E&P | Infrastructure | NGI All News Access

Santos, Perdaman Deal Could Supply Additional Natural Gas to Eastern Australia

Australia’s east coast could receive more natural gas supply at a time when shortages are projected for the region.

Adelaide-based Santos Ltd, Australia’s second largest independent oil and gas producer, and Perth-based industrial conglomerate Perdaman, said Friday that they have signed a heads of agreement to further study Perdaman’s new ammonia production facility using gas from Santos’ $3 billion Narrabri field.

In February, the two companies signed a non-binding agreement for the supply of 14.5 petajoules of Narrabri gas per year for more than 20 years, subject to a final investment decision for the project.

The heads of agreement reached last week includes a pre-front end engineering and design study, which is the next step in the development of a chemical and fertilizer facility near Narrabri, which will use appraisal and early development gas.

It will also further define hybrid power facility options, a combination of gas-fired power generation integrated with renewable power generation to provide electricity to both the Narrabri gas project and Perdaman’s ammonium nitrate plant, the two companies said.

“The Narrabri Gas Project could produce enough gas to supply up to half of NSW’s needs, with more and more manufacturers supporting it because they recognize the advantages of having a reliable and competitively-priced source of gas in NSW,” said Santos Managing Director and CEO Kevin Gallagher. NSW is on Australia’s southeastern coast and includes the cities of NewCastle and Sydney.

Over 40% of the gas used in NSW supports manufacturers, making essential items such as glass, bricks, paper, cement, steel, fertilizers, plastics and chemicals, the Australian Exploration and Production Association said in February. In most cases there is no substitute for the gas that is needed.

Gallagher said the Narrabri project is currently being assessed by the NSW Department of Planning ahead of a decision by the Independent Planning Commission. Santos is seeking approval to drill up to 850 coal seam gas wells on approximately 425 sites over the 95,000 hectare (235,000 acre) Narrabri project area.

However, the NSW government has yet to issue a timetable for Santos to proceed. The project, which is on state land in a section of the Pilliga forest set aside by the NSW government for logging and extractive industries, has been beset by delays and strong local opposition over the potential environmental impact of drilling on nearby waterways and farmlands.

In Australia, each of the country’s six states maintain a certain amount of sovereignty, including their own parliaments, and is able to legislate over certain residual and concurrent power areas.

In June, Santos called for the NSW government to take action and finally provide a clear timetable for the project. “Customers are crying out for Narrabri gas,” a Santos spokeswoman said at the time.

“It’s very important to us that the environment and water resources are protected, and NSW has very strong environmental regulation to provide the community with confidence that Narrabri can be developed safely and sustainably,” she said.

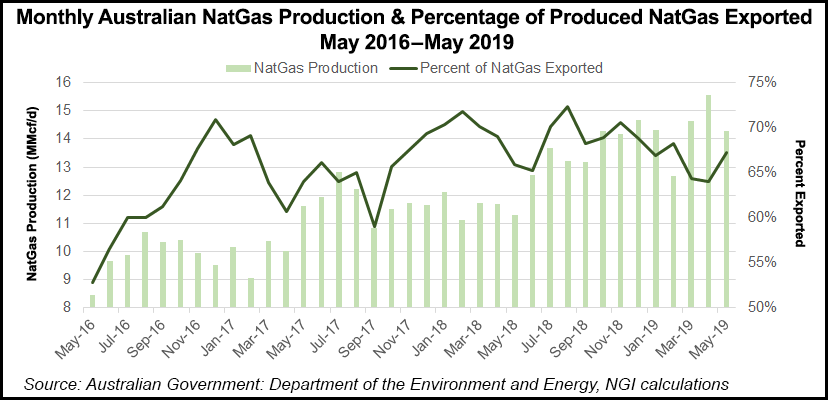

The Santos-Perdaman agreement comes as eastern Australia grapples with gas supply shortages due to the country’s liquified natural gas (LNG) export success. Australia, with a liquefaction capacity of 80 million metric tons/year (mmty), recently bypassed Qatar (77 mmty of liquefaction capacity) to become the global LNG leader.

In April, the Energy Users Association of Australia (EUAA) said rising commodity prices could force many manufacturers out of business, as gas costs for domestic users had risen by as much as 300% since Australia began exporting LNG from east coast terminals.

The EUAA called on the government to take action, noting that the Australian Energy Market Operator already had warned that the east coast faced a gas supply shortfall as soon as 2024.

Gas from the Narrabri project will be cheaper than importing both domestic and overseas gas. NSW imports 95% of its gas needs from other Australian states, which in turn increases gas prices per gigajoule by as much as $4 just in transport costs, according to Santos.

The Institute for Energy Economics and Financial Analysis warned in June that Australia could have to turn to gas imports to supply 90% of its gas in just three years’ time. As many as five LNG import terminals are being proposed in NSW, Victoria and South Australia to help the country meet the east coast’s possible gas shortage. One of those projects, an AUD $250 million ($170 million) facility at Port Kembla in NSW, was approved by the state government in April.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |