Markets | E&P | NGI All News Access | NGI The Weekly Gas Market Report

NGSA: Natgas Prices Lower This Winter, While Industrial Demand Seen Up Sharply

Natural gas prices are expected to be lower for the upcoming winter season than a year ago thanks to a combination of factors, including a return to normal winter temperatures, robust domestic production and adequate storage, according to the Natural Gas Supply Association (NGSA).

Meanwhile, the demand for gas from the industrial sector is projected to increase more than 6% from a year ago, hitting levels not seen since the 1990s. The electric sector is also expected to use slightly more gas through coal-to-gas switching.

“When NGSA weighed all the different pressure points, the picture that emerged for the upcoming winter is one of remarkable growth in supply and steady underlying growth in demand that will be moderated by the forecast for a warmer winter than last year’s,” said NGSA Chairman Greg Vesey. “The abundant supply of natural gas is great news for consumers. When all key supply and demand factors are combined, we anticipate downward pressure on prices compared to last winter.”

In a 19-slide presentation Wednesday, NGSA cited projections by Energy Ventures Analysis (EVA) that the upcoming winter season — the five-month period from November to March 2015 — will be 11% warmer than last year and 3% warmer than the 30-year average, with 3,442 heating degree days (HDD), defined as the difference between 65 degrees F and the average outside temperature for that day.

By comparison, the National Oceanic and Atmospheric Administration (NOAA) reported that the last winter season (November 2013-March 2014) was 11% colder than the previous winter and 9% colder than the 30-year average, with 3,865 HDD.

“As always, a significantly colder than expected weather pattern could lead to upward price pressure, especially if the very cold temperatures are concentrated in those regions that rely heavily on natural gas for space heating: the East and Midwest,” NGSA said. “The opposite would be true if the weather turns out to be much warmer than normal.”

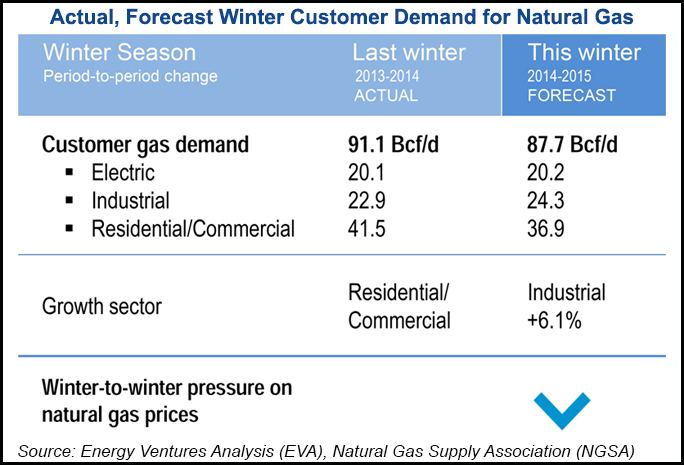

NGSA said EVA projects winter-to-winter natural gas demand will decline 3.7% overall, from 91.1 Bcf/d during the last winter season to 87.7 Bcf/d this winter. Although demand is expected to increase 6.1% from the industrial sector (from 22.9 Bcf/d to 24.3 Bcf/d) and 0.5% from the electric sector (from 20.1 Bcf/d to 20.2 Bcf/d), that’s not enough to offset a projected 11.1% decline in demand from residential and commercial customers (from 41.5 Bcf/d to 36.9 Bcf/d).

“In line with the growth projected for this winter, EVA points out that an extended forward view shows that scores of new, expanded and restarted major natural gas-intensive industrial projects loom on the 2012-2019 horizon,” NGSA said, adding that the industrial growth projected over the next five years “is primarily due to the petrochemical, fertilizer, steel and gas-to-liquids [GTL] industries expanding to take advantage of affordable, abundant natural gas in the U.S.

“Most of these projects are slated for southern states, and over 60% are brand new projects.”

According to EVA, there are 100 major industrial projects planned between 2012 and 2019, each with an investment of $90-100 billion for construction, and with a collective increase in gas demand of 5.4 Bcf/d. Broken down by type, they include 63 new projects (29 petrochemical, 13 fertilizer, 12 steel, seven GTL and two paper and pulp); 28 expansions (15 petrochemical, 11 fertilizer and two steel); and nine restarts (five petrochemical and four fertilizer).

EVA also projected that the electric sector will see 3.1 Bcf/d of monthly coal-to-gas switching. By comparison, there was 2.5 Bcf/d of coal-to-gas switching last winter.

NGSA said a record amount of natural gas was withdrawn last winter, and storage was below 900 Bcf at the end of the withdrawal season. But producers “rose to the challenge” and refilled supplies during the spring and summer, citing forecasts from EVA and the U.S. Energy Information Administration (EIA) that 3.44 Tcf of natural gas will be in storage at the end of the current injection season, an amount 85% of the five-year average for fill-ins. EVA and the EIA projected that withdrawals will be 90.3 Bcf per week this winter.

By comparison, EVA and the EIA reported that there was about 3.82 Tcf in storage at the end of the injection season before the start of the last winter season. Withdrawals totaled 137.9 Bcf/week.

Production is also expected to put downward pressure on natural gas prices, NGSA said. Again citing EVA projections, there were 7,397 annual natural gas well completions in the Lower 48 states ramping up to this winter season, compared to 7,971 wells completed before last winter. That translates to 70.8 Bcf/d of average winter production this season, a new record, compared to 67.2 Bcf/d last winter.

“Among reasons that winter production is expected to increase are continued strong production from shale wells, new pipelines and takeaway capacity in such areas as the Marcellus [Shale], and continued gains in drilling technologies and efficiencies,” NGSA said (see related story).

EVA also projected that net Canadian imports would be 7% lower this winter (from 5.7 Bcf/d to 5.3 Bcf/d), while net exports to Mexico would increase 29.4% (from 1.7 Bcf/d to 2.2 Bcf/d). NGSA said these were “interesting developments in supply,” and attributed the increase in Mexican exports to that country’s “robust economy.”

The shale revolution has “ushered in a remarkable era” over the past six years, said Vesey.

“This winter’s supply is expected to be even more robust than last year because of abundant shale and numerous new pipeline projects coming online to move natural gas out of producing shale areas,” Vesey said. “New infrastructure and improved drilling efficiencies are not the only reasons for abundant production. A solid 7% of this winter’s production is expected to come from ‘associated’ gas that is produced from oil wells. We expected associated gas to continue to be a key component of winter supply as oil drilling in the Bakken and Eagle Ford continues.

“The important takeaway is the strength and responsiveness of natural gas supply. Since the onset of shale production on a large scale, we’ve had winter after winter of stability for consumers.”

According to NGSA, EVA also provided a snapshot of drilled wells in the Haynesville, Marcellus and Utica shales, but which are not yet turned into production. According to EVA, 137 wells in the three plays are awaiting completion, 304 wells are waiting on hydraulic fracturing operations and 298 wells are completed but not producing.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |