E&P | NGI All News Access | NGI The Weekly Gas Market Report

NOV Facing Challenges in ‘Generational Oilfield Downturn,’ Says CEO

Houston-based oilfield services operator National Oilwell Varco Inc. (NOV) reported growth in its international and offshore businesses during the second quarter, but the North American land market suffered as producers slashed spending.

“NOV continues to face challenging cross-currents as it navigates a generational oilfield downturn,” CEO Clay Williams said Tuesday. “International and offshore markets are exhibiting growth, while North America land markets are declining as customers slash spending.”

Still, the consolidated results improved sequentially for each of the three business segments, with revenue 10% higher overall, as the operator pivots to higher growth areas. Demand for technology and equipment by international and offshore customers drove the third consecutive quarter of rising bookings for capital equipment.

“Though we are well positioned to support growth in the offshore and international markets as customers increase activity after years of curtailed spending, severe capital austerity and lower activity in North America are resulting in a rapid change in our business mix,” Williams said.

NOV has before it “opportunities and challenges. Growing backlogs will allow us to better balance loading and improve absorption across NOV’s global footprint, while the mix shift creates potential for temporary inventory and payment dislocations. We are nevertheless resolute on improving the working capital intensity of our business as we execute through the second half of the year.”

An emphasis on capital discipline by NOV’s oil and gas customers has driven producers to “do more with less,” he said, “and it has become clear in the second quarter that this approach is not going away anytime soon.

“Recognition of this challenging market dynamic, as well as lower equity values and diminished availability of capital for the energy sector, led to a significant impairment charge in 2Q2019 of nearly $5.8 billion,” Williams said.

NOV evaluated the carrying value of its long-lived assets during the quarter because there were “several market indicators hitting new decade-lows.” Based on the evaluation, the company recorded a charge of $5.37 billion to write down goodwill, intangible assets and fixed assets. NOV also recognized an additional $399 million in restructuring charges.

Net losses for the quarter totaled $5.389 billion (minus $14.11/share), versus year-ago profits of $24 million (6 cents). Revenue was basically flat year/year at $2.13 billion, but gross profit fell to $62 million, or 2.9%, from $355 million, or 16.9%.

The focus today is cutting the cost structure and managing working capital to improve cash flow and return on capital “while we continue to address our customers’ most challenging needs with the critical technology and equipment that NOV provides,” Williams said.

In the Wellbore Technologies segment, revenues totaled $850 million, a 5% sequential increase and up 7% year/year. Improving international market conditions drove a 14% sequential improvement in markets outside North America, while U.S. revenues increased 2% amid declining drilling activity levels. Operating loss was $3.30 billion, while adjusted earnings increased 15% sequentially to $134 million, or 15.8% of sales.

Completion & Production (C&P) Solutions generated revenue in the quarter of $663 million, up 14% sequentially but down 10% from a year ago. Operating loss was $1.93 billion, with adjusted earnings up 86% from 1Q2019 to $52 million, or 7.8% of sales.

New orders booked by C&P during the quarter totaled $548 million, “marking the segment’s highest quarterly order intake in five years and representing a book-to-bill of 145% when compared to the $379 million of orders shipped from backlog,” management noted. At the end of June, backlog for capital equipment orders totaled $1.22 billion.

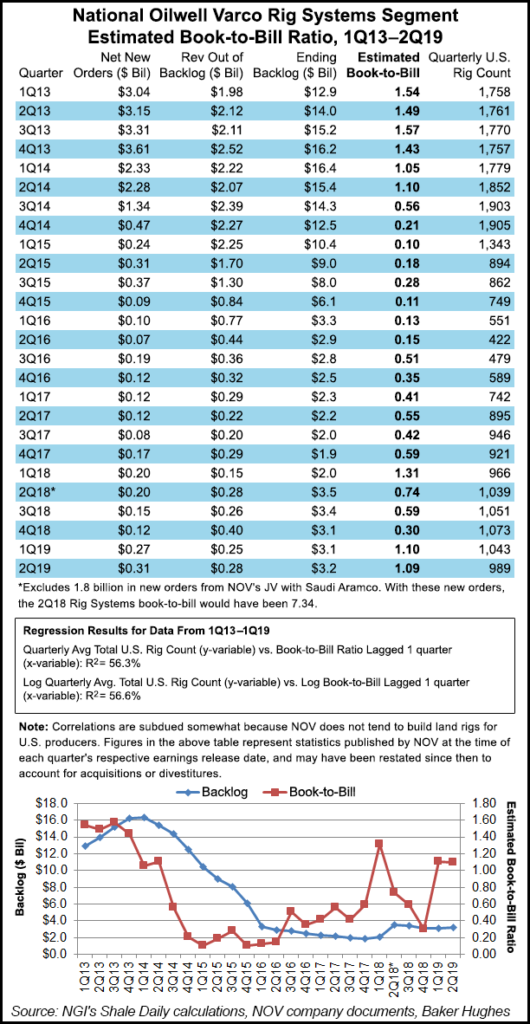

In the Rig Technologies segment, revenue climbed 3% year/year and 11% sequentially to $671 million on stronger contributions from offshore projects and growing demand for aftermarket parts and services. Operating loss was $422 million, with adjusted earnings up 32% sequentially to $74 million, or 11% of sales.

New orders booked by the Rig Technology segment increased 14% to $310 million, representing a book-to-bill of 109% when compared to the $284 million of orders shipped from backlog. Backlog for capital equipment orders at the end of June was $3.17 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |