Shale Daily | Markets | NGI All News Access

Saudis Signal OPEC to Impose Extended Oil Reduction to Restore Global Market

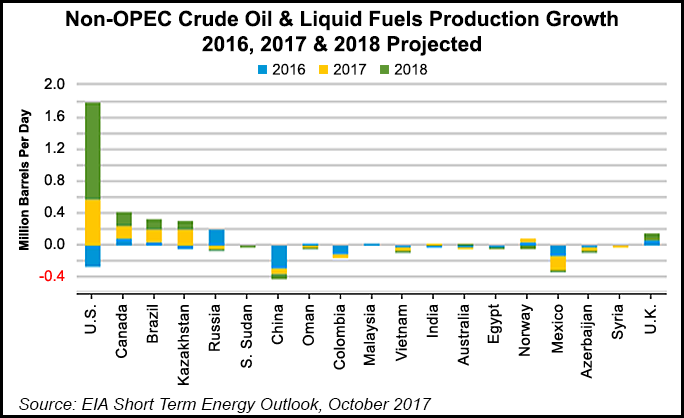

Saudi Arabia Crown Prince Mohammed bin Salman said the kingdom is ready to support extending an agreement to reduce oil production led by the Organization of Petroleum Exporting Countries (OPEC), which spiraled out of kilter in part because of huge output from North America’s onshore.

OPEC, which controls about 60% of global oil output and is led by the Saudis, already had reduced production with allies that include Russia through March. The extended supply reductions total about 1.8 million b/d. The extended agreement is a bet that worldwide prices would trend higher as the market rebalanced.

Brent crude oil prices last week climbed above $60/bbl for the first time since July 2015. West Texas Intermediate prices rose almost 4% last week to end at around $53.90/bbl.

“The kingdom affirms its readiness to extend the production cut agreement, which proved its feasibility by rebalancing supply and demand,” bin Salman said on Saturday. “The high demand for oil has absorbed the increase in shale oil production.

“The journey toward restoring balance to markets, led by the kingdom, is proving successful, despite the challenges,” bin Salman said.

OPEC Secretary General Mohammad Sanusi Barkindo earlier this month called on U.S. unconventional producers to help reduce the global oil surplus. Even with rising demand from India and emerging countries, the global oil surplus remains too high, Barkindo said.

The crown prince said during a conference last week oil demand would increase in the future, restoring “trust to petroleum markets.” He said the future of energy, “both conventional and renewable, will be promising,” with Saudi Arabia leading each sector.

OPEC has scheduled a ministerial meeting for the end of November in Vienna.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |