Southwestern Renegotiates Fayetteville Takeaway to Reduce Excess NatGas Capacity

Southwestern Energy Co. announced an agreement with Boardwalk Pipeline Partners LP on Monday to restructure some firm transportation agreements and add others on the Texas Gas Transmission system to reduce excess capacity in the Fayetteville Shale and build in more flexibility to serve future production.

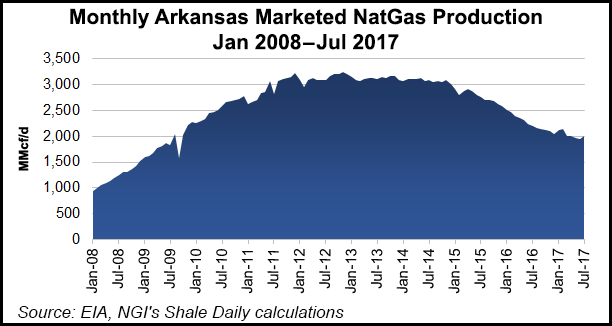

While the independent has been working to de-risk the Moorefield Shale, which sits below the Fayetteville in Arkansas, its volumes in the state have declined. The new agreement, effective Nov. 1, is expected to provide Southwestern with $70 million in savings through 2020 by lowering volume commitments and the costs it would have incurred for excess capacity. The agreements are subject to Federal Energy Regulatory Commission approval.

Southwestern’s Fayetteville Lateral volume commitment would be reduced from 800,000 MMBtu/d to 100,000 MMBtu/d through October 2020. Southwestern would also add long-term firm transportation agreements on the Fayetteville and Greenville laterals that are more flexible to guarantee capacity to Gulf Coast markets at competitive rates through 2030 to serve production swings.

“This agreement further enhances our margins and reduces excess demand capacity while securing option capacity for future development,” Southwestern CEO Bill Way said. “It also provides the flexibility to ramp activity in the Fayetteville and Moorefield area as economics dictate at competitive transportation rates without incurring additional liabilities during times of decreased activity.”

For Boardwalk, the restructured deal secures it the right to move Southwestern’s committed volumes from the Fayetteville and helps lock in more long-term revenue, the company said. Southwestern had said it was going to renegotiate its firm transportation contract in the Fayetteville, but that move was not expected to occur until next year. The company said it would realize $45 million in savings in 2018 alone as a result of the sooner-than-expected agreement.

Southwestern, which built its shale business as the leading operator in the Fayetteville, is bullish about its long-term prospects in the Moorefield, but today its core operations are in the Appalachian Basin, where it recently added 140 MMcf/d of firm takeaway capacity.

The Houston-based operator produced 222 Bcfe in 2Q2017, with Northeast and Southwest Appalachia units accounting for 140 Bcfe. Fayetteville production, with no rigs running and less expenditures, declined from 96 Bcf in 2Q2016 to 82 Bcf in 2Q2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |