NGI The Weekly Gas Market Report | Infrastructure | Markets | NGI All News Access

SoCal Winter Gas Risks Remain With Pipeline, Storage Limits, State Outlook Says

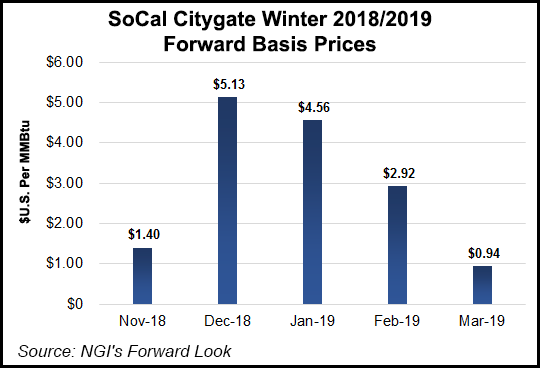

Southern California enters this winter heating season no different than the last, facing similar concerns as Sempra Energy’s Southern California Gas Co. (SoCalGas) continues to wrestle with the problem of transmission pipeline and underground storage limitations.

As a result, SoCalGas remains unable to meet its one-in-10-year peak cold day forecast gas demand of 4.965 Bcf and a conservation mindset will need to be applied for another heating season, according to the Aliso Canyon Risk Assessment Technical Report supplement for this winter that was posted Wednesday by the California Energy Commission (CEC).

Last year, gas curtailments to large industrial users were viewed as more likely since there were three gas transmission pipelines down and Aliso Canyon underground gas storage operations were limited. The latest outlook concludes that the same risk exists now.

“SoCalGas remains unable to meet its one-in-10-year peak cold day forecast gas demand without Aliso Canyon, and its ability to provide gas through the delivery system is largely the same this winter as a year ago,” the latest technical report noted.

The SoCalGas transmission pipelines remain hampered with Line 235-2, which ruptured Oct. 1 last year, declared out of service for the coming winter. The adjacent Line 4000 near the Line 235-2 rupture point will continue to have to operate at reduced pressure until testing and maintenance work is completed. Meanwhile, Line 3000 has returned to service at reduced operating pressures that will remain until Lines 235-2 and 4000 are back to normal operations next year.

With mitigation to the overall SoCalGas system, including an added 50 MMcf/d at Kramer Junction and 200 MMcf/d at Otay Mesa, the utility can raise its feasible system sendout to 4.057 Bcf/d, the latest outlook said.

“It is likely that SoCalGas will need to use gas stored at Aliso Canyon this winter,” according to the outlook. “If there are any extreme cold weather events, there may be insufficient gas supplies to meet demand even when relying on withdrawals from all storage fields, including Aliso.”

Risk assessment authors, who include officials from state energy agencies and the Los Angeles Department of Water and Power, said the risks aren’t from a single day with high gas demand, but from “multiple high demand days that draw down storage inventories to a point where there is insufficient withdrawal capacity to meet gas demand later in the winter.”

The California Public Utilities Commission in July authorized SoCalGas to increase the storage volumes at Aliso Canyon by 9.4 Bcf to 34 Bcf. Earlier this month, storage volumes at SoCalGas’ facilities totaled 80.3 Bcf, close to a full inventory.

While acknowledging that Aliso Canyon can help meet seasonal winter demand, the facility “is a resource of last resort and subject to the withdrawal protocol established by the CPUC,” the outlook said.

Given the continuing level of risk, the report states that “all mitigation measures established last year will need to continue” and some will need to be expanded.

SoCalGas has proposed expanding its demand response program from an initial 9,000 customer thermostats to more than 50,000 customer thermostats this winter, pending the CPUC’s approval later this month. Deliveries of some re-gasified liquefied natural gas supplies from Sempra Energy’s Energia Costa Azul facilities in Mexico through Otay Mesa are another contingency being examined by the Sempra utility.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |