E&P | NGI All News Access | NGI The Weekly Gas Market Report

Roan Reworks Anadarko Basin Plans on Well Interference Issues

Roan Resources Inc. has redesigned its 2019 drilling plans for the stacked plays within the Anadarko Basin after four wells targeting the Woodford Shale were impacted last year by well interference issues with the Mayes Shale.

The Oklahoma City-based operator, which plans to generate free cash flow by 4Q2019 while boosting production about 30% year/year, dropped four rigs in January and plans to run a four-rig program for the rest of the year. It also has three frac crews deployed.

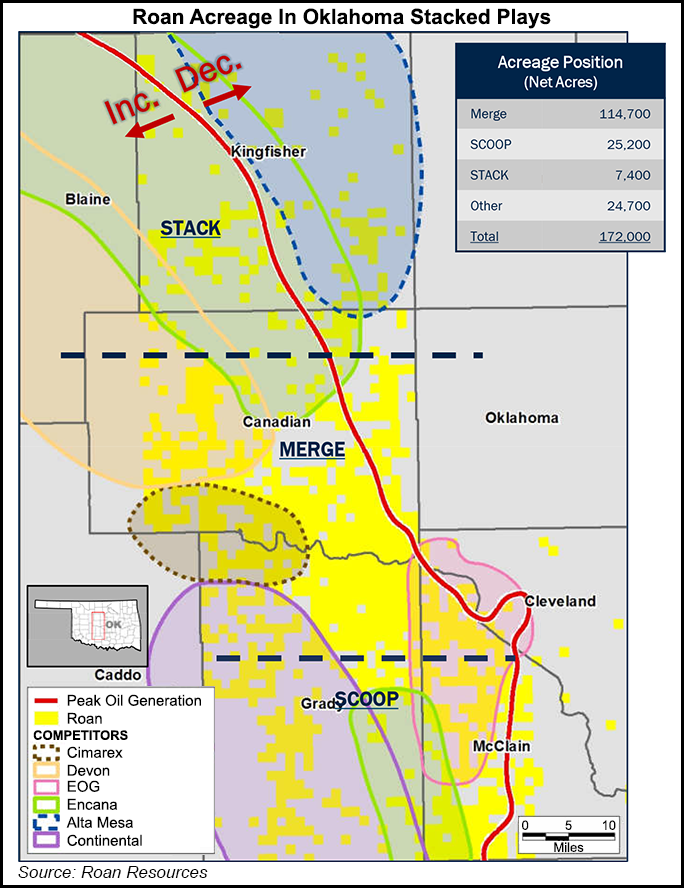

CEO Tony Maranto said Roan, which holds 172,000 net acres in central Oklahoma, learned in 2018 that there is no consistent barrier between the Mayes and Woodford intervals, which resulted in “significant communication” between wells targeting both formations.

Roan’s position includes 25,200 net acres in the South Central Oklahoma Oil Province, aka the SCOOP, and 7,400 net acres in the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties, aka the STACK. Sandwiched between them, the company holds 114,700 net acres as the Merge prospect, a legacy area with several pay zones.

“With the understanding of the Mayes and Woodford behaving as one flow unit over part of our Merge footprint, we’ve redesigned our co-development to account for this,” Maranto said during an earnings call Tuesday. “While some of the results in 2018 did not optimize capital efficiency, the lessons we’ve learned allowed us to understand the reservoir and better evaluate and de-risk our acreage. With the gained knowledge, in 2019 we will eliminate the poor performing wells…

“What we mean by co-development is to put enough offset between the Mayes and Woodford wells so that you can have independent [hydraulic fracturing] jobs and allow the two wells to produce independently. From our standpoint, it wouldn’t be cash efficient for us to go out and do a lot of work testing barriers.”

Maranto added that Roan has determined, through operated and nonoperated spacing tests, that an average of about eight wells per unit “drives the proper balance” for unit returns and per well capital efficiency.

Roan made no changes to annual guidance issued last month and still plans to spend 29.5% less this year, about $520-570 million on capital expenditures (capex). Full-year production is estimated to average 56,000-59,000 boe/d.

The company reported 4Q2018 production of 54,100 boe/d, up 111% from the year-ago quarter and 16.3% sequentially. Full-year production averaged 43,700 boe/d in 2018, up 170% from 2017. The production mix for the fourth quarter was 42% natural gas, 31% natural gas liquids (NGL) and 27% oil, while the full-year mix was 44% gas, 29% NGLs and 27% oil.

Roan drilled 19 net operated wells during 4Q2018, bringing the total for the year to 70. The company also brought about 15 net operated wells online during the fourth quarter, resulting in 61 wells being for the year. It ended 2018 with 33 wells awaiting completion.

The company reported net income of $148.2 million (97 cents/share) in 4Q2018, compared with a net loss of $10.4 million (minus 7 cents) in the year-ago quarter. Roan also reported a net loss of $140.7 million (minus 92 cents/share) for 2018, but had it had net income of $18.5 million (18 cents) in 2017.

Revenues totaled $307 million in 4Q2018, compared with $59 million in the year-ago quarter. Full-year revenues totaled $518 million, versus almost $160 million in 2017.

Roan was formed last year by Linn Energy Inc., Roan Holdings LLC and Roan LLC following a reorganization.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |