Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Range Resources Readies for Another Rough Commodity Cycle

Range Resources Corp. exceeded the high-end of its second quarter production guidance despite an unplanned outage at a MarkWest Energy Partners LP processing facility in Appalachia.

Management said the company was impacted by a temporary electrical outage at the facility that has since been resolved. It produced slightly more year/year at 2.287 Bcfe/d from 2.200 Bcfe/d and from 2.256 Bcfe/d in 1Q2019. The company had guided for 2.280 Bcfe/d at the high end.

With the quarter’s results, the company remains on track to produce 2.3 Bcfe/d within this year’s targeted $756 million capital budget as it confronts what could be a challenging 2020 for oil and gas producers across the country, management said.

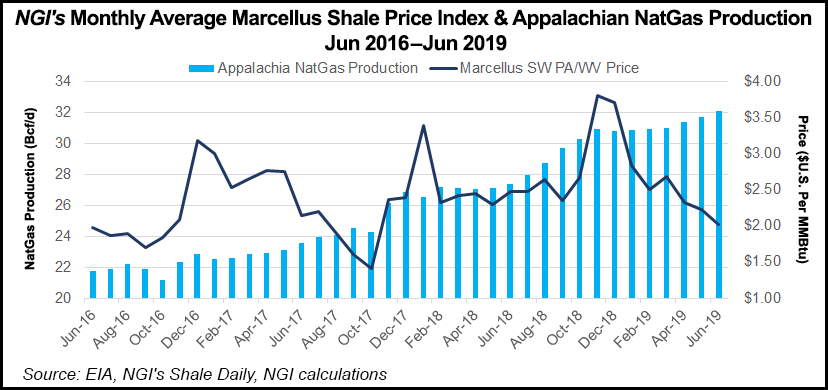

“The industry is clearly in the middle of challenging times with natural gas and natural gas liquids (NGL) prices lower on seasonal weakness,” said CEO Jeff Ventura, who acknowledged as others have this earnings season, that the upstream sector continues to struggle in finding investor interest.

Management is focused on guiding the company through the current cycle with a strategy aimed at generating free cash flow (FCF), improving cost structures and executing on operations within the budget. However, Ventura sees upside in the longer-term

“Looking at where the natural gas market sits today, we’re currently seeing record power demand, record liquefied natural gas (LNG) exports, record Mexican exports and industrial projects along the Gulf Coast and even in Pennsylvania,” he said during a call on Friday to discuss second quarter results. “This is happening at a time when natural gas producers are slowing activity…We think this sets up a very constructive story that has not been reflected in the forward curve.”

Despite abundant Lower 48 gas supplies being pushed higher by associated volumes from the Permian Basin, Ventura said he believes Appalachia is well positioned to continue providing incremental volumes.

While the company has been focused on reducing debt, mainly through noncore asset sales, Range has been working to diversify its marketing portfolio as management again touted the access it has to various markets.

The Mariner East (ME) 1 pipeline in Appalachia reentered service in late April after a series of outages, while ME 2 entered partial service late last year. The pipelines move NGLs to Philadelphia for export. Additional export access has lifted netbacks, and Range noted propane stocks in the Northeast are 13% below where they were at this time last year.

The company also has agreements in place to supply 440 MMcf/d to five different LNG export facilities. It is now in discussions with developers planning a second wave of export plants that are seeking to secure long-term supply to support incremental capacity.

Earlier in July, Range said it sold a 2% overriding royalty interest in 350,000 net surface acres in southwest Pennsylvania to Houston-based Lime Rock Resources, along with nonproducing properties in Armstrong County, PA, to another buyer for $634 million. Proceeds would go toward paying down debt as the company girds for another rough commodity cycle.

Range has sold nearly $1 billion in assets over the last year, while impacting annual FCF by less than 4%. The company continues to market several asset packages and has not ruled out a sale of its large position in North Louisiana, where the Cotton Valley Sands Terryville Complex continues to underperform. Other noncore assets, like those in northeastern Pennsylvania, are also on the table.

CFO Mark Scucchi told financial analysts on Friday that the company has a number of processes underway. “I’m reluctant to get into specifics on any one, but suffice it to say, we are actively working multiple meaningful projects and eagerly look forward to announcing those.”

While the Appalachia Division is lifting production, with second quarter volumes from Pennsylvania increasing 10% year/year, output from its North Louisiana assets continues to decline.

The bulk of Range’s production comes from Appalachia, where it produced 2.062 Bcfe/d in the second quarter. In North Louisiana, production again sank, falling to 225 MMcfe/d in the second quarter, compared to 313 MMcfe/d in the year-ago period and 229 MMcfe/d in 1Q2019. North Louisiana volumes have fallen in every quarter over the last year.

Range reported second quarter net income of $115.2 million (46 cents/share), compared with a year-ago net loss of $79.8 million (minus 32 cents). Year/year revenue increased 30% to $851 million in the second quarter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |