Markets | NGI All News Access | Regulatory

Pennsylvania PUC to Explore Competitiveness of Retail Natural Gas Market

The Pennsylvania Public Utility Commission has directed its Office of Competitive Market Oversight (OCMO) to go ahead with a long-awaited investigation into the state’s retail gas market that will explore competition and potentially modernize regulations as shale gas production grows.

Commissioners voted 5-0 to approve a final order that directs the OCMO to examine several issues involving retail gas competition in the state. The order also requires the office to form working groups composed of natural gas distribution companies, natural gas suppliers and other interested parties to investigate possible changes to the marketplace.

“I am excited by the potential for this investigation to bring real change to the commonwealth’s retail natural gas market, and I believe OCMO has provided us with a path forward to properly vet the issues,” said PUC Commissioner Pamela Witmer. “The order before us today provides a structured framework to bring our natural gas retail market to the next level, an effort I am certain will proceed with deliberate speed.”

The OCMO will examine capacity issues; storage assets; issues regarding system balance, tolerances and penalties, as well as non-discrimination in access points on distribution systems and issues specific to consumers, such as standard offer programs and low-income shopping.

In an October 2005 report to the General Assembly, the PUC determined that effective competition does not exist in the state’s retail natural gas market. As a result, the agency was required by law to explore further options, including legislation, to encourage increased competition. In August, the PUC issued a tentative order for an investigation that outlined several issues for the OCMO to examine.

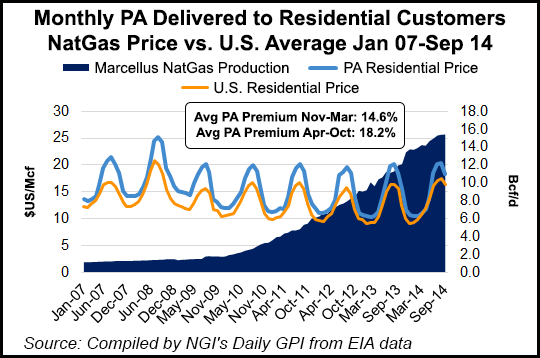

According to the U.S. Energy Information Administration, natural gas production from the Marcellus Shale has increased from about 1.5 Bcf/d in 2007 to roughly 16 Bcf/d this month. A large share of that gas is produced in Pennsylvania, where operators churned out 3.3 Tcf last year (see Shale Daily, Feb. 20).

PUC data shows that purchased gas cost rates in the state have declined by as much as 45-50% since 2008, in large part due to growing shale supplies. Under state law, utilities can’t earn a profit on the natural gas commodity portion of a customer’s bill. They are required to pass the cost of the gas they purchase directly through to customers without any markup.

But with growing supplies and increasing natural gas use have come other problems for state regulators. The brutal cold of last winter, for example, showed how supplies can be stretched thin with a lack of available infrastructure to deliver them. While gas costs have come down significantly in recent years, transportation costs, which are passed along to consumers, have increased during winters like last year’s (see Shale Daily, Dec. 11, 2012). There are also only 10 primary utility companies serving consumers in the state.

“Given the tremendous natural gas resources that exist in the Commonwealth, there is great excitement over the potential to grow the use of natural gas,” Witmer and Commissioner James Cawley said last year when they issued a joint motion supporting the investigation. “We believe that the time is right for the commission to renew its inquiry and initiate a formal investigation into the current status of Pennsylvania’s retail natural gas market to assess whether effective competition exists and make recommendations for improvements to ensure that consumers have more opportunities to realize the benefits of Pennsylvania’s abundant natural resources.”

Since 2007, the price of natural gas delivered to residential customers in Pennsylvania has been consistently higher than that for the United States as a whole, despite the surge in production from the Marcellus Shale in recent years. This price premium has tended to be more severe in non-winter months since 2007, with Pennsylvania prices averaging 18.2% higher versus those across the U.S. between April and October, while falling to 14.6% between November and March.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |