NGI The Weekly Gas Market Report | E&P | NGI All News Access

Oxy Secures $57B Agreement for Anadarko as Shareholders Meet

Hours after Chevron Corp. retreated Thursday, Houston-based Occidental Petroleum Corp. entered into a definitive agreement to acquire Anadarko Petroleum Corp.

The transaction, valued at $57 billion plus debt, is for $59.00/share in cash and 0.2934 shares for each Anadarko share.

“This exciting transaction will create a global energy leader with a world-class portfolio, proven operational capabilities and industry leading free cash flow metrics,” said Oxy CEO Vicki Hollub. “This transaction further establishes Occidental as a premier operator in prolific global oil and gas regions with the ability to deliver production growth of 5% through investment in projects with industry leading returns.

“With greater scale, an unwavering focus on driving profitable growth, and our commitment to growing our dividend, we are creating a unique platform to drive meaningful shareholder value.”

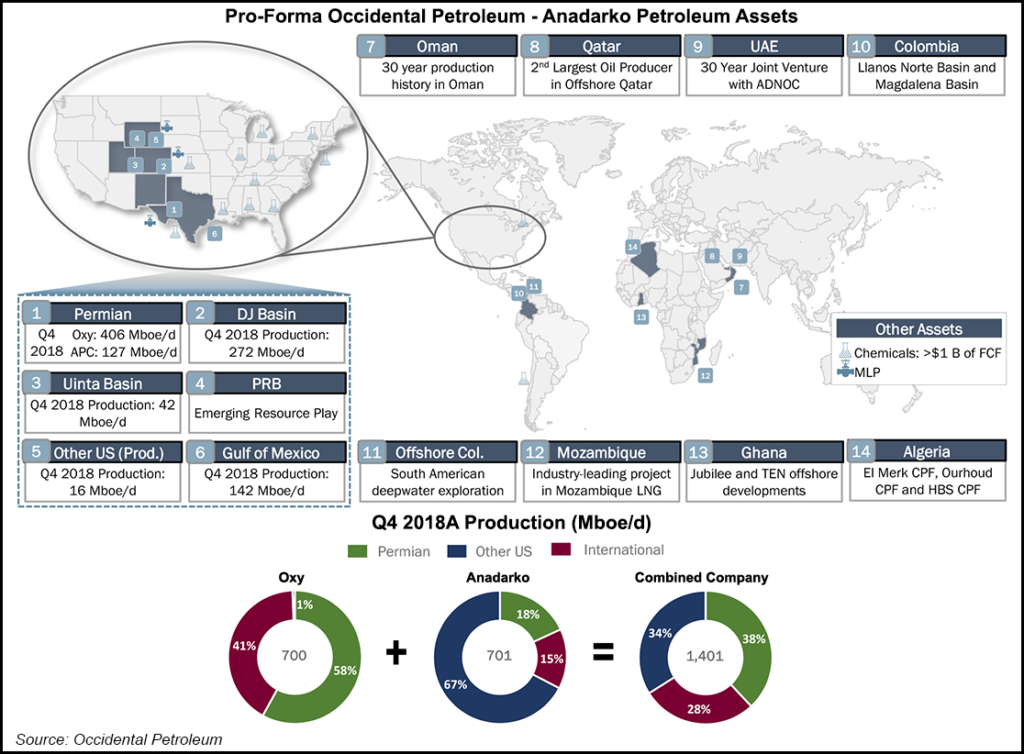

The transaction would enhance Oxy’s Permian Basin position, it’s No. 1 target and present opportunities “for high impact synergies and capital spending efficiency.”

However, Oxy management is expected to take some heat at the annual shareholder meeting, scheduled for Friday.

Oxy has said it would sell off some of Anadarko’s portfolio, which stretches into the deepwater Gulf of Mexico across the Denver-Julesburg Basin, two regions where it is a leading producer. In addition, Oxy is selling off some of the global assets, including Anadarko’s estimable African portfolio, which includes a liquefied natural gas (LNG) export project in pre-development in Mozambique.

Oxy has an agreement to sell the African assets, including Mozambique LNG, for $8.8 billion to French supermajor Total SA. Total is second only to Royal Dutch Shell plc for private LNG sales worldwide.

The purchase is being completed via a combination of cash, debt and equity financing, including proceeds from a $10 billion equity investment by Berkshire Hathaway Inc. The transaction is not subject to a financing condition.

“Occidental is confident in its ability to realize the full potential of the transaction while maintaining a strong balance sheet, investment grade credit rating and its current dividend,” management said. The operator expects to reduce debt over the next two years “through free cash flow growth, realizing identified synergies and executing a planned portfolio optimization strategy with $10-15 billion of divestitures over the next 12-24 months,” including the Total agreement.

Oxy’s Glenn Vangolen, senior vice president of business support, is to lead an integration team.

The acquisition of Anadarko has been unanimously approved by each board. Anadarko board members also have recommended shareholders approve the merger.

If all goes to plan, the transaction could be completed before the end of the year.

Bank of America Merrill Lynch and Citi are acting as Oxy’s financial advisers, while Cravath, Swaine & Moore LLP is serving as legal counsel.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |