Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Pennsylvania Shale Production, Operations Again Post Quarterly Gains

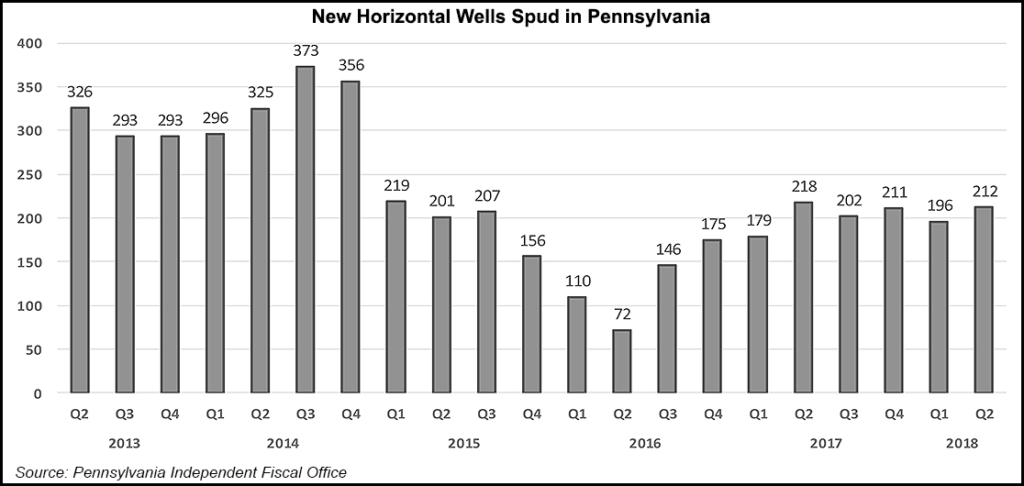

An unconventional natural gas production report issued Friday by the Pennsylvania Independent Fiscal Office (IFO) showed little to frown about during the second quarter, as volumes increased, more producing wells were online and the well inventory declined.

Based on data collected by the Pennsylvania Department of Environmental Protection, the IFO said second quarter unconventional production increased to 1.456 Tcf, or 10% higher than it was in the year-ago period and slightly above the 1.441 Tcf produced in 1Q2017. The gain was driven by a 10% production increase from horizontal wells, which account for nearly all production in the state.

It was the seventh consecutive quarter/quarter increase from horizontal wells. IFO added that over the last two years, horizontal production has increased by 15%. Over the same time, since 2Q2016, average per-well production increased by 27.4%, as operators continued pushing for optimized completions.

All of the second quarter production growth, according to the report, came from wells spud in 2016 and 2017. Wells spud in the two years comprised more than one-third of all production in the quarter. Wells spud in 2015, meanwhile, showed the largest decline in production (37%) and production from wells spud in 2014 or earlier declined by 17.8%.

The state’s second quarter well inventory, defined by the IFO as those drilled but uncompleted or shut-in, declined from 1Q2017 by 102 to 1,519. Similarly, total producing wells increased by 10.4% year/year to 8,672, consisting of 8,194 horizontal wells and 478 vertical wells drilled to unconventional formations.

Pennsylvania’s Susquehanna, Washington, Bradford and Greene counties were, in order, again the state’s top four producers during the second quarter, accounting for two-thirds of gas production.

The IFO report does not include production from conventional wells. The state began collecting monthly production data from unconventional operators in 2015, but legacy producers still report annually.

The growth in output is coming as the Appalachian Basin gains additional pipeline capacity, with more on the way with the 3.25 Bcf/d Rover Pipeline and the 1.7 Bcf/d Atlantic Sunrise near full-service, and as others including the 1.5 Bcf/d Nexus Gas Transmission system are expected to come online before the end of the year. In August alone, there was an additional 7 Bcf of takeaway capacity online compared with the same time last year in Appalachia, according to Genscape Inc.

Despite growing supply across the region, the additional takeaway appears to be closing the wide basis differentials that have plagued the region. The Ohio Department of Natural Resources also recently reported that unconventional gas production increased to 554.3 Bcf in the second quarter from 389.7 Bcf in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |