Markets | NGI All News Access | NGI The Weekly Gas Market Report

NGI’s 2Q2015 NatGas Marketers Survey Finds 2% Decline; Trading Prospects Brighter in 2016

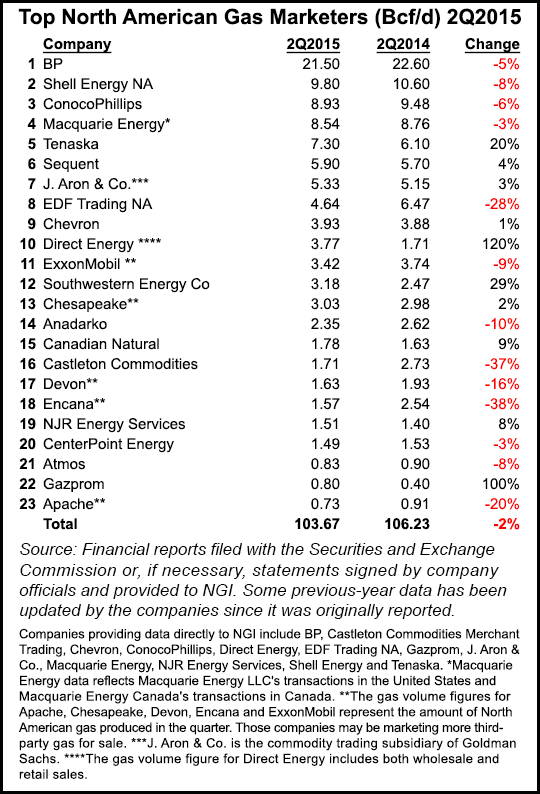

Four top North American natural gas marketers — BP plc, Shell Energy NA, ConocoPhillips and Macquarie Energy — and a majority of those participating in NGI‘s 2Q2015 Top North American Gas Marketers Ranking reported lower sales transaction numbers compared with 2Q2014.

Twenty-three leading gas marketers reported combined sales transactions of 103.67 Bcf/d in NGI‘s latest survey, a 2% decline compared with the 106.23 Bcf/d those same companies reported in 2Q2014. NGI‘s survey of North American marketers hasn’t reported an overall increase in sales since 1Q2014, when sales by participating companies increased 0.61 Bcf/d (about 0.5%) compared with 1Q2013. Prior to that, the last increase was recorded in 2Q2012, when participating companies sold a total of 135.86 Bcf/d.

But the bottom of the curve for marketers may finally be on the horizon, in the form of liquefied natural gas (LNG) exports, according to Patrick Rau, NGI director of strategy and research.

“The key to reversing declining U.S. marketed volumes may very well come from LNG exports,” Rau said. “U.S. LNG exports will not only bring more customers to the table, but also increase domestic price volatility, most likely. Just the threat of being able to ship gas overseas may impact prices in the United States.”

LNG shipments from the continental U.S. should begin during the first half of 2016, and could represent 10% of daily average demand for U.S. sourced gas by 2020, Rau said.

“Volatility is the lifeblood of marketing companies, and if volatility increases, both the number of and activity from marketing companies will likely increase as well in the coming quarters. While that may not lead to wholesale increases in total marketed volumes, at the very least, it should help slow their decline.”

The quarter brought declines to the top four companies in the survey, including perennial No. 1 BP, which reported 21.50 Bcf/d, a 5% decline compared with 22.60 Bcf/d in 2Q2014.

BP has increased its onshore rig count in the Lower 48 states and has increasing confidence in its U.S. prospects, CEO Bob Dudley said recently (see Shale Daily, July 29a). The energy giant’s natural gas marketing practices following Hurricane Ike in 2008 remain under review at FERC (see Daily GPI,Aug. 13).

Shell reported 9.80 Bcf/d in 2Q2015, an 8% decline compared with 10.60 Bcf/d in 2Q2014. During the quarter, parent Royal Dutch Shell plc gained the approval of U.S. regulators for its proposed buyout of UK rival BG Group plc, a $70 billion transaction that is expected to enhance Shell’s gas business, allowing it to become the global leader in liquefied natural gas exports (see Daily GPI, June 17;April 8). European regulators approved the deal earlier this month (see Daily GPI, Sept. 3). Shell plans to close the deal in early 2016.

ConocoPhillips, which had been plagued by double-digit declines since it implemented business model restructuring in North America following the spin-off of downstream operations three years ago (see Daily GPI, April 17, 2012), again reported a decline — 8.93 Bcf/d, a 6% decline compared with 9.48 Bcf/d in 2Q2014 — albeit a reduced one. ConocoPhillips, the largest independent in the world, announced recently that it is laying off 10% of its global workforce, with most of the job losses affecting North America (see Daily GPI, Sept. 2).

ConocoPhillips isn’t alone among the giants in cutting its workforce. BP disclosed in July that its upstream staff is about 8% smaller than it was in 2013, and its corporate support staff has declined 37% (see Daily GPI, July 28).

In July, Royal Dutch Shell plc said it planned to fire 7% of its workforce, an estimated 6,500 people, and Chevron said it would lay off 2,000 (see Daily GPI, July 30; July 29b).

Macquarie reported 8.54 Bcf/d in 2Q2015, a 3% decline compared with 8.76 Bcf/d in the same period last year.

Other decreases compared with 2Q2014 were reported by EDF Trading (4.64 Bcf/d, down 28%), ExxonMobil Corp. (3.42 Bcf/d, down 9%), Anadarko (2.35 Bcf/d, down 10%), Castleton Commodities (1.71 Bcf/d, down 37%), Devon Energy Corp. (1.63 Bcf/d, down 16%), Encana (1.57 Bcf/d, down 38%), CenterPoint Energy (1.49 Bcf/d, down 3%), Atmos (0.83 Bcf/d, down 8%) and Apache (0.73 Bcf/d, down 20%).

But it wasn’t all bad news, with several companies reporting increases compared with their 2Q2014 numbers. Tenaska led the pack at 7.30 Bcf/d, an impressive 20% increase compared with 6.10 Bcf/d in 2Q2014. Sequent Energy Management LP reported 5.90 Bcf/d, up 4% from a year ago. Other companies reporting increases included J. Aron & Co. (5.33 Bcf/d, up 3%), Chevron (3.93 Bcf/d, up 1%), Southwestern Energy Co. (3.18 Bcf/d, up 29%) and Chesapeake Energy Corp. (3.03 Bcf/d, up 2%).

Direct Energy, which moved into the Top 10 in the previous NGI survey, reported 3.77 Bcf/d, a 120% increase compared with 2Q2014, thanks in large part to the inclusion of both its wholesale and retail sales. Direct Energy acquired Hess Corp.’s energy marketing business two years ago (see Daily GPI, July 31, 2013).

The NGI survey ranks marketers on sales transactions only. The Federal Energy Regulatory Commission (FERC) tallies both purchases and sales. While production was rising, natural gas trading continued to decline last year compared with 2013, according to an analysis by NGI of 2014 Form 552 buyer and seller filings with FERC (see Daily GPI, May 28). Total volumes bought and sold declined for the third consecutive year, reaching 114,603 TBtu, down 3.0% compared with 2013. It was the lowest reported volume total since FERC began publishing Form 552 data six years ago (see Daily GPI, July 6, 2009).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |