Shale Daily | Coronavirus | E&P | NGI All News Access

Oklahoma-Based Templar Files for Bankruptcy, Citing Market Turmoil

Anadarko Basin independent Templar Energy LLC has filed for Chapter 11 bankruptcy protection, joining a growing list of distressed operators amid the sharpest oil market downturn in recent memory.

Templar on Monday said it is seeking to address “substantial challenges” amid “declining commodity prices, exacerbated by the Covid-19 pandemic.”

The Oklahoma City-based firm plans to liquidate all or substantially all of its assets through Chapter 11 and to eliminate an aggregate principal debt load of $426 million, plus about $20 million in annual interest expense.

The company has secured $25 million in debtor-in-possession (DIP) financing, which it will use to fund its operations during the Chapter 11 cases.

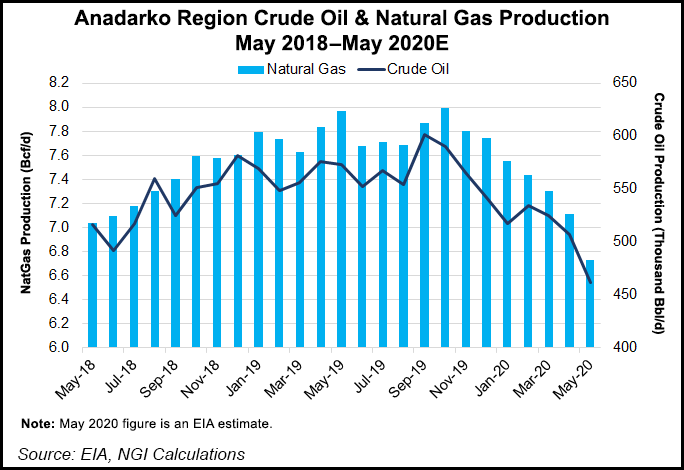

Templar’s exploration and production (E&P) portfolio targets liquids-rich natural gas and oil formations in the Greater Anadarko Basin in Western Oklahoma and the Texas Panhandle.

The Templar news follows a Chapter 11 filing announced on Thursday by Tulsa-based Unit Corp.

Chesapeake Energy Corp., a symbol of Oklahoma City and the unconventional E&P revolution, also acknowledged that it may be facing a similar fate after a staggering $8.3 billion first quarter loss, and last week reached a settlement with Oklahoma mineral owners to whom it owed back royalty payments.

It appears no oil-producing region of the United States is safe from the carnage, as evidenced by the Chapter 11 filings of Bakken Shale heavyweight Whiting Petroleum Inc. and Wyoming-focused Ultra Petroleum Corp.

The Oklahoma Corporation Commission (OCC), which regulates the state’s oil and gas industry, is scheduled to discuss and possibly vote on relief measures for operators struggling to stay afloat amid the current tumult at a public meeting on Wednesday (June 3).

The OCC in April approved a measure allowing operators to shut in production without losing their leasehold rights.

The North American oil and gas rig count stood at 321 as of Friday, down from 1,069 a year ago.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |