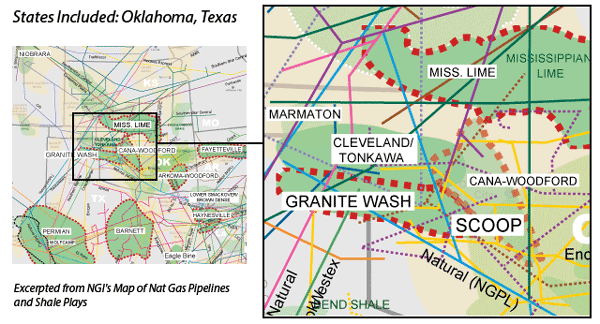

View more information about the North American Pipeline Map

Background Information about the Oklahoma Liquids Plays

Oklahoma, whose natural gas, oil and liquids formations are spread far and wide, is one of the top five of U.S. producing states with some of the largest oilfields. Between July 2014 and July 2015, Oklahoma also produced more natural gas than Louisiana, New Mexico or Wyoming. Best known by producers are the Anadarko and Ardmore basins, built by a plethora of stacked reservoirs that extend from the north to the south, east to west, and deep beneath the earth.

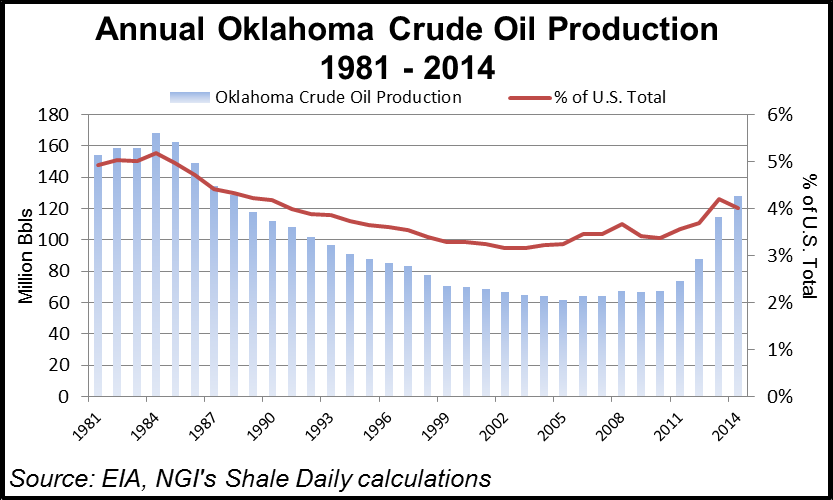

As producers moved from gassy targets to take advantage of higher oil prices about 2010, a lot of renewed prospecting began in the Sooner State. Oil production increased 74% from 2011-2014 to 128 million bbl, rising by nearly 300,000 b/d, according to the U.S. Energy Information Administration.

Even with the rig count steadily in decline during 2015, Oklahoma still had surpassed its 2011 oil production by July 2015 with 73 million bbl. According to Wood Mackenzie Ltd., Oklahoma oil production could double between 2014 and 2020.

Operators have been allowed to apply their own names to producing reservoirs in the state, which has led to thousands of “inconsistently” defined units, according to the Oklahoma Geological Survey. The state is divided into six geologic regions: the Anadarko Basin, Cherokee Platform, Wichita Uplift, Ardmore Basin, Arbuckle Uplift and Ouachita Mountain Uplift. However, there are names within the names, so keeping track of where production is coming from requires a map. The biggest target of late has been the Anadarko and its stacked reservoirs, where the spotlight often has been on the Woodford Shale.

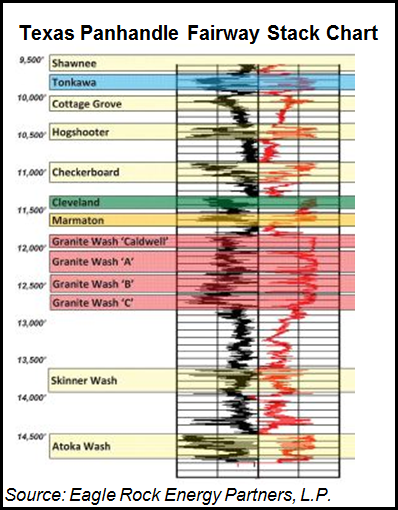

Improved drilling techniques are tapping into reservoirs today from Oklahoma’s carbonate, limestone, sand and shale in other formations, which bear the names Atoka, Caney, Tonkawa, Cleveland, Marmaton, Meramec, Springer, Hunton Lime, Hogshooter and Osage, to name but a few. The Mississipian Lime, which extends into Kansas, and the Granite Wash, are further detailed in other sections.

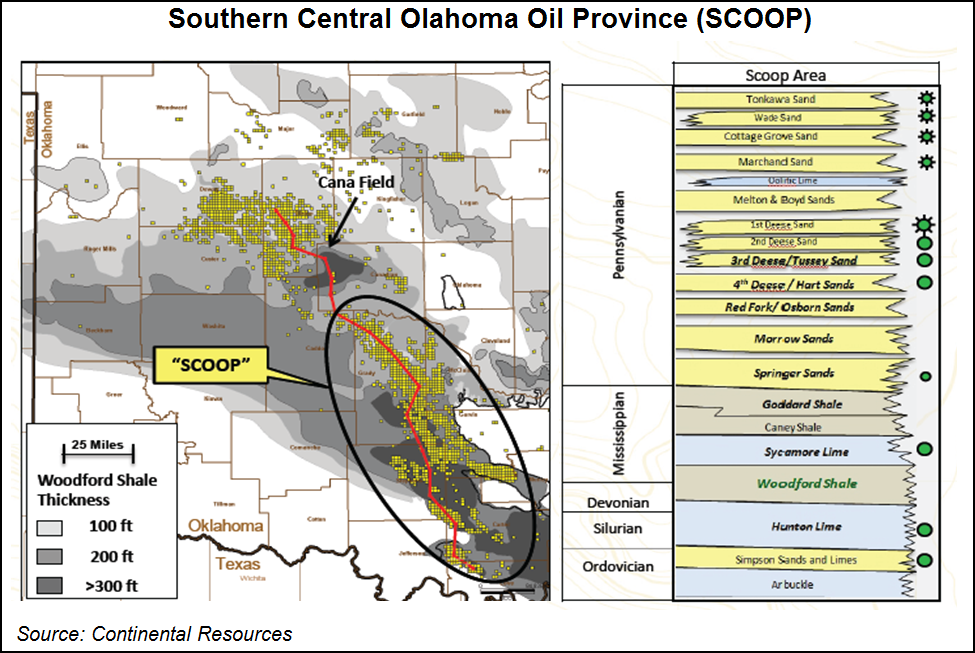

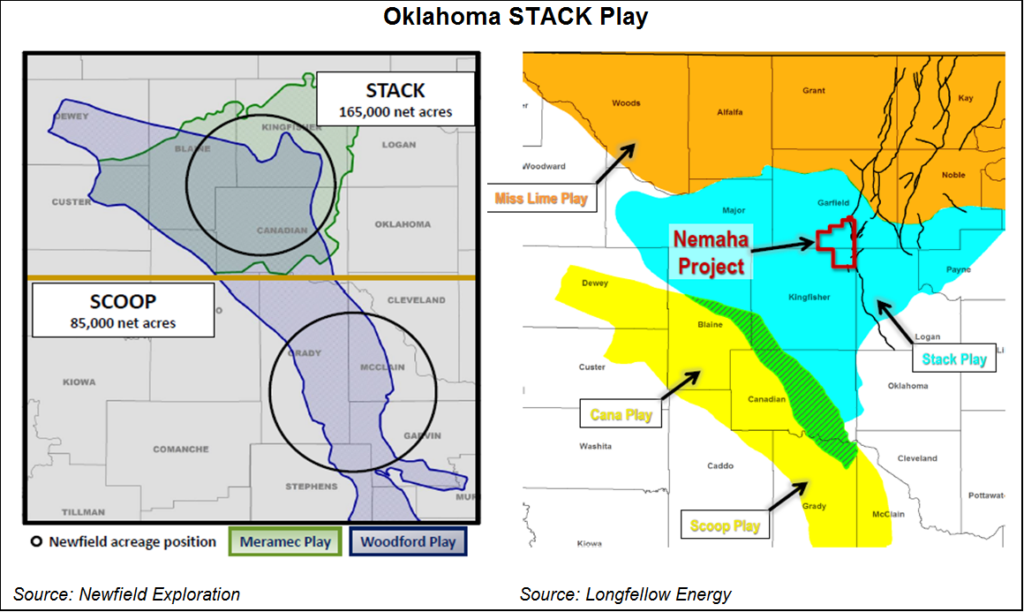

Producers have delineated their prime targets into areas better known by their acronyms. The SCOOP covers the “South Central Oklahoma Oil Province,” while north-central Oklahoma’s STACK represents the “Sooner Trend (oilfield) Anadarko (basin), mostly in Canadian and Kingfisher (counties).” CNOW — Central North Oklahoma Woodford — is another acronym, while the name “Mississippian-Woodford trend” also is used.

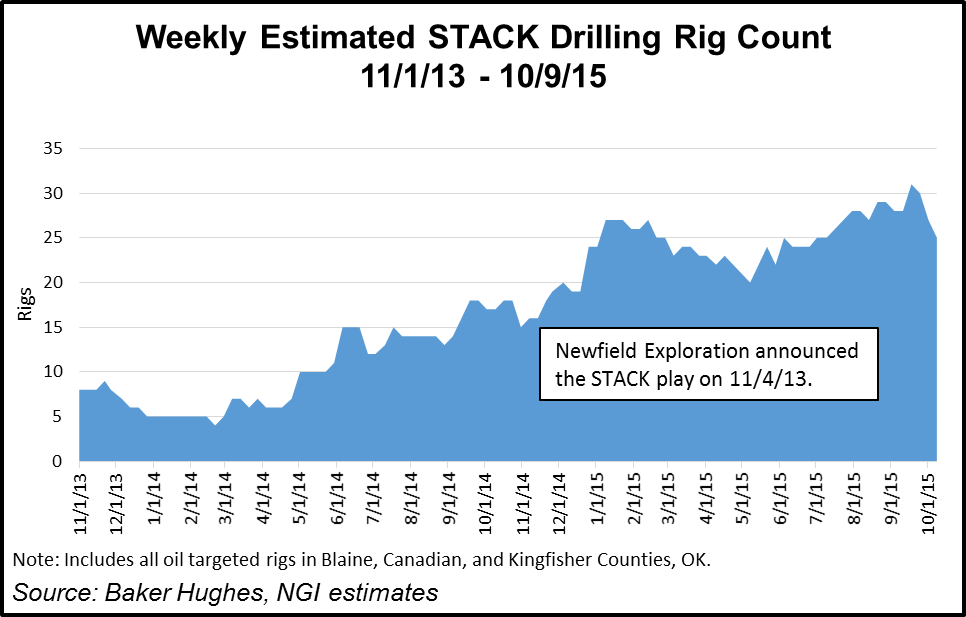

Operators are finding it more efficient to drill within several targets at a time, which reduces costs, and the rewards may be big. Wood Mackenzie said within Oklahoma, producers primarily are working nine sub-plays, rich enough to compete with the best areas of the Bakken and Eagle Ford shales (see Shale Daily, Feb. 13, 2015). During 2015, as hundreds of drilling rigs were dropped, the STACK became one of the few areas in the United States where the rig count actually increased. About 25 rigs were running specifically on STACK targets in November 2015, 20 of which we believe were targeting the Meramec.

ExxonMobil Corp.’s XTO Energy Inc. had one of the biggest leaseholds across Oklahoma at the end of 2014 with an estimated 1.153 million acres and gross production of 12,000 b/d of oil and 396 MMcf of natural gas. It operated in 25 Oklahoma counties.The Ardmore-Woodford dominated the work, but it also has branched out into other formations.

Newfield Exploration Co. (NFX), considered one of the top operators, said net daily production from the Anadarko had, for the first time in 3Q2015, eclipsed the combined production from its other U.S. assets. “This is quite a milestone considering that the SCOOP and STACK plays literally started from scratch just four years ago,” CEO Lee Boothby said in November 2015.

The Oklahoma Corporation Commission said the top producers in the state from 2008 to 2015 were SandRidge Energy Inc., 6,732 wells drilled and completed; Chesapeake Energy Corp., 6,098; Devon Energy Corp., 4,894; Charter Oak Production Co. LLC, 3,031; and New Dominion LLC, 1,730.

One downside to the increase in drilling activity within Oklahoma in recent years has been increased concerns about induced earthquakes. The Oklahoma Corporation Commission (OCC) has implemented an action plan to reduce the risk of such earthquakes in the Cushing, OK, area by changing the operations of some oil/natural gas wastewater disposal wells (see Shale Daily, Oct. 19, 2015). The issue is not new, and the OCC has been eyeing for some time injections into the Arbuckle formation as the potential cause of the quakes (see Shale Daily, Oct. 31, 2014; July 7, 2014).

Ardmore-Woodford Shale

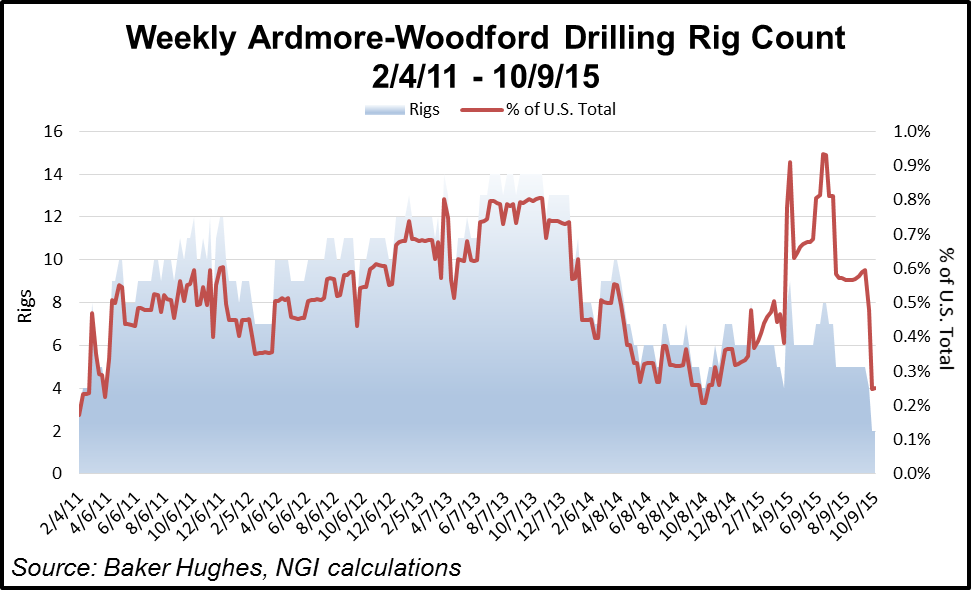

The Ardmore-Woodford Shale, which extends across Bryan, Carter, Johnston, Love, and Marshall counties, is dominated by ExxonMobil, which owns more than 270,000 net acres. During the company’s annual investor day in March 2015, CEO Rex Tillerson had said the company could make money in the Ardmore, Permian and Williston basins at an oil price of $55.00/bbl (see Shale Daily, March 5, 2015). Output from the three plays is set to double through 2017.

ExxonMobil was planning to increase volumes in the Ardmore by 36% a year between 2014 and 2017, but low oil prices had put a crimp on forecasts by the end of 2015 (see Daily GPI, Oct. 30, 2015). There were as many as 14 rigs drilling the Ardmore in 2013, but those were down to just two in early October 2015. Both those rigs were operating in Carter County.

Cleveland/Tonkawa

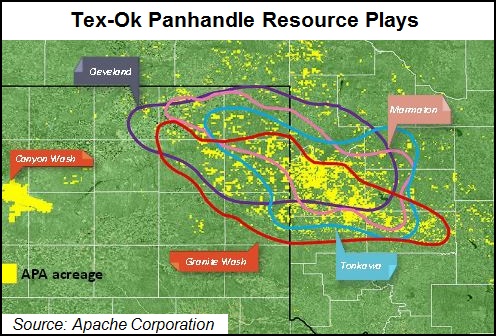

The Cleveland and the Tonkawa are actually two distinct and separate sandstone formations, but because they are at similar depths and largely overlap, many operators simply combine them into a single play. We believe the Cleveland/Tonkawa is most prospective in Oklahoma’s Custer, Dewey, Ellis, and Roger Mills counties, and in Hansford, Hemphill, Lipscomb, and Ochiltree counties in Texas.

The Tonkawa is the shallower of the two horizons, with a vertical depth of roughly 7,500-13,000 feet. The Cleveland lies about 1,500 feet deeper on average. We believe production in this area tends to be 50% oil, 25-35% NGLs, and the remainder natural gas.

At the start of 2013, an estimated 165 operators were reporting production from either Oklahoma’s Cleveland or the Tonkawa formations, according to the Oklahoma Corporation Commission, making this one of the heaviest targeted areas in the state. In its November 2015 investor presentation, Jones Energy Inc. listed the top 10 operators in the Cleveland in terms of undrilled locations as BP plc, Jones, Mewbourne Oil Co., Apache Corp., Chesapeake Energy Corp., Courson Oil & Gas Inc., EOG Resources Inc., Midstates Petroleum Co. Inc., EnerVest Ltd., and Templar Energy LLC.

Hogshooter

The Hogshooter formation, also known as the Missourian Wash, is considered by some to be part of the Granite Wash play, an area we describe in more detail in our separate Granite Wash section. We believe roughly 70% of the production from Hogshooter wells is crude oil, and given the disparity between crude oil and natural gas prices, that would explain the surge in oil rigs that moved to the Granite Wash before oil prices fell in 2014-2015.

The Hogshooter, considered an emerging area in 2013, got little notice as oil prices began to sink in 2014 and beyond. Linn Energy LLC in early 2014 said it would drill 60 horizontals during 2014 to target the Mayfield area of Oklahoma. Organic production was forecast to grow by 3-4%, which at midpoint would have been about 1,085 MMcfe/d in 1Q2014 and an average of 1,105 MMcfe/d for the full year. However, with commodity prices tanking, there was little news from Linn regarding the play in 2015.

Hunton Lime

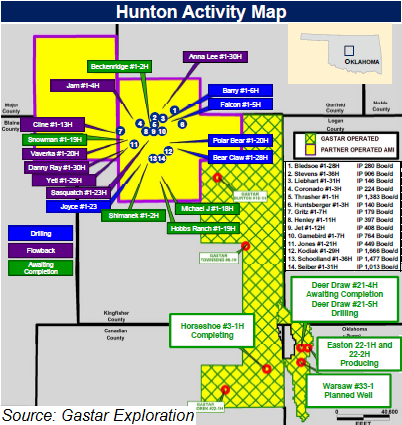

The Hunton Limestone is one of the deeper formations of the Oklahoma oil and gas layer cake, lying beneath the Woodford Shale. For that reason, operators typically do not include the Hunton as part of the STACK play, but the Hunton certainly is prospective across much of the STACK fairway.

We believe Gastar Exploration Ltd. is the publicly traded company most associated with this play, and the company has been drilling operated horizontal wells in Canadian, Kingfisher and Oklahoma counties, and participating in non-operated horizontal wells in Blaine, Kingfisher and Major counties. During the third quarter of 2015, Gastar brought online one Upper Hunton and two Lower Hunton wells and had completed a third.

According to Gastar’s November 2015 investor presentation, the Upper Hunton has an estimated ultimate recovery of 347,000 boe with a 75% oil cut, which at oil prices at the time generated a 36% internal rate of return (IRR) on drilling/completion (D&C) costs of $3.3 million. The Lower Hunton has a higher EUR at 425,000 boe, with an 82% oil cut, and a higher $5.0 million D&C cost per well, generates a lower 22% IRR.

Marmaton

As shown in the earlier map the Marmaton formation traverses much of the same portions of Texas and Oklahoma as does the Cleveland/Tonkawa and Granite Wash. However, we note that this is the Marmaton Wash formation, which is akin to the Granite Wash. This is not to be confused with the Marmaton Lime oil play, which is a carbonate formation located primarily in Beaver County, OK, and Ochiltree County, TX. These two counties are not part of the Granite Wash fairway.

Much of the drilling in the Marmaton Lime has been done via vertical wells, but several operators said the area could be a candidate for horizontal drilling as well. Unit Corp., which was the largest acreage holder in the Marmaton Lime in 2013, estimated that 90% of the reserves in this play are liquids.

Apache, Cabot Oil & Gas, Chaparral Energy Inc., EOG, Plano Petroleum LLC, QEP Resources Inc., Raptor Petroleum II LLC, and Texas American Resources LLC all had acreage in the Marmaton Lime, among others.

Mississippian Lime

The Mississippian Lime is a massive formation that traverses parts of Oklahoma and Kansas, although much of the horizontal drilling activity to date has been concentrated on the border of each state. Please refer to our separate Mississippian Lime section.

South Central Oklahoma Oil Province (SCOOP)

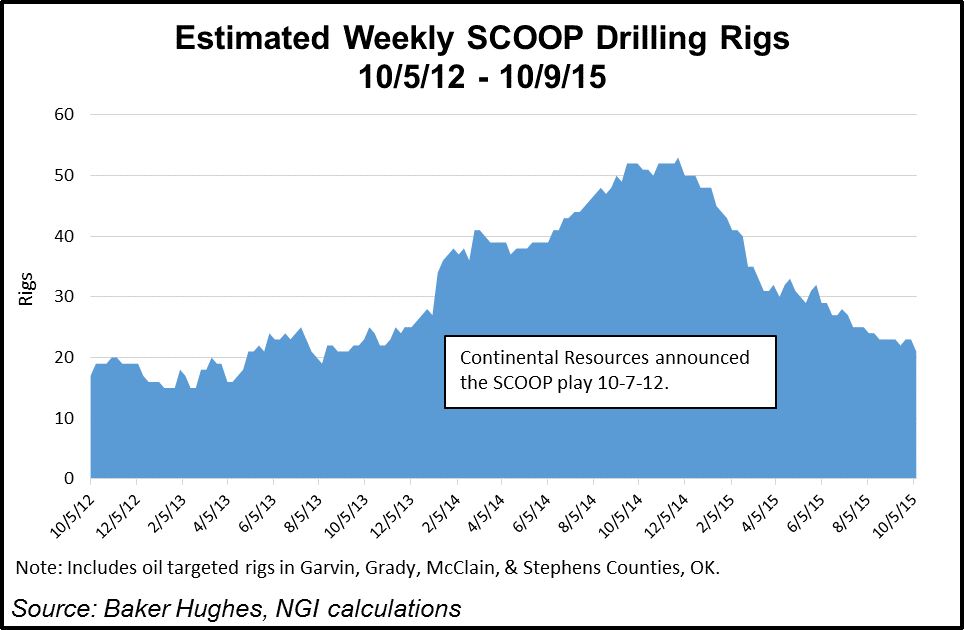

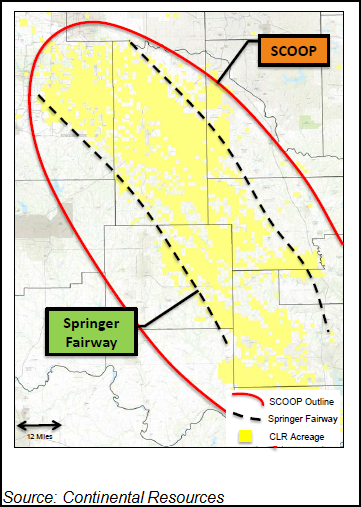

Continental Resources Inc. (CLR) introduced the world to the SCOOP in October 2012, with Oklahoma acreage in Carter, Garvin, Grady, Love, McClain and Stephens counties. Continental primarily has been focused on the Upper and Lower Woodford Shale, although management has said there could be more than 60 formations in SCOOP that would provide additional upside.

There was far less fanfare about the SCOOP relative to the STACK during 3Q2015 earnings conference calls, but we believe this is largely the result of the SCOOP being more of a known play to the investment community. The SCOOP was announced a full 13 months before the STACK, and was in development mode by mid-2015.

We estimate there were 21 rigs operating in the SCOOP in early October 2015, down from a peak of 53 rigs in late November 2014.

CLR’s core activity has been in the Woodford/Springer formations. At the end of September 2015, the Poteet project in the Woodford had 10 wells with combined peak production rates of 146.84 MMcf/d and 3,240 b/d of oil. Woodford wells were showing initial production rates of 280 b/d and 7 MMcf/d. In the Springer, rates were 670 b/d and 867 Mcf/d.

CLR’s Resource Development Manager Dan Harms said in 2014 “every Woodford well that’s drilled out there gets a free look at the Springer every time,” since the Springer lies above the Woodford. “We have an extremely high confidence in the distribution of this zone. We’ve never had a reservoir so well defined.”

Apache, which has legacy holdings across Oklahoma, had two rigs working in the state in November 2015, one targeting the Woodford/SCOOP and the other working the Marmaton formation (see Shale Daily, Nov. 6, 2015). “In the Woodford/SCOOP, we are in the early stages of delineating our approximately 200,000 acres gross and 50,000 net acres,” CEO John Christmann said. He noted that the Truman 28-6-6 No. 1H, tied to sales in 3Q2-15, recorded an average 30-day initial production rate of 1,949 boe/d.

Unit Corp. first drilled its Southern Oklahoma Hoxbar Oil Trend (SOHOT) play, which is located primarily in Grady County, OK, in 2013, and it has quickly become a core position for the company. The SOHOT holds up to six intervals, but so far, Unit has focused on two: the Marchand oil sand and the Medrano gas liquids sand. The Marchand is roughly 77% oil, and generated rates of return in excess of 100% based on October 2015 strip pricing, per Unit’s November 2015 investor relations presentation. UNT plans to operate one rig there in 2016. The Medrano is roughly 28% liquids, and with a rate of return less than 20%, Unit has no plans to drill this interval until further notice.

STACK: Sooner Trend (Oilfield) Anadarko (Basin), mostly Canadian and Kingfisher (Counties)

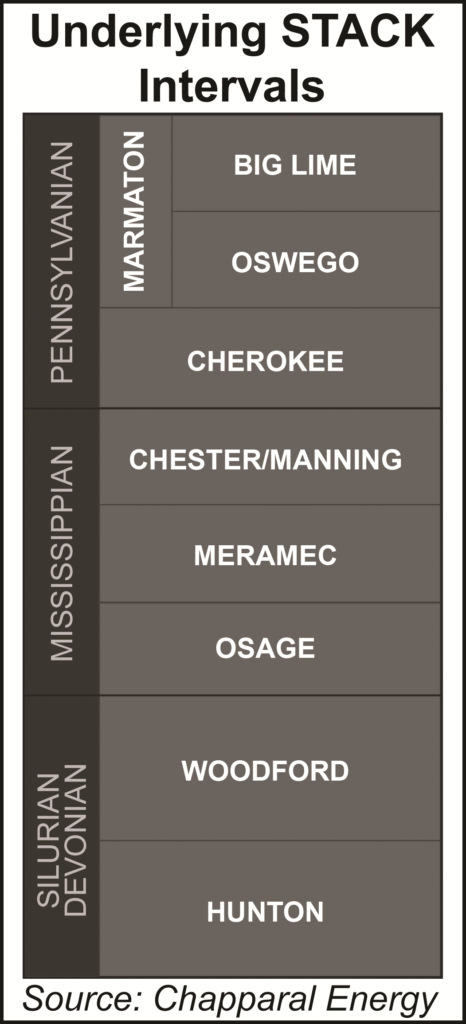

Defining the STACK depends on which producer is asked. Newfield Exploration Co., which unveiled the STACK in November 2013, defines the play as the Meramec and Woodford shales in Oklahoma’s Blaine, Canadian and Kingfisher counties. Canadian and Kingfisher are the “C” and “K” in STACK. Several other operators also include the Osage formation in their definition of the STACK, which seems reasonable, considering it is between the Meramec and Woodford. That would make the “official” definition of the STACK any layers including and between the Meramec and Woodford formations in Blaine, Canadian and Kingfisher counties.

But operators are including other formations in their definition of the STACK. The Oswego formation, which lies a few intervals above the Meramec, is being targeted by a number of operators, including Chesapeake, Chaparral and Gastar. The Chester formation lies just above the Meramec, and is being horizontally drilled by Chaparral, Chesapeake, and SandRidge. The Hunton Lime is located just below the Woodford, and is being developed primarily by Gastar. Furthermore, operators are having various degrees of success in counties outside the main three. For example, Chaparral includes Major and Garfileld counties, OK in its definition of the STACK, while Continental has targeted STACK intervals in Dewey and Custer counties.

“In STACK, we have now drilled nearly 70 wells and have seen strong well results across our acreage,” said Newfield CEO Lee Boothby. “With each well, we gain increased confidence in the play. Although the primary focus of our STACK drilling program today is to HBP [hold by production] our acreage, we are learning about well spacing both on the surface and sub-surface and we will be ready to enter full field development in 2017.”

At the beginning of 2015, Newfield’s estimate to complete a well was $8.5 million. By November, the cost had fallen to $7.5 million or less. Drilling days to depth were averaging about 16 days, with some drilled in 12 days. Other operators reported drilling & completion costs of $7.0-$7.5 million during the 3Q15 earnings season as well.

From 22 new extended lateral wells, Newfield had 68 in the STACK dataset covering more than 1,500 square miles and spanning more than 50 miles from corner to corner. Average 30-day rates from the 22 new wells exceeded wells completed in 2Q2015 by 100 boe/d. On a wellhead basis, the oil percentage averaged nearly 80% over the first 30 days of production. By the end of 2015, Newfield expected to have drilled about 100 STACK wells.

Much of the activity in the STACK so far has been centered on the Meramec, not only because of its economics, but also because it is shallower than the Woodford, and therefore a bit less expensive to drill in order to hold acreage positions. But as Cimarex Energy observed on its 3Q15 conference call, it still remains to be seen whether it will be more efficient to develop the Meramec and Woodford intervals simultaneously, or one then the other.

NGI estimated that there were 25 rigs working the STACK in early October 2015, versus 17 rigs a year prior. That makes the STACK one of only two U.S. unconventional formations to see a year/year increase in rigs, and the only one that we believe is statistically significant. The other formation, the Arkoma-Woodford, came off an extremely low starting base. We believe the majority of those 25 rigs were targeting the Meramec.

Todd Dutton, president of Longfellow Energy, told NGI in March 2014 that the STACK play may extend even further north into Major, Garfield, Logan, and Payne counties, and include that portion of the Mississippian Lime.

The area goes by other names as well, including CNOW and the Mississippian-Woodford trend, but in reality, reserves pumped from the region are defined by how deep or shallow the reservoirs are tapped.

Both the Mississippian Lime and Woodford Shale intervals are thicker in the STACK, and the portion of the Miss Lime within the STACK tends to have a higher oil saturation, with less produced water. Moreover, the Woodford is a primary producing formation in the STACK, but it is also a secondary contributor within the Mississippian Lime.

Chesapeake has more than 1.8 million net acres in the STACK area of Oklahoma, with an estimated 1,200 future locations to be drilled in the Meramec and Oswego formations alone, CEO Doug Lawler said in November 2015. Combining the STACK, Miss Lime, Oswego and Meramec targets, Chesapeake has an estimated 400,000-acre position, according to Senior Vice President Jason Pigott, who runs the southern operations.

Because operators can capture production from other formations when they drill, “drilling and completion efficiency have really been what’s outstanding there,” Pigott said. For instance, one of its 10,000-foot wells saved it $1.4 million in drilling costs versus drilling two traditional 5,000-foot laterals. “But it saves 35% on our cost to develop that field if those wells are successful,” he said. The STACK interval play “has three powerhouse formations that all have great economics.”

Operators working in the STACK in late 2015 were attempting to core up their positions to minimize lease operating expenses (LOE) and other costs, according to Pigott. A big challenge is on the technical side, he said. For instance, the Oswego formation is thinner than some of the other targets, so the question is, is it thick enough to drill a 10,000-foot lateral? “The preference is to push these things out as far as we can, because it maximizes our efficiency of the drillbit, our LOE, minimizes surface footprint as well. So, it’s a win for everybody when we can drill those cross unit laterals.”

Devon Energy Corp. in 2015 was training its focus on the Meramec, where it had drilled about 20 of the nearly 100 total industry wells as of November 2015.

“When we look at the commercial expectation for the Meramec it really competes in our mind with our top-tier returns from DeWitt County [Permian Basin], the Parkman in the Powder River Basin, and also the southern portions of Lea and Eddy County in the heart of the Delaware Basin,” Devon exploration chief Tony Vaughn said. “We’ve characterized about 500 locations there. In my own mind, that’s conservative. And as we drill that out, it will have the potential to greatly improve. So it’s going to be one of our go-to areas as we go forward. It’s slightly more commercial than, say, the good work that we do in the Woodford right now and the Cana area.”

For Cimarex Energy Inc., the Anadarko Basin has become a go-to play as well, with a big focus on the Meramec. There, Cimarex completed its first two-mile lateral during 3Q2015, the Clayton 1HX, which had a peak 30-date production rate of more than 16 MMcfe — a 72% uplift versus the average one-mile lateral drilled to date. Going forward, Cimarex planned to drill long laterals on all of its delineated Meramec acreage “whenever possible.”

Gastar Exploration Co. narrowed its focus in 2015 to the Midcontinent, and specifically Oklahoma, for its “better economics and substantial upside,” CEO Russ Porter said in November 2015. “On the vast majority of our leasehold, by drilling one well in any of these STACK formations, we should be able to hold all depths and maintain exposure to multiple plays with the production from that single well,” Porter said. “The Woodford Shale between the Osage and Hunton Limestone is a big gassier,” and while the focus was to be on oil targets until gas prices improved, it also was considering ways to participate in force pooled Woodford wells.

Counties

Ardmore-Woodford: Oklahoma: Bryan, Carter, Johnston, Love, and Marshall Counties

Cleveland/Tonkawa: Texas: Hansford, Hemphill, Lipscomb, Ochiltree, Oklahoma: Custer, Dewey, Ellis, Roger Mills

Hogshooter: See Granite Wash section

Marmaton: Beaver, OK; Ochiltree, TX

SCOOP: Carter, Garvin, Grady, McClain, Stephens (all Oklahoma)

STACK: Blaine, Canadian, Kingfisher (“official” definition}, Custer, Dewey, Garfield,, Logan, Major, Noble, Payne (included in individual company definitions of the STACK) (all counties in Oklahoma)

Local Major Pipelines

Natural Gas: CenterPoint Energy, Enable Gas Transmission’s Cana & STACK Expansion (CaSE) (proposed), Enogex, NGPL, OGT, OkTex Pipeline, Panhandle Eastern, Sooner Trails (proposed), Southern Star

Crude Oil: Basin, Centurion, Cherokee, CK Red River, Diamond (Plains) (proposed), Phillips 66

NGLs: Southern Hills

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Marcellus | Eagle Ford | Upper Devonian / Huron | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily