Marcellus | E&P | NGI All News Access | Utica Shale

Southwestern Lifts Production Guidance on Outperforming Appalachian Assets

Southwestern Energy Co. is raising full-year production guidance to 955-970 Bcfe from its previous range of 930-965 Bcfe, driven primarily by outperforming assets in the Appalachian Basin.

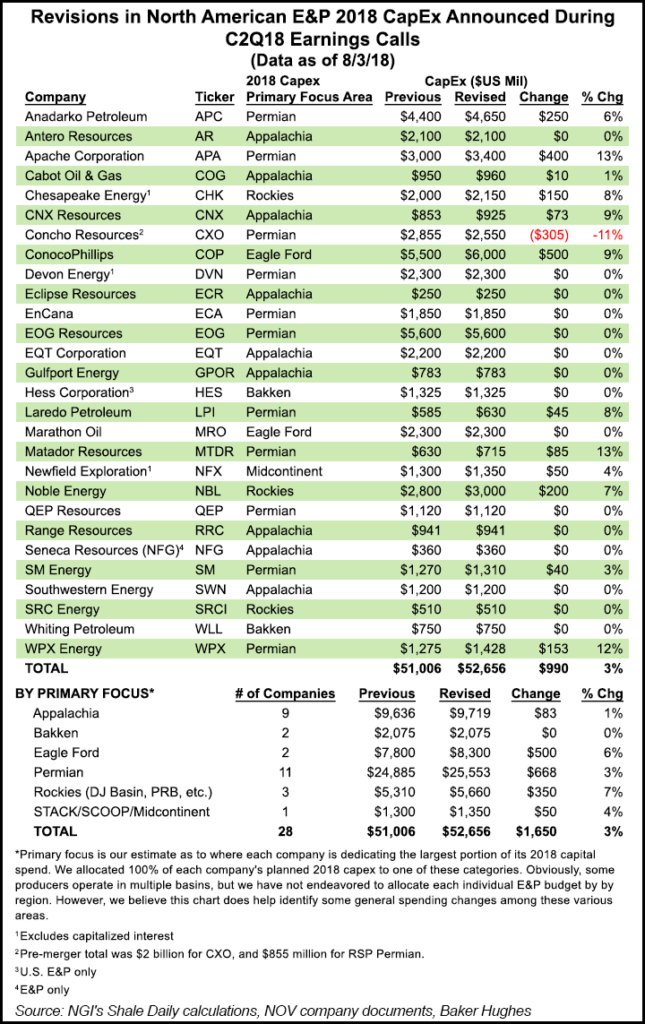

The company’s capital expenditures this year are to remain unchanged at up to $1.25 billion. Improved operational cycle times, increased gathering capacity and stronger well results pushed second quarter volumes above the company’s production guidance for the period. It was also able to accelerate the completion of 13 wells during the quarter, which helped lift volumes.

In southwest Appalachia, the company raised total natural gas liquids (NGL) and oil production guidance by 5%, while better results from its northeast Appalachia assets have it increasing the production forecast there by 15 Bcf at the midpoint.

“Our focus on liquids growth continues to improve our economics and we have ample current, and forward planned, NGL processing and fractionation capacity to deliver further results,” CEO Bill Way told analysts on Friday during a second quarter earnings call. “We are working with multiple counterparties to strategically structure additional long-term takeaway capacity for propane-plus liquids to maximize prices and accelerate future growth, all while assuring flow.”

Southwestern produced 234 Bcfe during the second quarter, including 61,370 b/d of NGLs and condensate, or a 44% year/year increase in liquids volumes. Overall, production was up from 222 Bcfe in the year-ago period and 226 Bcfe in 1Q2018.

The company, emboldened by higher prices to continue targeting liquids as other Appalachian operators have been this year, saw a 34% and 46% increase in NGL and oil prices, respectively. On a blended basis, the company reported average realized prices, including hedges, of $2.30/Mcfe for the second quarter. That was up from $2.20/Mcfe in 2Q2017.

Earlier this year, Southwestern disclosed that it was exploring a sale of its expansive Fayetteville Shale assets as part of a broader cost-cutting initiative. Management shared no new details on that process during Friday’s call.

“Our commentary around the Fayetteville strategic process remains unchanged,” Way said. “As we’ve clearly and consistently communicated, we want to protect the integrity of this process.”

He reiterated that it’s in the best interest of the company’s shareholders to refrain from discussing additional details or speculating on outcomes. Production from the play dropped again in the second quarter to 67 Bcf from 82 Bcf in the year-ago period. It was flat from 1Q2018.

In other developments, the company said it has expanded its core position in Tioga County, PA, where only last year it began delineating the position. Offering few details about the assets in the north-central part of the state, the company said it has entered a joint development agreement with “a private firm.” It has added 23 future drilling locations with projected lateral lengths averaging 11,000 feet.

Southwestern reported net income of $51 million (9 cents/share) for the second quarter, compared to net income of $224 million (45 cents) in 2Q2017. Revenue was up slightly to $816 million from $811 million over the same time.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |