Utica Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Shales Push 2013 Ohio NatGas Output to Double 2012

Combined unconventional and conventional natural gas production in Ohio nearly doubled from 86 Bcf in 2012 to 171 Bcf last year, an increase driven mainly by high-volume horizontal fracturing (fracking) in the Utica Shale, according to data released Wednesday by the Ohio Department of Natural Resources (ODNR).

Three hundred and fifty-two horizontal Utica and Marcellus shale wells in the state reported more than 100 Bcf of natural gas production in 2013, up more than 600% from 2012 when only 85 wells reported 12.84 Bcf (see Shale Daily, May 17, 2013). Combined with conventional production, the year-over-year gas production increase in 2013 set a state record.

“Last year, I shared production data that showed Ohio is at the beginning of an unprecedented era of oil and gas production,” said ODNR Director James Zehringer. “Today, we have data showing history is being made as we speak. The increase in Ohio’s Utica Shale almost doubled Ohio’s natural gas output from 2012 to 2013, and that’s a first for Ohio.”

Zehringer’s remarks were delivered during a presentation that highlighted the impact of increasing Utica development in Ohio over the last two years.

“We’re seeing a fairly significant increase in oil production again. ONDR’s Richard Simmers, who helms the Division of Oil and Gas Resources Management. “It’s going up at a very high rate and it will continue to increase as other wells are drilled. The historic gas production will follow a similar trend.”

Combined unconventional and conventional oil production increased to 8 million bbl last year from 5 million bbl in 2012 Unconventional operators reported producing nearly 3.7 million bbl of oil, compared to 636,000 bbl in 2012.

Simmers said production stayed relatively flat between 3Q2013 and 4Q2013, at an average of 38 Bcf of natural gas and 1.3 million bbl of oil (see Shale Daily, April 25; Dec. 31, 2013). He credited expanding midstream infrastructure, a historically cold winter and increasing knowledge about the Utica in rising output in 1Q2014. ODNR said 418 horizontal wells reported 67 Bcf and 1.9 million bbl in 1Q2014.

Limited oil production, though, has pointed to the play’s gassy composition. Several operators have increasingly switched their focus from a wet gas window in Eastern Ohio to counties farther southeast (see Shale Daily, Nov. 19, 2013); some have begun testing the Utica’s viability in West Virginia (see Shale Daily, May 16; March 26).

“Notable activity includes a drop in permits granted in Harrison County and an uptick in both Belmont and Monroe [counties],” said Wells Fargo Securities analysts of Ohio’s growth on Wednesday. “It’s still early in the play with industry still zeroing in on the core while optimizing completion techniques. But the uptick in permitting activity in Monroe and Belmont indicates, at least for now, that operators are chasing the dry gas window.”

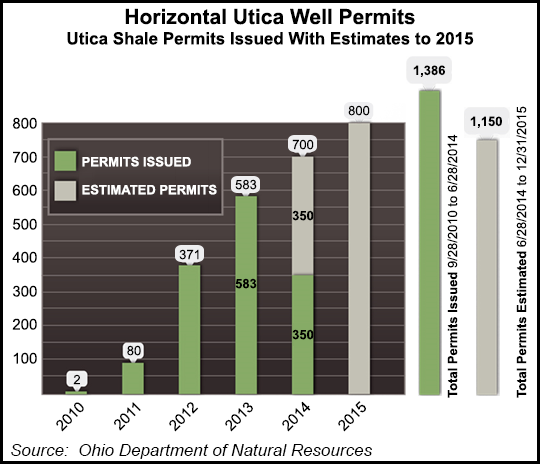

Last November, Ohio issued the 1,000th horizontal permit (see Shale Daily, Dec. 6, 2013). Since then, 386 permits have been issued, along with 44 in the Marcellus where 27 horizontal wells have been drilled. Currently, 41 rigs are running in the Utica and 926 wells have been drilled.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |