LNG | Mexico | NGI All News Access | NGI Mexico GPI | NGI The Weekly Gas Market Report

Pajaritos FSRU Project in Southern Mexico Loses CFEnergia as Anchor Client

The fuel marketing affiliate of state power utility Comision Federal de Electricidad (CFE) will no longer participate in a tender for a liquefied natural gas (LNG) project in southern Mexico, a company official told NGI’s Mexico GPI.

The official at CFEnergia, one of CFE’s two fuel trading units, explained that the expected commercial operations date (COD) for a planned floating storage and regasification unit (FSRU) in the port of Pajaritos was no longer attractive, given the start-up of coastal pipeline infrastructure later this year.

Mex Gas Supply (MGS), a subsidiary of state oil company Petroleos Mexicanos (Pemex), will now carry out the tender on its own.

“CFEnergia considers that the timing for the COD of the Pajaritos FSRU is past when it’s necessary to supply its needs for bringing gas to the southeast,” CEO Guillermo Turrent said.

The Pajaritos tender was originally planned for December, but has been delayed for several months. MGS has yet to release bidding documents for the auction to procure LNG supply and rent an FSRU.

“The Sur de Texas-Tuxpan pipeline will reach COD by year’s end,” Turrent said. “Pajaritos depends on a few factors that we at CFEnergia thought would take it past December.”

The pipeline, “in combination with modifications on the Sistrangas, will allow gas from Sur de Texas-Tuxpan to displace gas from the southeast moving today into the middle of the country. Gas will be delivered into the southeast via displacement.”

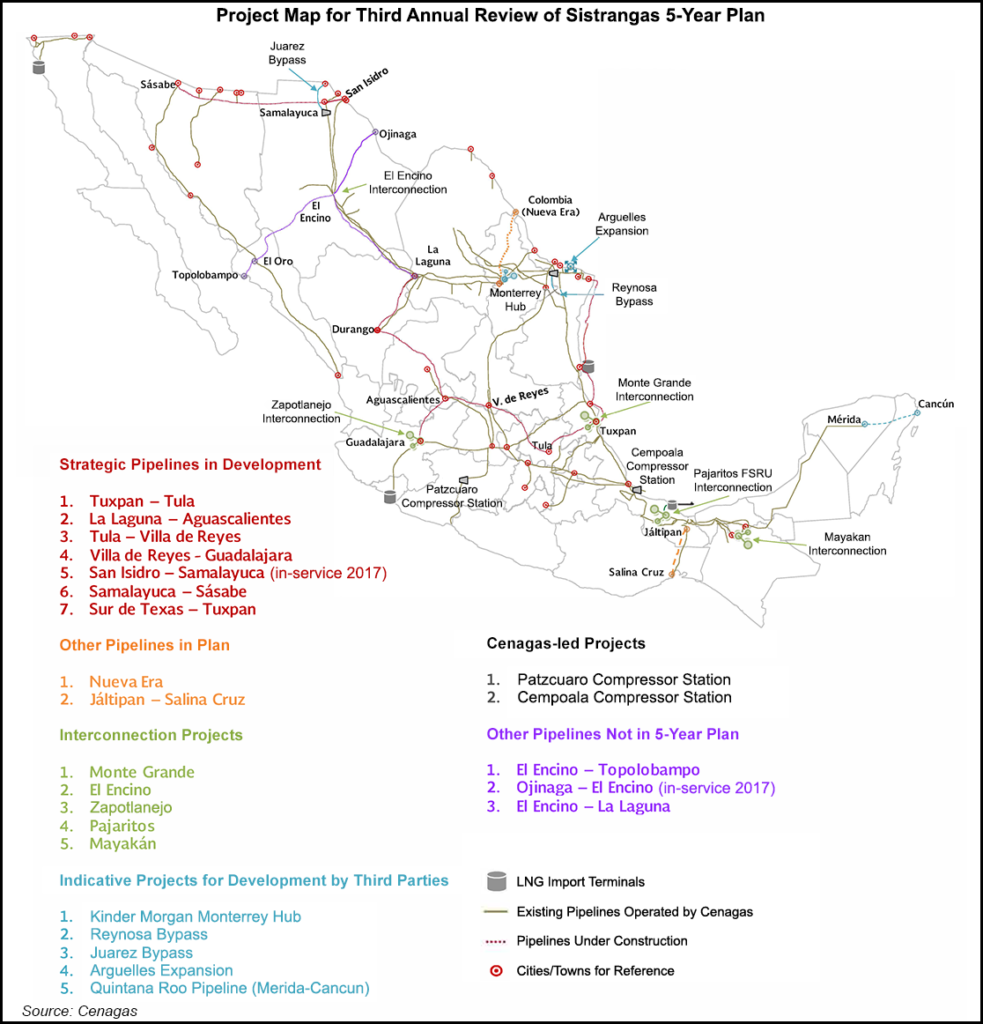

Pajaritos is in Coatzacoalcos, in the southern Gulf of Mexico state of Veracruz. Tuxpan lies about 280 miles to the north, also on the Veracruz coast. The 2.6 Bcf/d marine pipeline project, which would transport imported gas from South Texas, includes a 500 MMcf/d interconnection to the Sistrangas, Mexico’s main transmission network.

Sur de Texas-Tuxpan and the Pajaritos FSRU are two of three projects that the Mexican government expects will ease gas shortages in the southeast, especially on Yucatan peninsula, where the 485-mile Mayakan pipeline supplies five CFE combined-cycle plants.

The third project is being overseen by the Centro Nacional de Control del Gas Natural (Cenagas), which operates the Sistrangas. That project, due to wrap up in 2019, entails reversing flows at a compressor station in Cempoala to allow gas from central Mexico to reach demand centers farther south, once the marine pipeline comes in-service.

Pipeline imports from the United States do not currently reach southeast Mexico, while domestic production of associated gas from Pemex’s offshore oilfields in the region has dropped sharply in recent years.

As originally planned, the Pajaritos FSRU would have required 2.5 million metric tons/year (mmty) of LNG to be split 50-50 between Pemex and CFE, NGI’s Mexico GPI reported in December. An extra 2 mmty would be purchased on a quarterly basis as needed.

The terminal would connect to the Sistrangas through a 390 MMcf/d link, according to planning documents released earlier this year by Cenagas.

With CFEnergia no longer an anchor client, the terminal will likely be resized to serve Pemex’s needs alone.

Turrent said CFEnergia could “potentially” procure gas from the Pajaritos terminal once it comes online, “but this would probably be on a day-to-day basis since continental gas would get a much lower price than LNG to the southeast. LNG is $8/MMBtu and continental gas is $3/MMBtu plus transport.”

Mexico’s LNG needs are expected to gradually diminish after Sur de Texas-Tuxpan and several other pending pipelines in the northwest come in-service later this year. CFE is the anchor client for most of the new privately owned pipelines.

LNG supplied 713 MMcf/d or 9.1% of the country’s natural gas in February, according to the latest data from the Energy Ministry.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |