Pennsylvania Production Pummels Previous Record

Pennsylvania natural gas producers may be pulling back to focus on higher-margin targets, but their wells appear to have not gotten the message. Gas output in the commonwealth broke another record for the first half of 2014 (1H2014), topping out at just under 2 Tcf.

The Department of Environmental Protection (DEP) issued the latest numbers late Monday, indicating total output between January and June was 1.94 Tcf, about 520 MMcf higher than in the year-ago period.

The data, compiled from producer reports, indicated that production increased from 1.42 Tcf in the first half of 2013 (see Shale Daily, Aug. 20, 2013). Between July and December 2013, operators pumped 1.7 Tcf (see Shale Daily, Feb. 20). In the first half of 2012, gas production totaled 894.8 Bcf, with 2.04 Tcf for the entire year (see Shale Daily, March 6, 2013).

Operators in 1H2014 also produced 1.8 million bbl of condensate and slightly more than 200,000 bbl of oil.

Chesapeake Energy Corp. was reported to be far and away the leading gas operator in the state after it produced 3.99 Bcf, easily surpassing any other company. The top five gas producers accounted for almost half of the state’s gas supply in 1H2014 and were, in order, Chesapeake, Cabot Oil & Gas Corp., Range Resources Corp., Southwestern Energy Co. and EQT Corp.

The six-month figures “typically are updated as operators update their production reports due to reporting errors that may include missing wells, incorrect data and in some cases there are operators who have not submitted their data prior to DEP releasing the data,” said Pennsylvania State University’s Matt Henderson, shale gas asset manager for the Marcellus Center for Outreach and Research.

Oklahoma City-based Chesapeake delivered 1H2014 gas output of 399.9 Bcf, with Cabot contributing 260.2 Bcf. Range, the initial developer of the Appalachia unconventional bonanza, recorded 139.1 Bcf, followed by Southwestern’s 138.8 Bcf and EQT at 135.6 Bcf.

According to data, Anadarko Petroleum Corp. was the sixth-largest gas producer in 1H2014 with 117.7 Bcf, followed by Talisman Energy Inc., 90.1 Bcf and Chief Oil & Gas LLC, 88.0 Bcf. Seneca Resources Corp., the exploration arm of National Fuel Gas Co., reported total gas output of 69.6 Bcf, while Chevron Corp. rounded out the top-10 at 62.9 Bcf.

“When looking at production on a per-well basis during the period, Cabot has the top five, and seven of the top-10,” Henderson said. “Chief has the other top three wells.” On a daily average basis, “Cabot has nine of the top-10, and 11 of the top-20 in the Commonwealth. Chief…has seven, and Range and Seneca Resources each had one.

“The top eight wells all averaged over 20 MMcf/d.”

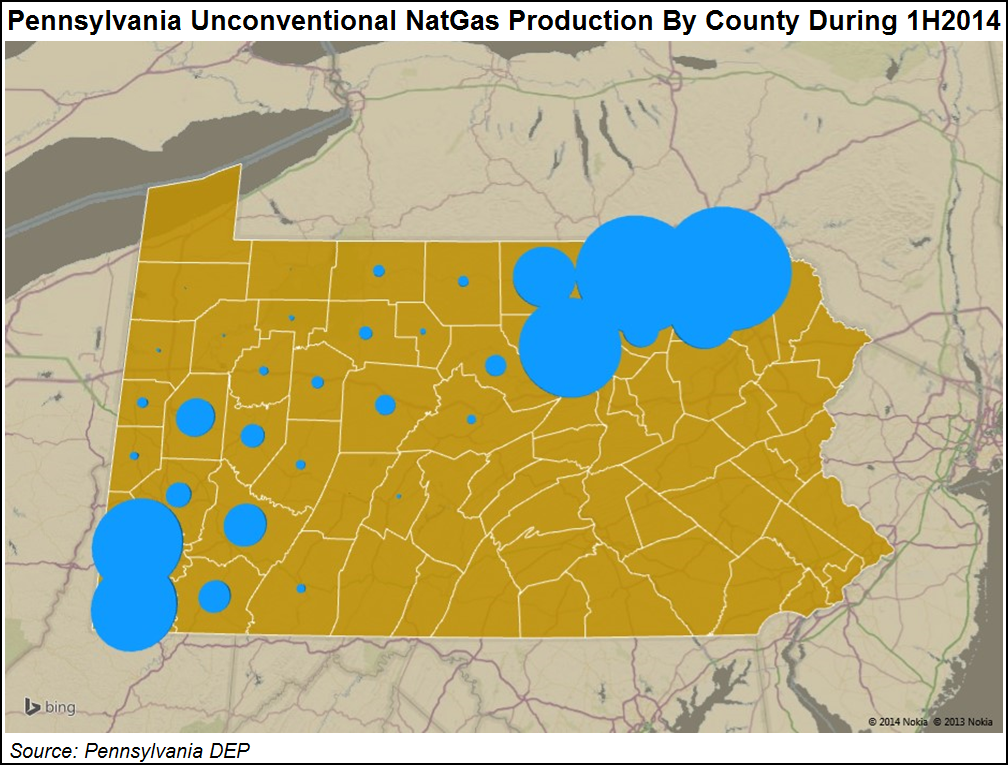

The gas produced in 1H2014 predominately was from the Marcellus Shale, and most were horizontal wells. Horizontal/vertical drilling also targeted the Utica and Upper Devonian formations. As in previous periods, most of the state’s dry gas gains were from southwestern and northeastern Pennsylvania.

Leading the way was Susquehanna County, which reported 456 Bcf in the first six months of this year, followed by Bradford County at 411 Bcf. Lycoming County wells brought in close to 271 Bcf between January and June, while Washington County had close to 198 Bcf total.

Greene County reported 172 Bcf, followed by Wyoming County with 112 Bcf and Tioga County with 107 Bcf. Westmoreland County for the first six months reported 43 Bcf of gas production, while Butler County produced 37 Bcf. Sullivan County rounded out the Top 10 for gas production at 34 Bcf.

According to DEP, 510 wells were ramped up in 1H2014, and there were 1,676 new gas permits issued.

Cabot’s big wells all were in Susquehanna County, except for one in Lycoming. Cabot’s top Susquehanna producer (Molnar M1) had 26,680 MMcf/d during the period, followed by Molnar M3 at 26,382 MMcf/d, according to Henderson.

Chesapeake has of late been turning to more oil/liquids targets, but its gassy showing in Pennsylvania might offer a different tale. Although it has been dropping gas rigs to move to oilier targets, northern Marcellus output in Pennsylvania rose 12% in 2Q2014 from a year ago to average 878 MMcfe/d net; it was down 3% sequentially (see Shale Daily, Aug. 6).

Chesapeake, like its peers, could have produced even more gas in the first six months of this year had there been enough infrastructure, according to management. At the end of June, Chesapeake had 120 wells that were awaiting pipeline connection or were in various stages of completion across the region. It was the same story for Cabot, Range and others.

Cabot’s Marcellus production was 41% higher year/year in the second quarter at 1.26 Bcf/d (see Shale Daily, July 25). Range during 2Q2014 reported 848 MMcfe/d of output in the southern division, where 36 wells were turned to sales, while in the northern division, it produced 200 MMcfe/d and turned five wells to sales (see Shale Daily, July 29).

Washington County, in the Greater Pittsburgh area, edged out all others in the state for condensate production with 1.76 million bbl reported. During 1H2014, most of the liquids were produced by Range, with Chesapeake contributing all of the reported oil supplies at 204,316 bbl. Washington County also was the fourth largest dry gas producer in 1H2014 at close to 198 Bcf.

Forest County, in second place for condensate, reported 14,500 bbl. Mercer County reported 4,695 bbl of output, all by Halcon Resources Corp. Eight counties reported condensate production for 1H2014: Mercer, Crawford, Lawrence, Venango, McKean, Forest and Butler.

“Some of this production is due to increased activity within other shale formations than the Marcellus,” Henderson said.

Based on DEP and Railroad Commission of Texas (RRC) data, the two states would appear to be contributing slightly more than half of all U.S. onshore production.

Texas gas output was nearly 3.8 Tcf between January and June, versus 4.06 Tcf in January-June 2013, according to the RRC. Top Texas gas producers last year were led by ExxonMobil Corp.’s XTO Energy Inc., which produced close to 12% of the gas volumes, followed by Devon Energy Corp. (10.8%), Chesapeake (9.8%), Anadarko (5.6%) and EOG Resources Inc. (4.0%).

The U.S. Energy Information Administration only had information on gas production from January through May 2014 for the Lower 48, which was estimated at 10,370 Bcf, versus 12,394 Bcf in the five-month period of 2013 (see Daily GPI, Aug. 1). May’s gas output was the highest on record at 2,166 Bcf, or 69.9 Bcf/d.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |