquin and Maritimes pipeline systems, using existing pipeline routes. The project would be scalable and be capable of delivering more than 1 Bcf/d to serve the region’s “most efficient” power plants and meet increasing demand from heating customers, the project partners said.

“Spectra Energy is excited to offer this unique solution with Northeast Utilities, one that calls for collaboration and cooperation with key New England natural gas providers in order to customize a scalable project around existing assets,” said Spectra CEO Greg Ebel. “We’ve had a very positive response from natural gas asset holders as the region comes together for a solution.”

More natural gas transportation capacity into the New England market is sorely needed, according to the recently released draft of ISO-New England’s (ISO-NE) annual Regional System Plan (see Daily GPI, Sept. 9).

ISO-NE last week was ordered by FERC to “initiate a stakeholder process to develop a proposal to address reliability concerns for the 2015-2016 winter and future winters” (see Daily GPI, Sept. 11). The Federal Energy Regulatory Commission order was a response to a 2014-2015 Winter Reliability Program previously proposed by ISO-NE and the New England Power Pool [ER14-2407].

The Commission said ISO-New England’s 2013-2014 plan “bridged the reliability gap created by the colder than average winter weather,” and ISO-New England had hoped that market improvements would address the region’s dependence on natural gas heading into winter 2014-2015. However, gas pipeline constraints last year were among the issues that prompted FERC to conclude that another reliability program was necessary.

Spectra and Northeast aren’t alone in their bid to feed New England’s gas-starved power plants and would-be gas utility customers eager to switch from more costly and dirtier fuel oil for their heating requirements.

Tennessee Gas Pipeline Co’s Northeast Energy Direct Project has been attracting interest from local distribution companies in the region, according to the Kinder Morgan Energy Partners LP (KMP) pipeline (see Daily GPI, July 30). Northeast Energy Direct is offering capacity scalable from about 800,000 Dth/d to 1.2 Bcf/d, or ultimately up to 2.2 Bcf/d, depending upon final customer commitments, KMP has said. Tennessee on Monday made its request at FERC to use the Commission’s prefiling process.

Analysts at Tudor, Pickering, Holt & Co. said Tuesday they think the Spectra-Northeast project “has [a] clear advantage” over the Tennessee project as it would make use of existing right-of-way for its entire length, while Tennessee would follow a partially greenfield route. KMP spokesman Richard Wheatley told NGI in an email that Spectra’s project “has no effect on the Northeast Energy Direct project.”

Access Northeast was originally outlined by Spectra Energy in a June 27 letter to the New England States Committee on Electricity (NESCOE) (see Daily GPI,July 1). The project is estimated to cost roughly $3 billion and has an anticipated in-service date in November 2018. Spectra and NU will be equal partners in the project, with the option of additional investors joining in the future. The two companies said they will work with electric and gas industry representatives, including ISO-NE and NESCOE, to establish the levels of firm natural gas supply required to ensure both generation reliability and local distribution company (LDC) demand growth.

NESCOE was formed by a group of New England governors in 2004 to initially focus on developing and making policy recommendations related to resource adequacy and system planning (see NGI, July 5, 2004). More recently, there have been multiple calls to get more natural gas into the New England market to serve heating and power generation load (see Daily GPI, Dec. 24, 2013; Oct. 24, 2013).

Historically, New England’s pipeline capacity has been built for average daily usage while relying on supplemental facilities for high-demand times. Spectra and Northeast Utilities said they will partner with interconnecting pipeline and regional storage facilities to enhance grid reliability at peak demand times and augment existing pipeline facilities within existing right of ways.

Over the past 15 years, natural gas-fueled generation has grown from serving 15% of New England’s annual electric requirements to serving about half, according to Northeast Utilities CEO Tom May. At the same time, tens of thousands of New England homes and businesses have converted to natural gas heating, while pipeline capacity into the region has not grown. In the bitterly cold first quarter of 2014, gas demand for heating customers rose significantly, leaving much less gas available for electric generation. Older coal- and oil-fueled plants filled in the gap, forcing prices to skyrocket (see Daily GPI, Jan. 28). Access Northeast would enable new, efficient gas-fueled generation, which emits up to 50% less carbon than older oil and coal plants, to operate much more frequently during cold winter weather, he said.

“This new partnership with Spectra Energy will benefit our customers, drive costs down and help take a substantial step toward solving the looming energy crisis in New England,” May said. “Last winter, the New England electric market reached a critical point, as lack of access to natural gas capacity cost customers dearly. New England wholesale electricity costs were nearly double compared to the previous year, largely due to pipeline constraints. These challenges will remain the same for the next several years, and our customers will feel the effects if we do not act. We recognize that a portfolio of investments will be needed to address this challenge and we intend to deliver a reliable solution to customers with this project.”

During a conference call with reporters to discuss the project, May said New England continues to face a “looming crisis” that just popped its head up last winter. Gas pipeline constraints left about one-dozen gas-fueled generators on the sidelines last winter. Consumers suffered with high power prices, and they likely will gain this winter, he said.

The existing pipeline infrastructure pegged for the project is attached to about 60% of ISO-NE’s gas-fueled generating capacity, according to the project partners. They said they intend to partner with operators of existing gas storage assets in the region to facilitate peak-day gas deliveries. The project also will include additional delivery points on Algonquin and Maritimes to serve LDCs as needed.

The project is seen as a complement to Spectra Energy’s previously announced Algonquin Incremental Market (AIM) and Atlantic Bridge projects. The AIM expansion will begin to de-bottleneck the pipeline system by winter 2016-2017, helping to enhance reliability and reduce natural gas price volatility in New England. AIM is underpinned by long-term commitments from gas utility companies across southern New England. Atlantic Bridge’s proposed in-service date is in November 2017, and it is expected to be similarly supported by gas utilities. Access Northeast will provide additional firm supplies, delivered directly to power generators.

Expressions of interest from natural gas service providers for regional assets are to be secured by Oct. 31. For project information, contact Rich Paglia (617) 560-1310, or visit spectraenergy.com/newengland.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |