Shale Daily | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

SM Energy Considers 15,000-Foot Laterals in Eagle Ford, Permian; Defers Some 4Q Completions

Denver-based independent SM Energy Co., which is focused mostly on Texas, said it plans to defer some completion activities in the fourth quarter to recover from flooding in the state, as it considers where to drill longer laterals next year in the Eagle Ford Shale and the Permian Basin.

During 3Q2018, SM reported production of 12 million boe (130,200 boe/d), 62% liquids, a 12% increase from year-ago output of 10.7 million boe. Crude oil production grew 48% to 5 million bbl from 3.4 million bbl, but natural gas production fell 7% to 27.2 Bcf from 29.1 Bcf. Natural gas liquids (NGL) production was unchanged at 2.4 million bbl (26,200 b/d).

Broken down by play, Eagle Ford production totaled 6.02 million boe, while Permian production totaled 5.96 million boe. The company cited strong well performance and increased processed NGL volumes for the production increase.

During an earnings call to discuss 3Q2018, operations chief Herb Vogel said the company is looking at its inventory in the Eagle Ford and the Permian to determine where it may drill 15,000-foot laterals. Some of the results would be published in February.

“There’s quite a bit of room for 15,000-foot and even longer laterals in the Eagle Ford, particularly in the western area,” Vogel said last Friday. “On the Permian, it’s really driven by the existing well in the lease geometry. There’s areas where there’s quite a few 15,000-foot wells. We’re going to figure out the optimal between 10,000- and 15,000-plus wells, and that will depend a little bit on area and location.”

SM drilled 39 net operated wells in 3Q2018, of which 34 net were in the Permian and five net were in the Eagle Ford. The company also completed 33 net wells during the quarter, including 28 net in the Permian and five net in the Eagle Ford.

Most of the 29 net wells drilled and completed in the Permian were in its RockStar operating area. The remainder was in the company’s Sweetie Peck area. Both areas are in the Midland sub-basin of the Permian, where the company holds 82,290 net acres. SM holds 164,400 net acres in the Eagle Ford.

SM highlighted 25 wells in the RockStar operating area, where it said new wells were averaging 1,300 boe/d (88% oil). The company said 15 wells in the Big Iron area had a 30-day average peak rate of production of 1,350 boe/d, while seven wells in the Coyote Valley area produced 1,074 boe/d; three Signal Mountain wells produced 1,567 boe/d. Big Iron production included 87% oil, while production from the Coyote Valley and Signal Mountain wells included 91% oil.

Of the 25 RockStar wells, 17 targeted the Wolfcamp A interval (1,341 boe/d, 90% oil), while three wells targeted the Wolfcamp B (1,228 boe/d, 83% oil) and five wells targeted the Lower Spraberry (1,198 boe/d, 86% oil).

SM narrowed its full-year production guidance to 43.9-44.3 million boe (120,300-121,400 boe/d) from a previous range of 43.5-45 million boe (119,200-123,300 boe/d).

Production in 4Q2018 is expected to be 11.3-11.7 million boe (122,800-127,200 boe/d). The company expects to lose 600,000 boe of production because of a force majeure incident at a third-party gas processing facility, as well as regional storms. The RockStar was also affected by flooding from Hurricane Willa.

“In September, there were about four-plus inches of rain in the Big Spring area and the ground got quite saturated,” Vogel said. “At same time, we had a lot of trenches that were being put in place or open for connecting wells and for gathering lines and for water infrastructure. That was followed by Hurricane Willa coming through, and we wound up with quite a bit of standing water everywhere.

“Our choices were to attempt to pump a lot of water out of those trenches and continue our operations or to wait for the water to subside. Obviously, you can’t pump forever and be successful; it’s very inefficient. So we basically elected to defer laying of the lines and that led to a deferral of completion.”

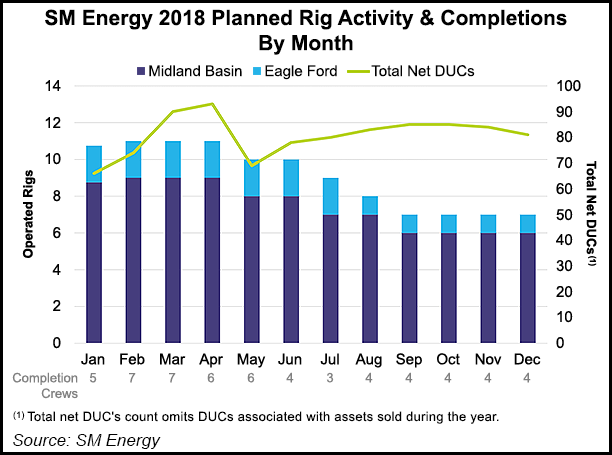

The capital budget for the year remains unchanged at $1.31 billion. The company expects to complete 103 net wells in the Midland in 2018, as well as 25 net wells in the Eagle Ford. Through the third quarter, SM completed 83 net wells in the Midland and 19 net wells in the Eagle Ford. The company is currently running six rigs and three completion crews in the Midland, and one rig and one completion crew in the Eagle Ford.

SM reported a net loss of $135.9 million (minus $1.21/share) in 3Q2018, compared with a year-ago net loss of $89.1 million (minus 80 cents). Operating revenues totaled $459.4 million in 3Q2018, compared with $295.4 million in 3Q2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |