Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

Record Storage Draw Sends Bulls On A Run

Physical natural gas trading Thursday for Friday delivery was muted for much of the country, with gains or losses of a few pennies, except for in the Northeast, which saw another day of steep price drops. The real news Thursday was made over in the natural gas futures arena, where a record-setting storage withdrawal report opened the gates for the bulls.

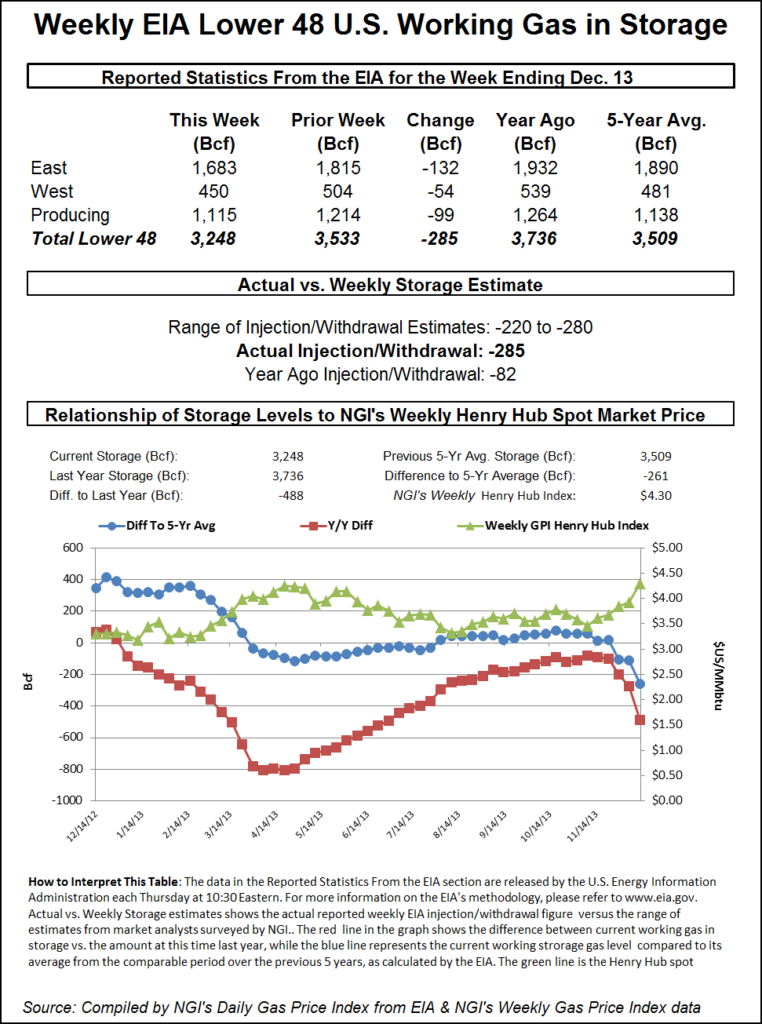

The Energy Information Administration (EIA) in its 10:30 a.m. EST release of storage data reported a record drawdown of inventories of 285 Bcf for the week ending Dec. 13. The draw was about 25 Bcf higher than what the market was expecting and 11 Bcf above the previous one-week record draw of 274 Bcf, which was set on the week ended Jan. 25, 2008.

Futures prices responded accordingly. January natural gas surged 20.9 cents to finish the regular session at $4.460, and February added 21.5 cents to $4.489. January crude oil rose 97 cents to $98.77/bbl.

At New England points, next-day gas tumbled in spite of pipeline restrictions, but next-day power prices skidded and a warming trend was expected throughout the region. Forecaster Wunderground.com reported that Thursday’s high in Boston of 45 degrees was expected to hold Friday before reaching 49 on Sunday. The seasonal high in Boston is 40. Hartford, CT’s Thursday high of 47 was expected to ease to 44 Friday before rising to 46 on Saturday. The normal high in Hartford is 38 at this time of year. Providence, RI’s high on Thursday of 45 was seen holding Friday and reaching 52 on Saturday. The normal high in Providence during mid-December is 41.

New England pipelines were having difficulties. Industry consultant Genscape in a Thursday morning report said, “Algonquin Gas Transmission has restricted interruptible and 100% of secondary out of path nominations that exceed entitlements sourced upstream of its Stony Point Compressor Station for delivery downstream of Stony Point, interruptible and 100% secondary out of path nominations that exceed entitlements sourced from points west of its Cromwell Compressor Station for delivery to points east of Cromwell, and approximately 68% IT [interruptible transportation].”

Power generators in the area utilizing natural gas found little incentive to buy additional next-day gas. IntercontinentalExchange reported that next-day peak power at the New England ISO’s Massachusetts Hub tumbled $27.42 to $70.75/MWh, and peak power at the PJM West terminal fell $3.80 to $35.08/MWh.

The National Weather Service in New York City said, “high pressure over the southeast U.S. will slowly move offshore tonight. Meanwhile…low pressure tracking across Canada will drag a cold front through the Great Lakes. A persistent SW flow will continue to usher mild temperatures to the local area tonight [Thursday].”

In the Mid-Atlantic, price declines were not so severe. Friday deliveries on Transco Leidy fell 14 cents to $3.32, and on Dominion gas was seen at $3.45, down 9 cents. Gas at the Tetco M-3 delivery point shed 22 cents to $3.95, and gas headed for New York City on Transco Zone 6 dropped 34 cents to $4.05.

Eastern and Northeast softness stood in sharp decline to market firmness elsewhere. In the Midcontinent, Friday packages came in a few pennies higher. Deliveries to NGPL Mid-Continent Pool rose 3 cents to $4.23, and on ANR SW gas for Friday eased a penny to $4.23. On Oklahoma Gas Transmission, next-day gas changed hands at $4.16, up 7 cents, and on Panhandle gas was quoted at $4.08, up 4 cents.

Turning attention to the day’s storage report, the record withdrawal occurred during a week that saw a widespread Arctic push of cold air accompanied by winter storms that touched much of the Lower 48. The weather system strained pipe capacity, while also forcing production freeze-offs across the country (see Daily GPI, Dec. 10; Dec. 6; Dec. 5; Dec. 4).

The report stunned many, and the record 285 Bcf pull lost no time in launching prices. “This is huge,” said a New York floor trader in the minutes after the fresh data was released. “Volume is 74,000, which is high for this early in the session, and the March-April spread is 19.8 cents bid at 20. It’s up 5 cents and moves around like no other spread; $4.40 will be an initial resistance level and above that $4.50, but I think we are looking at $4.25 on the downside. We made a high of $4.402 and the market seemed to back off that. If we can get through that, $4.50 would be the next objective,” he said.

Citi Futures Perspective analyst Tim Evans called the report “bullish,” adding that the withdrawal more than doubled the 133 Bcf five-year average pull for the week. “The decline likely reflected higher heating demand than most models projected as consumption became non-linear with population-weighted degree days,” he said. “Combined with today’s forecast for colder temperatures, the storage report should reopen the upside for prices.”

Whether another record draw is in the cards remains to be seen, but weather forecasts continue to call for ongoing cold with risks to the forecast leaning to colder rather than warmer. In its morning six- to 10-day and 11- to 15-day outlooks, Commodity Weather Group said, “At the current time, the models collectively agree that the six-15 day would be a cold-prevailing variable pattern with the cold periods outweighing the warmer intervals. Ridging in the east Pacific continues to keep this theme going with some models occasionally spiking it stronger into Alaska, which could generate a stronger cold outbreak, but given recent model performance, extreme caution is exercised on those risks.”

Matt Rogers, president of the firm, admitted that in the very near term a warming pattern was expected. “The big picture themes are fairly similar to [Wednesday’s] version with very impressive warmth into the East over the coming days and then a series of fast-moving cool pushes start their advance across the U.S. starting late this weekend into early next week. In between these fast-moving cold air masses, we could see briefly stronger warm-ups too.”

Ahead of Thursday’s storage report, traders were expecting the EIA to show a large pull. Last year a minuscule 70 Bcf was withdrawn, but a Reuters poll of 25 traders and analysts revealed an average draw of 258 Bcf, with the sample ranging from 220 Bcf to 284 Bcf, a range high enough for both bulls and bears to trade with abandon.

Bentek Energy calculated a titanic 272 Bcf draw using its flow model and said demand increased more than 30 Bcf/d from the previous week, spread among all three regions. It observed that this week’s forecast is the second largest on record. “There is increased risk to the forecast this week as the unprecedented cold weather blanketing the majority of the country during the storage week makes this week difficult to compare with previous history.”

United ICAP was expecting a pull of 265 Bcf and Ritterbusch and Associates calculated a 260 Bcf withdrawal.

Inventories now stand at 3,248 Bcf, 488 Bcf less than last year and 261 Bcf below the five-year average. In the East Region 132 Bcf was withdrawn, and in the West Region 54 Bcf was pulled. Inventories in the Producing Region decreased by 99 Bcf.

The Producing region salt cavern storage figure dropped by 32 Bcf from the previous week to 277 Bcf, while the non-salt cavern figure fell by 66 Bcf to 839 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |