Shale Daily | E&P | NGI All News Access

Potential End to Price War Said Not Enough to Halt Covid-19 Demand Destruction as Energy Industry Cutbacks Continue

The start of the second quarter has not been a good one for the oil and gas industry, as it appears no global operator will be spared from the devastating oil price war and deadly coronavirus pandemic.

Covid-19 has thus far shown little regard for the massive efforts underway to halt its spread, forcing millions of people inside around the world, which in turn slammed consumption.

The U.S. economic slowdown is trampling natural gas demand “through lower power burns,” according to Goldman Sachs.

“Specifically, we have observed a clear shift from burns averaging above modeled levels earlier this year to moving 1-2 Bcf/d below such levels from mid-March, with recent data points are quickly moving in line with our April expectations, which we recently revised lower by nearly 2 Bcf/d,” said the Goldman analysts.

“Interestingly, we have yet to see similar impacts to industrial demand for gas. Recent industrial consumption numbers remain in line with year-ago levels and with the expectations we held prior to our recent demand downgrade, that is, approximately 2.5 Bcf/d above our revised April expected levels.”

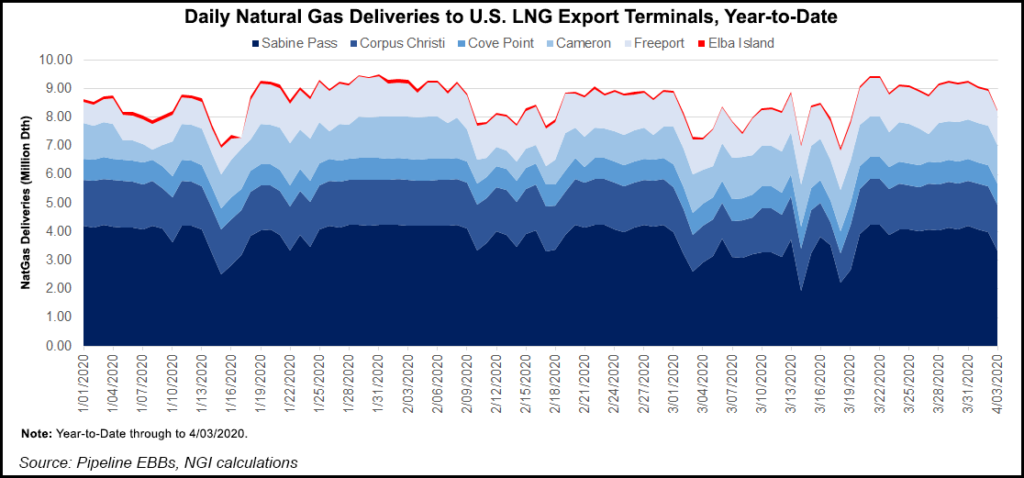

The Energy Information Administration’s gas storage report on Thursday was “softer than consensus,” but April began “tighter than expected” on industrial demand, “exceptionally high” liquefied natural gas (LNG) feed gas and Lower 48 production, “slightly below our 93 Bcf/d expectation for the month, more than compensate for the observed declines in power burns.

“Going forward, we expect U.S. gas balances to soften in the coming weeks as the economic slowdown weighs more visibly on U.S. manufacturing and a sustained shutting of the U.S. LNG export arbitrage incentivizes further reactions from offtakers.”

The Trump administration reportedly is working to mediate the nearly month-long oil price war between the Saudi-led Organization of the Petroleum Exporting Countries (OPEC) and Russia. Behind-the-scenes, however, talk of negotiations as of midday Friday had done little except spur slightly higher oil prices to the mid-$20s.

President Trump was scheduled to meet late Friday to get insight from several of the largest North American producers, including the CEOs of ExxonMobil, Chevron Corp., Devon Energy Corp. and Continental Resources Inc.

According to a report Friday in The Wall Street Journal, the Trump administration was considering a “mandated shutdown of oil production in the Gulf of Mexico,” using the spread of coronavirus among the platform crews in its reasoning.

Meanwhile, a formal meeting between OPEC and its allies (OPEC-plus) was said to be in the works for Monday (April 6). However, International Energy Agency executive director Fatih Birol poured cold water on what any reduction in output could do for the markets.

The head of the global energy watchdog said the loss from Covid-19 has created such an “unprecedented” reversal in consumption that oil demand could fall as much as 25% this year.

Even if OPEC-plus members were to reduce overall oil output by 10 million b/d, or around 10% of global supply, inventories still could increase by 15 million b/d in the second quarter, Birol said in an interview with Reuters.

“Monday’s meeting with OPEC-plus countries can well be a good start, but even the numbers people are talking about may not be enough to find a solution to the problem,” Birol said. “It would only help to mitigate the damage we are seeing.”

For the oilfield services (OFS) sector and its exploration and production (E&P) customers, there is no place to hide. Operators began slashing capital expenditures (capex) in early March, but many now are whittling away even more.

Denver-based Liberty Oilfield Services Inc., a hydraulic fracturing specialist in the Denver-Julesburg (DJ) Basin, for the second time since mid-March reduced capex and went one step further: laying off people for the first time ever.

“The Covid-19 pandemic has led to the world’s largest oil demand destruction that will reset oil and gas development activity levels over the next year or more,” CEO Chris Wright said. “We have never before reduced our workforce, always charting a different path. We deeply regret that today’s circumstances necessitate that we make significant cuts to our workforce and restructure the compensation for those remaining.”

Liberty now has reduced 2020 capex to $70-90 million, down by half from the previous reduction. Executives have agreed to a base salary reduction of 30%, which is 10% more than announced two weeks ago. The cash retainer for directors was cut by 30%. Future quarterly dividends have been suspended.

“These industry conditions are unprecedented,” Wright said, “hence, we are taking bold, decisive action to position Liberty to survive this downturn and come out in a stronger competitive position, just as we did during the previous downturn. We are playing the long game.

“The next few months are likely to be the most trying as storage constraints are blowing out differentials across all basins, leading to significant interruptions in fracture activity. We currently expect that industrywide activity in the second quarter will be down more than 50% from first quarter levels.”

Denver explorer Extraction Oil & Gas Inc., whose focus also is the DJ, reduced 2020 upstream capex by 42% to $250-300 million. Senior executives are taking 10% cuts to salaries and bonuses.

“As we continue to focus on strengthening our balance sheet and maximizing liquidity, we are reducing our activity in light of current challenging economic conditions,” said CEO Matt Owens. “We will continue to monitor oil prices and the economy in general, and we may further adjust our level of activity if market conditions change materially.”

Alberta’s Cenovus Energy Inc., which cut $450 million from capex early in March, has sliced another $150 million off the top, with guidance now $750-850 million, 43% lower than in December. The dividend has been suspended.

“It is challenging to predict the duration and depth of these unprecedented low commodity prices,” said CEO Alex Pourbaix.

Effective May 1, the board is taking a 25% compensation reduction. Pourbaix’s base salary has been trimmed by 25%, and other top executives are taking a 15% cut to pay. Vice presidents and their equivalents will see a 12% cut to annual base salaries.

“The salary rollback, which will have the greatest impact on senior leaders, is a way to demonstrate the entire company is committed to addressing the challenges we face” Pourbaix said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |