View more information about the North American Pipeline Map

Background Information about the Niobrara-DJ Basin

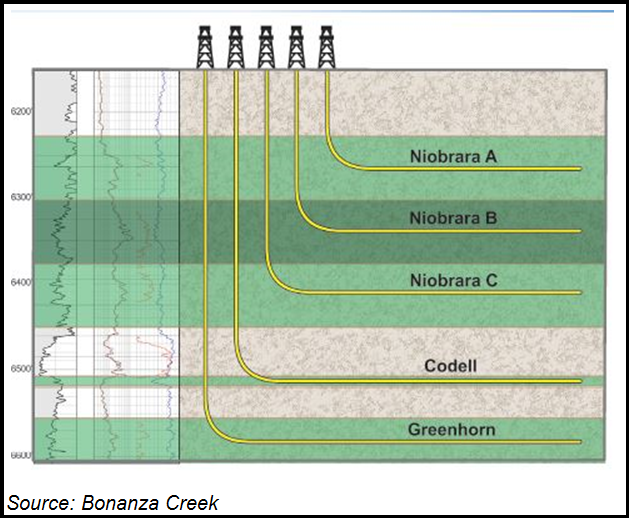

The Niobrara-DJ Basin is a crude oil and liquids rich gas play that is located in Northeast Colorado and Southeast Wyoming. The Niobrara is located in several areas of the Rocky Mountains, including the Powder River in Wyoming and in parts of Northwest Colorado. The portion that lies within the Denver-Julesburg (DJ) Basin is a combination shale/marl/chalk/sandstone formation that lies at depths 5,500′-8,500′, and is comprised of three separate zones, or “benches:” the A, B, and C benches. Just below the C bench sits the Codell tight sands formation, which is more of an emerging natural gas play, but is also garnering the interest of operators, especially those who are able to drill commingled Niobrara and Codell wells. However, the Codell is generally not prospective throughout the entire DJ Basin, since the formation tends to thin to the east. Operators have also begun drilling or are planning to test the deeper Greenhorn interval, but we believe early results from that formation have not been all that promising thus far.

The Niobrara within the DJ Basin is actually a combination of two basins in one. On the eastern side of the DJ Basin, the Niobrara reservoir holds widespread biogenic gas deposits that are similar to those in the Antrim Basin in Michigan. This “biogenic” Niobrara gas lies at shallower depths within Northeast Colorado, and parts of Nebraska and Kansas, than the more oil rich “thermogenic” Niobrara that we described in the first paragraph. The remainder of this article focuses on the “thermogenic” portion of the Niobrara.

The DJ Basin is certainly no stranger to exploration and production activity. The Wattenberg Field, which is located primarily in Southwest Weld County, Colorado, was discovered in 1970, and was one of the 15 largest proved gas fields in 2009, per the U.S Energy Information Administration. The majority of production from the Wattenberg to date has come from vertical drilling in the Niobrara/Codell formations, and the Muddy J Sandstone, which is a tight sands play that lies several hundred feet below the Codell.

EOG Resources kicked off the trend toward horizontal drilling in the Niobrara DJ in October 2009, with its Jake well at the Hereford Ranch Field in Weld County. Much of the horizontal drilling for the Niobrara and the Codell that has occurred since has been in the Wattenberg Field in Weld County, Colorado, and to a lesser extent in and around the Silo Field in Southeast Wyoming. These have been the most heavily targeted areas in part because many companies already held acreage in those areas, and also because those regions have existing infrastructure.

Weak economics thanks to oversupply and low commodity prices (crude south of $40/bbl and natgas hovering just above $2) has crashed drilling activity across North America, and the Niobrara-DJ Basin has not been immune. According to Baker Hughes data from early October 2015, drilling activity in the play is down 56% from the first week of December 2014, with active rigs falling from 61 to 27 (see Shale Daily, Dec. 4, 2015). 22 of those rigs were in Weld County, CO, with 2 each in Laramie County, WY and Lincoln County, CO, and another in Elbert County, CO. However, the Niobrara-DJ Basin has been more fortunate than some other plays. Over the same period, producers have reduced drilling activity in the Powder River Basin of Northeast Wyoming and Southeast Montana by 73% — from 33 active rigs to just nine. In July 2015, RBN Energy tabbed the Niobrara as having some of the best relative economics in the United States, with average rates of return ranging from 3%-17% in the area, depending on well cost assumptions. Those figures were on par with RBN’s return estimates the Eagle Ford Shale at the time.

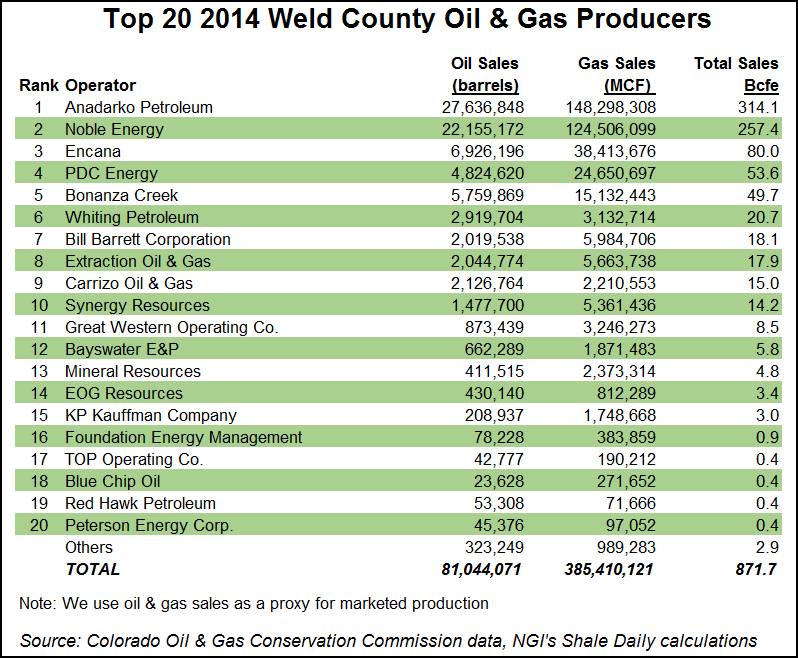

With the emergence of the DJ Basin as a leading producer, Weld County is being touted as the DJ’s core. The county was on pace to become the state’s major natural gas producer in late 2015, according to Colorado Oil and Gas Conservation Commission (COGCC) data (see Shale Daily, Sept. 22, 2015).

Historically, two western counties, La Plata (San Juan Basin) and Garfield (Piceance Basin), have alternated for more than a decade as Colorado’s leading gas producers. But in the current low commodity price environment for both crude oil and natural gas, operators have focused on their higher-return areas, and the DJ Basin is apparently one of those. The DJ is a liquids-rich play, so producers are going after oil and getting lots of wet associated gas.

Through part of July 2015, Weld County produced 242.5 Bcf, or about one-third of the state’s overall total at that time. Comparatively, Garfield County, in the far northwestern part of the state, produced 224.7 Bcf, and La Plata in the southwestern corner of Colorado had 181.3 Bcf of production.

In 2014, Garfield produced about one-third of Colorado’s gas production of 1.6 Tcf with 610.9 Bcf produced; Weld was second at 388.4 Bcf with La Plata, which for many years was the state leader, third with 334 Bcf in production. Analysts are now assuming that Weld and the DJ Basin are going to take over the state’s gas leadership. Various industry analytical sources, along with COGCC data point to the DJ as being on the rise, while Garfield and La Plata draw on more mature fields.

Tough economics within the industry has also led to some recent exits from the play. Encana Corp.’s U.S. subsidiary in October 2015 said it would sell its entire 51,000 net-acre portfolio in the DJ Basin for $900 million to improve its balance sheet (see Shale Daily, Oct. 8, 2015). The sale by Encana Oil & Gas (USA) Inc. is with a partnership formed by Canada Pension Plan Investment Board (95%) and private equity owner The Broe Group (5%). Broe’s energy affiliate is Denver-based Great Western Oil & Gas Co.

“As we advance our strategy we continue to focus our portfolio and capital on our four most strategic assets, the Permian, Eagle Ford, Duvernay and Montney,” said Encana CEO Doug Suttles. “Our efforts to transform our portfolio, improve efficiency and grow margins are increasing returns and strengthening our balance sheet, positioning Encana for success throughout the commodity cycle. The new entity is acquiring a quality asset along with a highly talented team.”

The DJ, once one of Encana’s top performers, has seen its importance to the portfolio diminish as more investment dollars have been moved to four onshore regions only: the Permian Basin, Eagle Ford Shale and British Columbia’s Duvernay and Montney fields (see Shale Daily, Sept. 24, 2014). In May Encana had only one rig working in DJ (see Shale Daily, May 13, 2015).

Other E&Ps are moving into the play to as well. SandRidge Energy Inc., stumbling financially as it dwells in a lower-priced commodity world, is once again attempting to diversify its operations by acquiring proved reserves and producing wells in the Niobrara formation of Colorado (see Shale Daily, Nov. 5, 2015). The $190 million cash agreement announced in November 2015 followed news that the Oklahoma City-based independent reported a $640 million net loss in 3Q2015, including a $1.1 billion writedown on the value of its portfolio.

The Niobrara acquisition, with privately held EE2 LLC, would give SandRidge a position in the North Park Basin in Jackson County, CO. The acreage “is largely concentrated in rural north-central Colorado and ideal for pad drilling and efficient infrastructure installation,” management said. The property, 100% operated, has proved reserves estimated at 27 million boe, 82% weighted to oil, and currently is producing 1,000 boe/d from 16 horizontal wells. SandRidge is planning initially to run one rig and would increase to a two-rig program by the middle of 2016. Thirteen drilling permits already have been approved, it said. It has 3-D seismic coverage on 54 square miles, with close to half of the 136,000 acres held by production and by two federal units.

In a 3Q2015 earnings call, Noble Energy CEO Dave Stover said the company intends to focus on the DJ Basin and Eagle Ford Shale going forward (see Shale Daily, Nov. 2, 2015). Noting that enough has been said about the impact of lower prices on activity and earnings, Stover instead focused on the positives of better efficiencies and lower operating costs and how they will carry the company forward.

“Next year’s onshore capital program will again focus on those activities with the highest returns and value,” he said. The DJ Basin and Texas portfolios “should continue to attract the majority of our investment.”

He added that while exploration capital will remain lower in 2016 than previous years, Noble believes it is a great environment to enhance and deepen its exploration inventory of high quality opportunities at a relatively low cost of entry. “We intend to continue achieving more while spending less,” Stover said.

Noble said volumes in the DJ averaged 13% higher during 3Q15 to hit a record 116,000 boe/d. Gas processing capacity on the DCP system, following the start-up of the Lucerne-2 plant, increased to more than 800 MMcf/d, which allowed Noble to reduce line pressures in the northern part of the field, particularly the Wells Ranch area, by up to 100 psi. PDC Energy and Synergy Resources noted similar pressure reducing benefits from the Lucerne 2 plant, particularly for older, vertical wells. Moreover, the DCP Grand Parkway gathering project should further improve line pressures within the Wattenberg when that project enters service in early 2016.

Noble operated four drilling rigs in the DJ for most of the third quarter, but has since dropped to three with two full-time completion crews. The big news for the DJ are improved designs, with longer laterals and the use of slickwater fluid. Noble drilled 39 wells at an average lateral length of more than 7,300 feet, versus an average well of about 4,500. Production ramped up at 58 wells, equivalent to 70 standard lateral length wells.

Several operators also noted they are using the plug-and-perf method to complete wells in the Niobrara much more often these days, with PDC Energy declaring on its 3Q2015 earnings conference call that plug-and-perf is quickly become the standard completion procedure in the Wattenberg.

“Cumulative production from the slickwater completions is outperforming the hybrid gel wells by more than 20% on average after 30 days,” Stover noted. For a standard lateral length well, those designed with slickwater are about 10% lower in total well cost. Based on 3Q15 activity, Noble was on target to exit 2015 in the DJ with about 40 wells drilled but uncompleted.

However, the Noble family of companies hit a stumbling block in late November 2015. Just a week after announcing that it would launch a public offering of shares in a new limited partnership with interests in some of its DJ Basin crude oil, natural gas and water-related midstream services, Noble Midstream Partners LP postponed it (see Shale Daily, Nov. 23, 2015). The Noble Energy subsidiary said it had postponed the offering “as a result of unfavorable equity market conditions” and would “continue to evaluate the timing for the proposed offering as market conditions develop.” A registration statement relating to the proposed sale of the securities has been filed with the Securities and Exchange Commission (SEC), “but has not yet become effective,” Noble said.

According to the original SEC filing, Noble Midstream has a 75% ownership interest in its “core assets,” including crude oil gathering at the Wells Ranch and East Pony integrated development plans (IDP), natural gas gathering at Wells Ranch, and crude oil treating at all NBL DJ Basin acreage, and also a 5-10% ownership interest in its “growth assets,” including crude oil gathering at the Mustang, Greeley Crescent and Bronco IDPs, and natural gas gathering at Mustang.

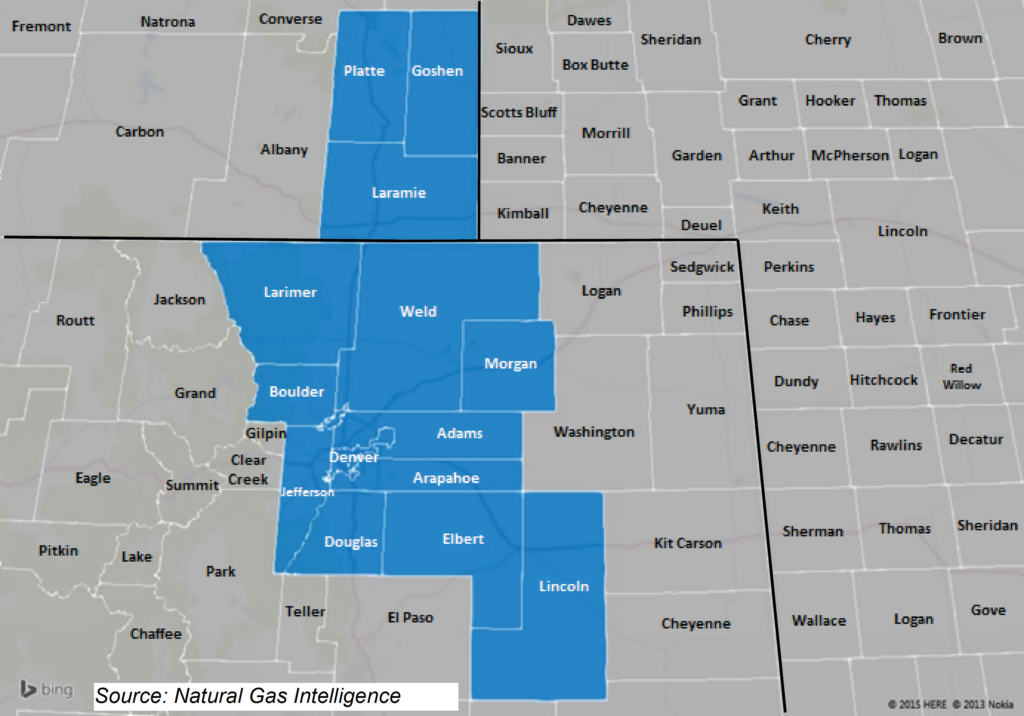

Counties

Colorado: Adams, Arapahoe, Boulder, Broomfield, Douglas, Elbert, Larimer, Lincoln, Jefferson, Morgan, Weld

Wyoming: Laramie, Goshen, Platte

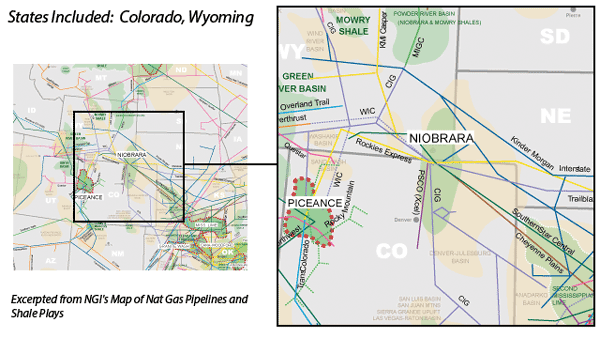

Local Major Pipelines

Natural Gas: Cheyenne Hub, Cheyenne Plains, CIG, PSCO, Rockies Express, Southern Star, Tallgrass, WIC

Crude Oil: Grand Mesa (proposed), Platte, Pony Express, Rocky Mountains (Plains), Saddlehorn (under construction), White Cliffs

NGLs: Bakken NGL Pipeline, Front Range, Overland Pass, Rocky Mountains (Enterprise), Wattenberg (DCP)

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Oklahoma Liquids Play | Marcellus | Eagle Ford | Upper Devonian / Huron | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily