Utica Shale | E&P | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

Pennsylvania On Track to Set Another Natural Gas Production Record

Newly released data from the Pennsylvania Independent Fiscal Office (IFO) projects that unconventional natural gas production in the state is on track to hit 6 Tcf in 2018 after volumes jumped significantly year/year in the third quarter.

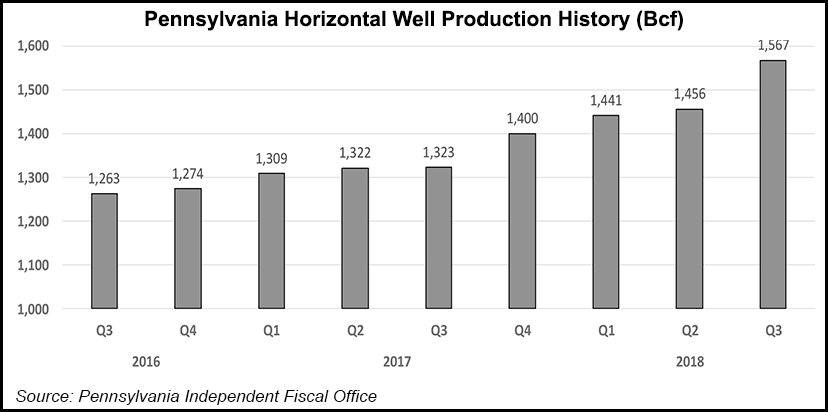

Based on data collected by the Pennsylvania Department of Environmental Protection, IFO said unconventional natural gas production reached 1.570 Tcf in the third quarter, up 18.5% from 3Q2017 and 8% from 2Q2018. The bulk of the production gain came from horizontal wells, which produced 1.567 Tcf during the period, according to the IFO report, which does not include conventional production volumes. Vertical wells drilled to unconventional formations produced 2.6 Bcf.

The third quarter growth rate, IFO said, is considerably higher than the year/year gains reported in 1Q2018 and 2Q2018, which came in at 9.9% and 10%, respectively. Wells spud in 2016 and 2017 comprised more than one-third of all production in the quarter. The state’s third quarter unconventional well inventory, defined by the IFO as those drilled but uncompleted or shut-in, still dropped by 76 wells, or by 5% from 2Q2018, to 1,459 wells.

Unconventional operators produced about 5.4 Tcf last year. The 3Q2018 gain marked the eighth consecutive quarter of horizontal well production increases. The IFO also noted that since 3Q2016, as commodity prices and industry sentiment began to rebound from a downturn two years earlier, horizontal production in the state has increased by 24.1%.

Producing wells, meanwhile, also saw a year/year increase in the third quarter, when there were 8,917, including 8,431 horizontal wells and 486 vertical wells. That’s up from 8,076 producing wells in the year-ago period and 8,672 in 2Q2018.

The gains also appeared to come in part on optimized completions. IFO said that from 3Q2016 to 3Q2018 average production per well increased by 44% in the state.

To be sure, the IFO attributed last quarter’s growth to new pipeline capacity that has come online in the Appalachian Basin throughout the year, better technology and higher natural gas prices.

Pennsylvania is Appalachia’s leading natural gas producing state, but unconventional development in Ohio and West Virginia has helped drive production volumes in the basin to their current levels of more than 30 Bcf/d, according to the Energy Information Administration (EIA). The Northeast would account for the bulk of the 83.2 Bcf/d of dry natural gas production that the EIA forecasts the United States to produce this year in its latest Short-Term Energy Outlook.

An analysis by ClearView Energy Partners LLC released in October said the firm expects 11 Bcf/d of natural gas pipeline takeaway capacity to be added in Appalachia this year, followed by another 5 Bcf/d in 2019. Several major projects, including the Nexus Gas Transmission and the Atlantic Sunrise pipelines have come online this year to help lift local prices and get more volumes flowing in parts of the basin.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |