Ring Energy Tacks on Permian Acreage, Production For $75 Million

Ring Energy Inc., an independent oil and gas exploration and production (E&P) company based in Midland, TX, has agreed to purchase 14,000 net acres in the Delaware Basin, plus an undisclosed number of producing wells, in a deal valued at $75 million, the company said.

Ring said Tuesday it will serve as operator for the acquired acreage — located in Texas’s Culberson and Reeves counties — and will hold a 98% working interest (WI) and an average net revenue interest of more than 78%. Bill Parsons, a spokesman for Ring, told NGI’s Shale Daily Tuesday that the deal officially includes 14,600 gross (14,300 net) acres. The seller was not disclosed.

“This acquisition represents an ideal complement to our existing core area in West Texas,” said Ring CEO Kelly Hoffman. “Not only does it immediately add reserves and increase our current production, but offers excellent upside through the drilling of new vertical wells with multiple pay zones and the reworking of existing wells.”

Ring said current daily production net to the company from the acquired properties is approximately 1,300 boe/d, of which about 80% is oil. Ring’s initial proved developed producing (PDP) reserves at the end of 2014 were an estimated 4.7 million boe net to the company, with a PV-10 value of approximately $128.5 million. Those figures were compiled by Cawley, Gillespie and Associates, an independent engineering firm, using an average price of $90.24/bbl for oil and $4.64/Mcf of gas.

The company said the deal is expected to close on or before June 30, with an effective date of May 1, and will be financed with existing cash reserves and its expanded senior credit facility. Ring said it has entered a new five-year $500 million senior credit facility (up from $150 million) with an immediate borrowing base of $100 million (up from $40 million).

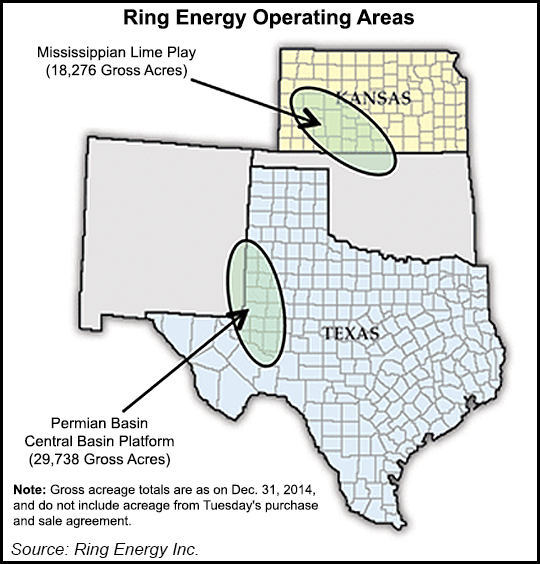

According to Ring, pro forma for the pending acquisition it will have more than 2,750 boe/d of current net daily production, and more than 45,000 gross (32,000 net) Permian acres. The company’s latest presentation shows that it held 48,013 gross (34,285 net) acres at the end of 2014. Of that total, 29,738 gross (17,270 net) acres were in the Permian Basin. Ring also holds 18,276 gross (17,270 net) acres in the Mississippian Lime formation, in Kansas.

Before the acquisition, Ring’s position in the Permian was centered on Andrews County, TX, located about 10 miles from the core legacy acreage position once held by the company’s predecessor, Arena Resources Inc. Ring said Arena was sold in July 2010 for $1.6 billion.

At the end of 2014, Ring held 10.4 million boe of proven reserves, 35% of which were developed and 98% was oil. The proven reserves had a PV-10 of $281.7 million. The company drilled 135 wells into the Permian in 2014.

Ring reported a net loss of $975,624 (minus 4 cents/diluted share) when it announced its 1Q2015 results on May 6. By comparison, the company reported net income of $1,163,689 (5 cents/diluted share) for 1Q2014. It cited the collapse in world crude oil and gas prices for the loss.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |