Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Noble Midstream IPO Exceeds Expectations as Other Operators Eye Opening

Exploration heavyweight Noble Energy Inc. proved the second time was the charm Wednesday, after launching its onshore U.S. midstream business above market expectations, breaking a year-long drought for energy partnership offerings.

Noble Midstream Partners LP raised $281 million in its first trading day on the New York Stock Exchange, pricing 12.5 million shares at $22.50, above an initial estimate of $19-21. Noble had shelved plans last fall for the initial public offering (IPO), citing market uncertainty (see Shale Daily, Nov. 23, 2015).

The midstream business, to be based in Houston with its sponsor, would be most active in the Permian and the Denver-Julesburg (DJ) basins. Noble Energy initially has dedicated roughly 300,000 net acres in its DJ holdings and 40,000 net acres in the Permian’s Delaware sub-basin in West Texas to the new company.

Noble Energy all together holds more than 1.53 million net acres across the U.S. onshore, including 360,000 net acres in the DJ and 54,000 net acres in the Delaware. As well, it has around 50,000 net acres in the Eagle Ford and 350,000 net acres in the Marcellus shales. During 2Q2016, U.S. onshore production alone was estimated at 292,000 boe/d, with onshore proved reserves at the end of 2015 of 847 million boe (see Shale Daily, Aug. 3).

The midstream partnership also holds rights of first refusal (ROFR) to provide services to its sponsor across a combined 156,000 additional acres in the DJ, Permian and Eagle Ford. As well, it has ROFRs for “certain future acreage that is onshore in the United States outside of the Marcellus Shale.”

On a pro forma basis, Noble’s midstream business accounted for $108 million to the bottom line in 2015, with net income of almost $54 million.

Noble Midstream conducts business through long-term contracts at fixed fees. According to its prospectus, the partnership plans initially to pay about $1.50/unit per year in distributions. At the IPO pricing of $22.50/unit, the yield would be around 6.7%.

The public would hold common units representing more than 39% of the limited partner interest, or about 45% if underwriters exercised their option to purchase more units. Noble Energy would own the remaining MLP interest and all of the incentive distribution rights.

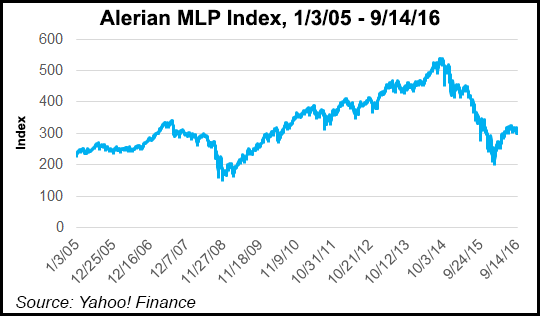

Enthusiasm for energy IPOs waned as commodity prices were squeezed, but the market appears to be strengthening once again (see related story). Currently, roughly one-dozen public/private producers and oilfield services (OFS) deals are in the offing. Already launched this year was Riverstone Holdings LLC’s blank check producer Silver Run Acquisition Corp., which debuted on Nasdaq in February and secured $450 million to begin purchasing energy assets (see Shale Daily, Feb. 25).

Among those scheduling IPOs, but with indefinite launch dates, is one by privately held Mammoth Energy Services Inc., an OFS whose top customer is Gulfport Energy Corp. (see Shale Daily, Sept. 8). And on Wednesday Denver-based Extraction Oil & Gas LLC, a private equity-backed producer that focuses its onshore efforts in the DJ’s Wattenberg field, filed its intentions to launch an IPO.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |