E&P | M&A | NGI All News Access | NGI The Weekly Gas Market Report

Occidental Completes Anadarko Takeover but Board Fight May Continue

Houston-based Occidental Petroleum Corp. on Thursday completed its mega tie-up with Anadarko Petroleum Corp. in a transaction including debt now valued at $55 billion.

Completing the transaction followed approval by Anadarko shareholders at a special meeting, with more than 99% of the shares voting in favor of the merger. Occidental in May usurped an offer by Chevron Corp. to secure the merger, initially valued at $57 billion; the share price has since declined.

CEO Vicki Hollub said work now begins “to integrate our two companies and unlock the significant value of this combination for shareholders. We expect to deliver at least $3.5 billion annually in cost and capital spending synergies, and the focus of our board and management team is on execution to achieve the promise of this exciting combination.”

Anadarko shareholders are exchanging each of their shares for $59.00 in cash and 0.2934 shares of Occidental common stock.

Effective at the end of trading on Thursday, Anadarko’s common stock was to no longer trade on the New York Stock Exchange. The purchase is being completed via a combination of cash, debt and equity financing, including proceeds from a $10 billion equity investment by Berkshire Hathaway Inc.

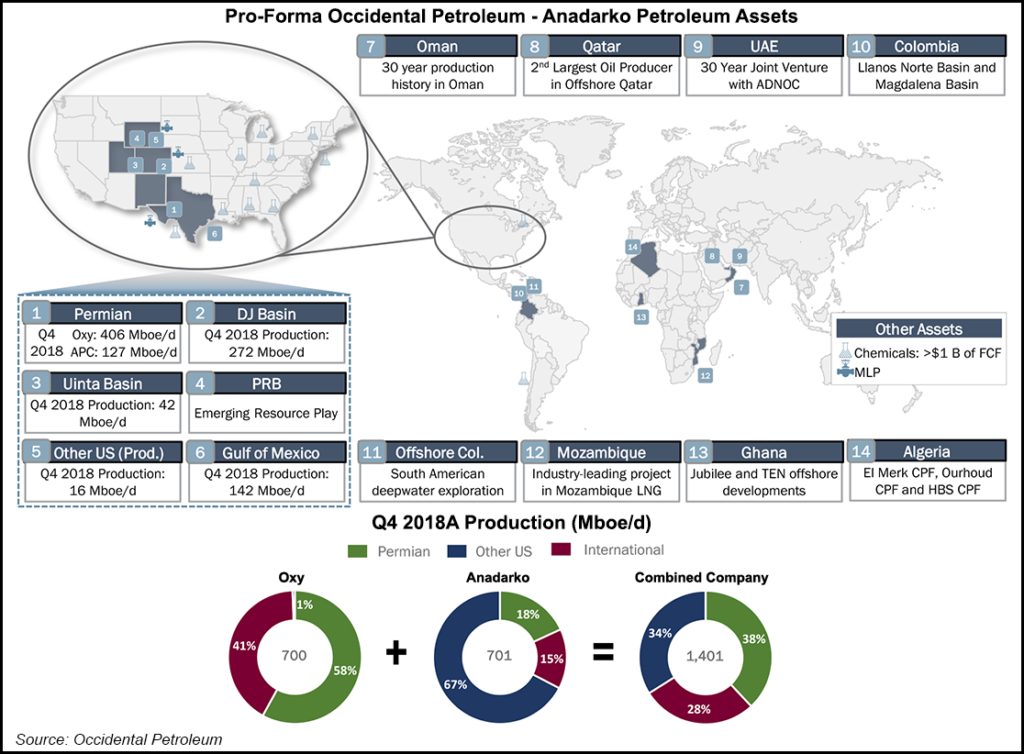

Occidental, which signaled that Anadarko’s Permian Basin assets were its No. 1 target, already is paring some of the global portfolio, which stretches into the deepwater Gulf of Mexico across the Denver-Julesburg Basin and overseas. Anadarko’s estimable African portfolio, which includes a liquefied natural gas export project underway in Mozambique, is being sold to Total SA by Occidental for $8.8 billion.

Founded in 1959, Anadarko has been headquartered in The Woodlands, north of Houston. Its U.S. operations accounted for 86% of total sales volumes during 2018 and 88% of total proved reserves at year-end 2018.

The merger is the largest in the oil and gas industry since Royal Dutch Shell plc three years ago acquired BG Group Ltd.

According to Moody’s Investors Service, the merger adds more than $40 billion of debt to Occidental’s capital structure.

The debt increase offers the producer “less flexibility to confront commodity price volatility,” Moody’s analyst Andrew Brooks said in a note. The senior unsecured rating was downgraded by three notches to “Baa3,” the lowest investment-grade level.

Occidental also still faces a board fight with shareholder Carl Icahn, who has blasted the merger over the last few weeks. The activist investor’s entities are seeking to replace four board members and change company bylaws after claiming Occidental mismanaged the deal.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |