E&P | NGI All News Access | Permian Basin

Pioneer Raising Permian Spend, Mitigating Constraints with FT Contracts, Exports

Pioneer Natural Resources Co. increased its Permian Basin-directed capital spending by 15%-plus for the year, indicating it is avoiding some of the oil and natural gas transportation constraints that are plaguing some of its peers.

The Dallas-based independent, the largest acreage holder in the Midland sub-basin with an estimated 750,000 gross acres, has secured firm transportation (FT) agreements for more than 90% of its oil production. Beginning in September, the operator expects to have no exposure to Midland pricing.

Natural gas constraints also are being mitigated as more supply moves to West Coast markets.

“The company’s marketing strategy continues to provide incremental cash flow and margin improvements that flow directly to our bottom line,” CEO Tim Dove said. “Our firm transportation agreements on greater than 90% of our Permian Basin oil volumes continue to be a key differentiator.”

Oil transportation contracts to the Texas coast “not only expose us to Brent-related pricing, but also insulate us from domestic oil price and differential volatility,” he said. In addition, by executing a contract option, Pioneer could receive West Texas Intermediate/Cushing pricing through 2020 on remaining oil volumes beyond the Gulf Coast FT commitments.

About 70% of Pioneer’s Permian natural gas contracts are tied to the Southern California price index, with the remainder mostly sold under term contracts at Waha hub pricing. Southern California-priced sales received an uplift of 25 cents/Mcf versus Waha during the second quarter.

“If you look at July, because of the heat that’s been hitting in Southern California, we do expect a 60-cent uplift” in gas prices, CFO Rich Dealy said. Based on where the sales are in August to date, Pioneer expects “about a $2 uplift in realized prices for those sales.”

Pioneer is “continuing to “reap the benefits of long-term planning in the Permian,” Dove said. “As we all realize, this is a multi-decade development and it needs multi-decade thinking in advance…”

For example, investments in natural gas processing are high on the list of priorities. Targa Resources Corp. is adding three gas processing facilities to the Permian in September, with two more planned to ramp in the first half of 2019.

“That will actually increase our capacity by 70% compared to where it is today,” Dove said. “We’re taking broad-brushed steps to make sure we’re ahead of issues surrounding line pressure and just availability of gas prices.”

Toward that end gas processing plants now are being designed to handle 250 MMcf/d versus the usual 200 MMcf/d facilities.

Water is another issue that has to be addressed for long-term Permian growth, but Pioneer’s “environmental footprint is very important to us as well,” the CEO told analysts during a conference call. The company’s use of freshwater “approaches zero in a few years. In fact, once we increase our reuse volumes and also bring the Midland water processing facility online in probably early 2020 or so, we’ll get down to a very low percentage.”

Still, Pioneer is anticipating a slowdown in the Permian — not on the drilling side but in completions.

Pipeline constraints for both oil and gas are “coming to fruition,” Dove said. “The rigs in general are contracted for longer periods of time than the fracture fleets, so I think the rig count you see is relatively stabilized and not moving.”

A slowdown in completions “naturally makes sense if you have essentially full pipelines. That does not bode well for increases in cost when activity levels are coming down.”

Capital expenditures (capex) through the end of the year were increased to $3.4 billion from $3.3 billion. Capex is to be funded from forecast operating cash flow, estimated through 2018 at $3.3 billion based on current strip prices of $69/bbl oil and $2.80/Mcf gas.

The capex adjustment is tied in part to “operating in a higher oil price environment,” Dove said. The impact of the Trump administration’s 25% hike in steel tariffs are raising oilfield services costs for tubular products and other steel products Pioneer needs. “We can see steel easily compared to last year be 20% to 25% over last year’s cost for the same products.”

Pioneer “had a more significant increase in cost issues than we would have assumed.”

More money also would be directed to raise four more rigs in the Permian by the end of the year. Pioneer has 20 rigs working across the play today.

In addition, some capex would be directed to about 60 enhanced completions in the Permian using the company’s proprietary Version 3.0-plus drilling technique.

With the additional spend, Permian production is forecast to climb by 19-24% year/year; output now is trending in the upper half of the range.

Companywide, quarterly production totaled 328,000 boe/d, including 280,000 boe/d from the Permian. Average oil sales were 185,000 b/d, while gas sales totaled 466 MMcf/d and natural gas liquids (NGL) sales averaged 64,000 b/d.

Oil output from the West Texas/southeastern New Mexico basin increased to 175,000 b/d in the second quarter, with nearly 165,000 b/d delivered to the Texas coast under FT contracts; the company also exported 103,000 b/d.

In addition, 67 Permian horizontals went online between April and June. Among the highlights was a three-well Wolfcamp D pad tied to sales using Version 3.0 completion techniques. The pad delivered 90-day cumulative production of 373,000 boe, 60% weighted to oil, which the company said was nearly a 75% improvement over 2014 and 2015 Wolfcamp D wells drilled and completed in the same area.

In the Spraberry horizontal appraisal program, plans are to tie about 19 wells to sales to help determine the “optimal long-term development strategy” for the Middle Spraberry, Jo Mill and Lower Spraberry formations.

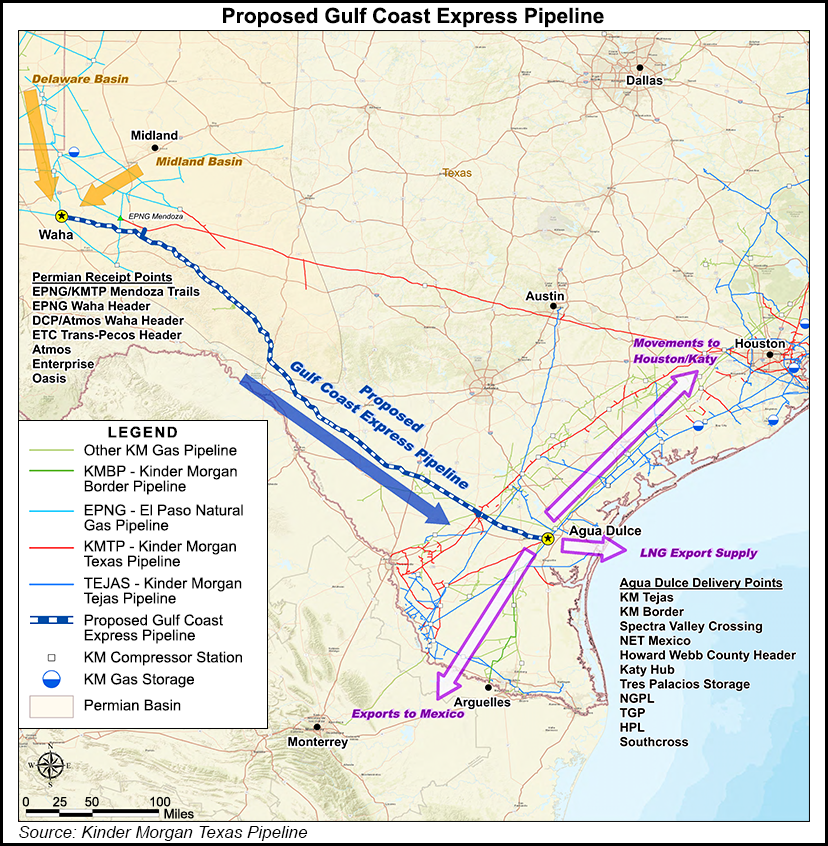

For its Permian natural gas, Pioneer has secured additional FT capacity on Kinder Morgan Inc.’s 2 Bcf/d Gulf Coast Express, set for service by late 2019. The pipeline, which would terminate in South Texas at the Agua Dulce hub near Corpus Christi, would provide access to “liquefied natural gas export terminals, refineries, petrochemical facilities and Mexican markets.”

The company is estimating 2018 gas sales revenues should be about 5% of forecast Permian oil, NGL and gas revenues.

Average realized prices for oil were $61.20/bbl in 2Q2018, with gas fetching $1.97/Mcf and NGLs at $28.83/bbl. During the second quarter, Pioneer reported a $69 million cash flow uplift from Gulf Coast refinery sales and export markets at Brent-related pricing.

Net income was $66 million (38 cents/share) in the quarter versus year-ago profits of $233 million ($1.36). The sharply lower profits resulted from one-time impairments on $170 million in hedging losses and asset divestiture-related net charges. Adjusted income in 2Q2018 was $243 million ($1.41/share).

Transitioning to a Permian pure-play should be completed by year’s end, with sales of the Raton Basin and Eagle Ford Shale already completed, and an agreement in place for the West Panhandle field.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |